Quantum Computing In 2025

Quantum computing involves using quantum physics to perform calculations, which differs from normal semiconductor-based computing methods. Instead of generating 0 and 1 (no current or current), it uses “quantum bits,” called qubits, where particle data is either 0 AND 1 at once, 1, or 0.

This could be a game changer for very complex calculations, like climate modeling, cryptography, or the 3D configuration of complex molecules like proteins.

Source: IonQ

It also requires a very different type of hardware than “normal” computing, a field still very much in its infancy, akin to the first microprocessors in the 1970s.

You can read more about what makes quantum computing so unique and the challenge in making a mainstream way of performing calculations in “The Current State of Quantum Computing”.

Recent Milestones

From the first proof-of-concept a few years ago, quite a few milestones have been achieved recently, as well as pioneering steps in entirely new ways to do quantum computing:

All of these advancements are, for now, mostly academic and made in labs but are likely to be quickly integrated into quantum computers’ design by the leading companies in the sector.

Especially as the race to produce the first scalable commercial quantum computer heats up, which would be an instant hit with defense departments, financial institutions, pharmaceutical companies, and top research institutes.

Here are the 5 top quantum computing companies in 2025.

1. Alphabet / Google

Alphabet Inc. (GOOGL -0.66%)

Google is very active in quantum computing, mostly through its Google Quantum AI lab and Quantum AI campus in Santa Barbara.

Google’s quantum computer made history in 2019 when It claimed to have achieved “quantum supremacy” with its Sycamore machine. The machine performed a calculation in 200 seconds that would have taken a conventional supercomputer 10,000 years.

This is now dwarfed by the performance of its newest chip, Willow. Willow is the first quantum computing chip with an error rate low enough that the more qubits you add, the less error you get. This makes it the first scalable quantum chip design.

But maybe the greatest contribution of Google will be in software, an activity where it has an impressive track record, actually better than in hardware (search, GSuite, Android, etc.).

Already, Google’s Quantum AI makes available a suite of software designed to assist scientists in developing quantum algorithms.

It also openly advocates for “researchers, engineers, and developers to join us on this journey by checking out our open source software and educational resources, including our new course on Coursera, where developers can learn the essentials of quantum error correction and help us create algorithms that can solve the problems of the future.”

Thanks to this open approach, Google is now leading in hardware and cloud solutions. Google might be one of the companies that set the standards for quantum computing software and quantum programming, giving it a privileged position to direct the field’s future evolution.

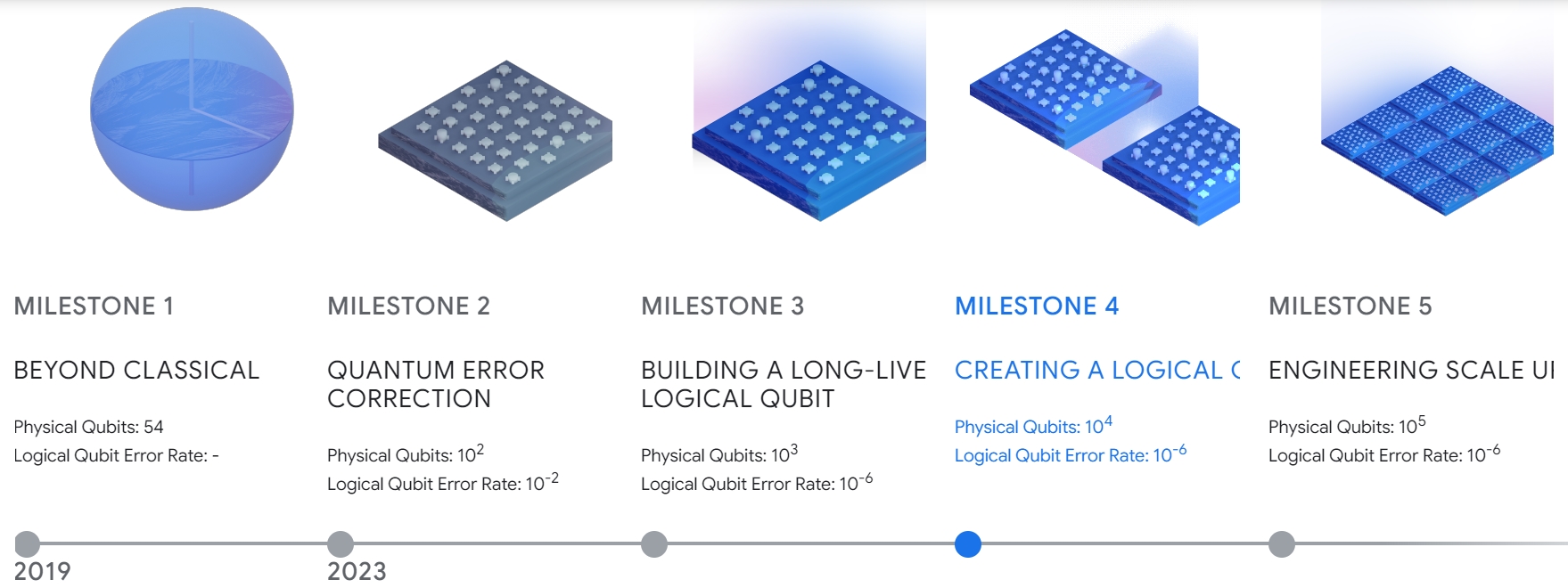

Overall, Google is aiming for an ambitious timeline of innovation, looking forward to steps like long-live qubits and scaled-up quantum computers, which would increase the total of qubits by 1000-fold and divides the error rate by 10,000.

Source: Quantum AI Google

Meanwhile, AI solutions, including Waymo’s self-driving cars, might become the new revenue driver for Alphabet, which still holds a massively dominant position in the search & ads industries.

You can learn more about Google non-quantum-related activities, especially ads and AI, in our dedicated report from December 2024.

International Business Machines Corporation (IBM +0.92%)

International Business Machines Corporation (IBM) was the leading force behind the commercialization of the first mainframe computer. However, in classical computing, it has fallen behind other tech giants like Apple (AAPL -1.24%), TSMC (TSM -3.43%), and NVIDIA (NVDA +0%).

However, it is at the forefront of the development of quantum computers. For example, it developed its 127-qubit “Eagle” quantum computer, which was followed by a 433-qubit system known as “Osprey.”

And this is now followed by “Condor”, a 1,121 superconducting qubit quantum processor based on cross-resonance gate technology, together with “Heron”, a quantum processor at the very edge of the field.

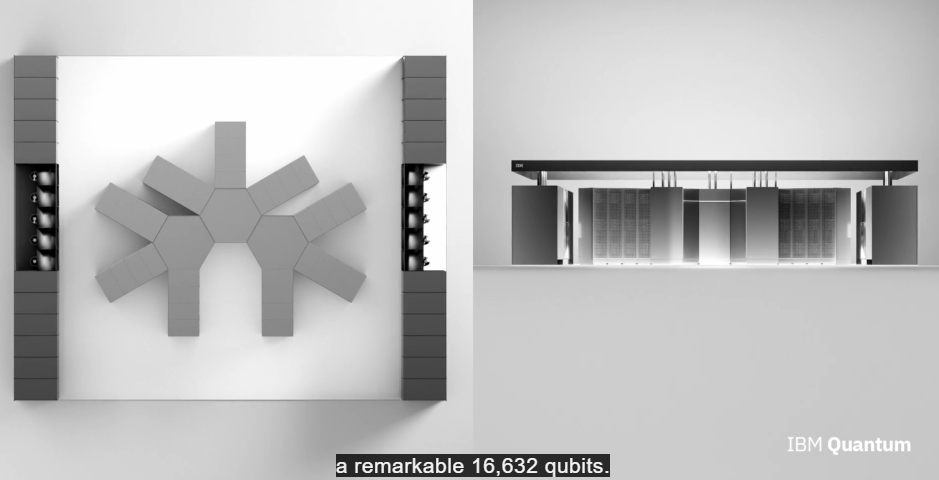

Looking forward, IBM has already announced its next major goal in anticipation of its current quantum chips ‘outgrowing’ the currently used infrastructure.

This goal is known as ‘IBM Quantum System Two’; a modular system that has the potential to support up to 16,632 qubits through a modular system combining up to 3 quantum units.

Source: IBM

Finally, IBM released Qiskit 1.0 in February 2024, the most popular quantum computing SDK (Software Development Kit). It has improvements in circuit construction, compilation times, and memory consumption compared to earlier releases.

The current version is Qiskit 1.3.1. with the 1.3 version released in December 2024. It also comes with a series of tutorials, including in video form:

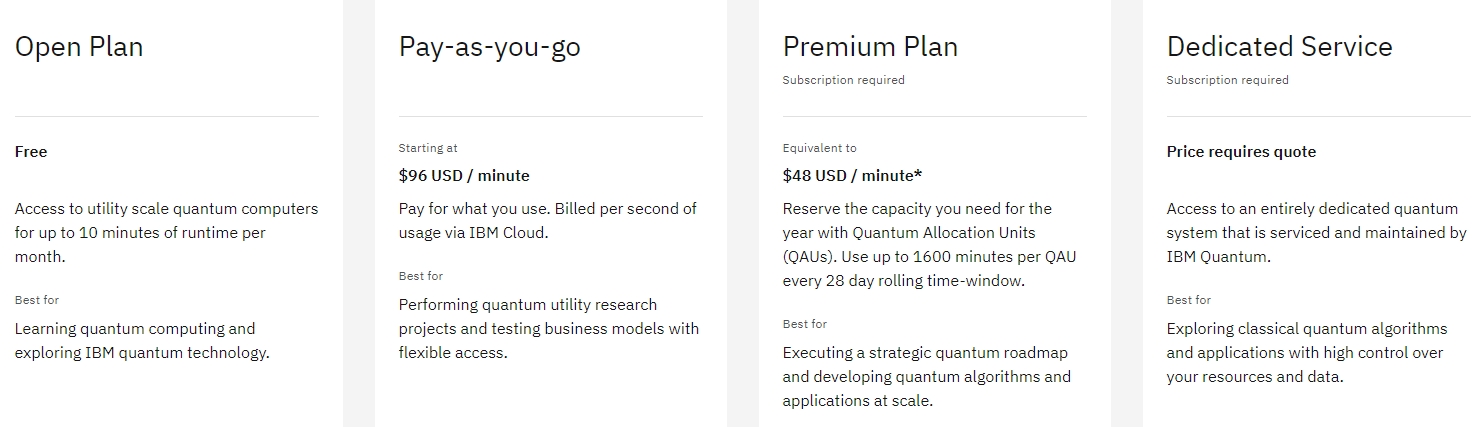

Currently, IBM is offering access to 100-qubit QPUs (Quantum Processing Units) through several plans, which are paid on a per-minute basis. The service is already in use and displayed in corresponding case studies with electric grid company E.ON, airplane manufacturer Boeing, battery producer Mitsubishi Chemical, or the particle accelerator CERN, running on 10+ utility-scale quantum computers deployed worldwide.

Source: IBM

IBM’s strength has always been since its inception in developing ultra-powerful supercomputers, a segment of the market overshadowed by the rise of consumer electronics and standardized chips. The emergence of quantum computing is an occasion for IBM to shine again and become a leader in this upcoming important segment of computing for scientific research and large corporation computing needs with an extensive roadmap planed up to 2033.

Source: IBM

Main International ETF (INTL -0.11%)

Intel has been struggling to keep up with the likes of TSMC in classical chip design, leading to a series of cuts to its workforce in 2024.

However, Intel seems to target a leading position in quantum computing. It would replicate its historical strategy of being early on a developer of new computing technology.

In 2023, Intel released “Tunnel Falls”, the “most advanced silicon spin qubit chip”. Because it relies on spin quantum computing, it uses the tools and materials used in classical chip manufacturing like silicon wafers and EUV lithography to create quantum dots. It could give Intel a serious advantage, as all of the other quantum computing companies are working with less-proven technologies that need to be built from scratch.

Source: Intel

This makes Tunnel Falls remarkable in that it is not a prototype but a chip built at scale, with a 95% yield rate across the wafer and voltage uniformity. This opens the way to mass production of quantum computing chips, something for now elusive in a nascent and quickly changing industry.

Intel is also working on neuromorphic designs, chips that mimic neurons instead of the classical binary design. This is especially useful for AI computing using less power, with Intel announcing in 2024 that it has created the world’s largest neuromorphic system with 1.15 billion artificial neurons.

Faithful to its roots, Intel is also developing the software to utilize its chips, with the release of the Intel Quantum SDK. This provides the guideline for programmers to develop software for quantum computing compatible with Intel quantum chip design, which has historically been a very strong & profitable business moat for Intel’s conventional chip business.

Source: Intel

The arrival of scalable quantum chip manufacturing could be as revolutionary for the industry as any other more technical scientific breakthrough, bringing down costs, and setting common programming standards and chip architectures.

Intel is a company that knows from experience how strong a force this can be in the computing industry. It is still riding on the tail of its innovations and associated patents from the 1960s onward.

Honeywell International Inc. (HON +0%)

Quantinuum is the result of the merger of Honeywell Quantum Solutions and Cambridge Quantum.

Honeywell remains the company’s majority shareholder (likely 52% ownership) after a fundraising round valuing it at $5B. Founder, Ilyas Khan is reported to own approximately 20% of the company. Other shareholders include JSR Corporation, Mitsui, Amgen, IBM, and JP Morgan.

A potential IPO of Quantinuum in the future, potentially as a part of a larger corporate restructuring, is estimated to be worth as much as $20B.

As is the case for Google, quantum computing is not the central part of Honeywell’s business, more centered around products in aerospace, automation, and specialty chemicals & materials. Each of these domains might, however, benefit from quantum computing, potentially giving Honeywell an advantage against its competitors.

Quantinuum seems, for now, to focus on segments less explored by other quantum computing systems, notably financial and supply chain-related analyses, through its Quantum Monte Carlo Integration (QMCI) engine, launched in September 2023.

QMCI applies to problems that have no analytic solution, such as pricing financial derivatives or simulating the results of high-energy particle physics experiments, and promises computational advances across business, energy, supply chain logistics, and other sectors.

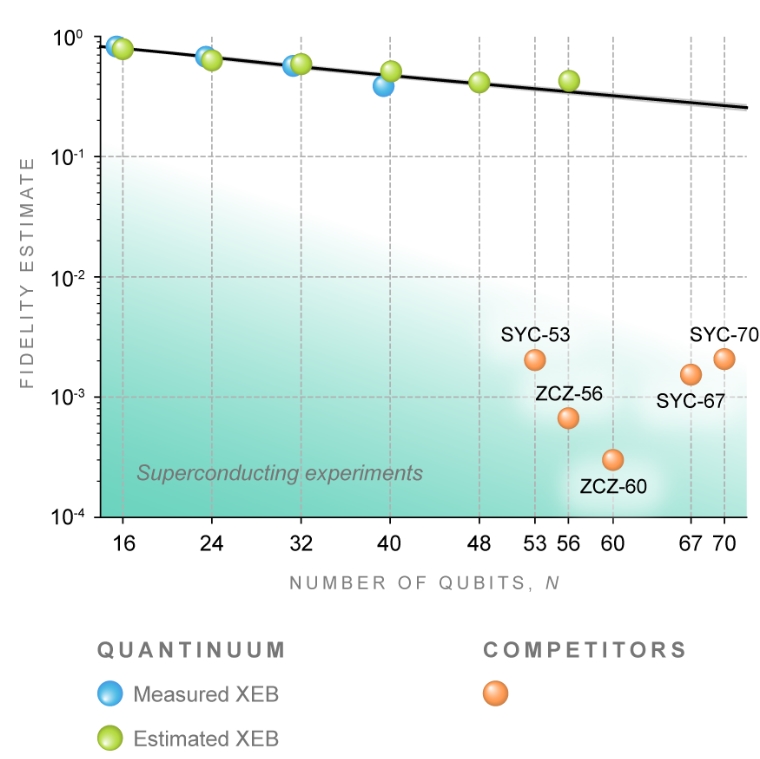

The company has pursued high-quality computing with very little error more than adding as many as possible qubits, creating a so-called “fault-tolerant quantum computing”. This approach is labeled by the company “Better qubits, better results”, with a similar amount of qubits achieving 100-1,000 fold more reliable results.

Source: Quantinuum

To do so, they use a different technology than other quantum computer companies, called “trapped-ion”. For example, they upgraded their H2 systems from 32 to 56 qubits while achieving a “three 9’s” fidelity: 99.914(3)% 2-qubit gate fidelity.

Source: Quantinuum

This notably could make a difference in urgently needed quantum-resistant cryptography, with defense company Thales (HO.PA +1.31%) is already collaborating with the company and the international bank HSBC.

Quantinuum also offers its proprietary quantum computational chemistry InQuanto, usable for pharmaceuticals, material sciences, chemicals, energy, and aerospace applications.

Like many other quantum computing companies, Quantinuum offers Helios “hardware-as-a-service”, allowing users to benefit from quantum computing without having to deal with the complexity of operating the system themselves.

Quantinuum signed in November 2024 a partnership with German Infineon, Europe’s largest semiconductor manufacturer. Infineon will bring its integrated photonics and control electronics technology to help create the next generation of trapped-ion quantum computers.

Quantinuum’s focus on high fidelity might make it valuable sooner as its high fidelity makes it immediately usable, more akin to normal computing than the still experimental other approaches.

More ongoing use cases could strongly boost the future value of the company, and therefore, Honeywell’s stack in it and the potential profit investors could make from it.

5. IonQ

IonQ is another quantum computing company using trapped-ion technology, founded by pioneering scientists in the field from the University of Maryland and Duke University. It was publicly listed on the NYSE in 2021.

IonQ quantum computing platforms are able to produce a 99.9% fidelity result. It currently uses a 64-barium ion chain, producing a 36-algorithmic qubit (AQ). The chain organization allows for much quicker computing than other trapped-ion designs without losing fidelity.

Source: IonQ

IonQ acquired Qubitekk in January 2025, adding to its operations the company’s team and 118 patents to IonQ. Qubitekk’s specialty is in quantum networks, using photonic interconnects, enabling quantum clusters, and advancing quantum internet capabilities. Quantum networks should facilitate highly secured communications and ultimately allow for distributed quantum computing.

IonQ is developing a partnership with NKT Photonics (NKT.CO) to help develop future data center-ready quantum computers.

It is also collaborating with Imec on photonic integrated circuits and chip-scale ion trap technology to scale up the company’s qubit count and system size and costs.

Instead of developing its own SDK, the company is supporting all the major ones at once, and partnering with many leading companies for developing new quantum computing applications.

Source: IonQ

IonQ is the closest to a pure quantum computing stock for investors who are uninterested in the main activities of other leaders like Google, Intel, IBM, or Honeywell.

So together with its competitor Quantinuum, IonQ is closer to developing commercial quantum computers, with its focus on high fidelity, lower qubit count trapped-ion systems. Its early success has helped it build a strong network of partnerships with other quantum computing innovators to keep pushing this technology forward.