- Solana’s design enables more efficient DeFi applications with less capital locked up.

- Solana’s architecture offers faster transactions and parallel processing.

- Network metrics showcase this efficiency.

The Decentralized Finance (DeFi) sector is at the forefront of blockchain innovation, offering an alternative to traditional financial systems through decentralized applications (dApps). Within this competitive landscape, Solana and Ethereum stand out as leading platforms, each striving to offer the most efficient, secure, and user-friendly environment for DeFi applications.

The battle for dominance hinges on several factors, including transaction speed, fees, and scalability. Most recently, a Reflexivity Research report highlighted the importance of capital efficiency in DeFi. Notably, Solana stands out in terms of this key metric, offering better performance for traders than Ethereum.

Solana’s Capital Efficiency Outshines Ethereum

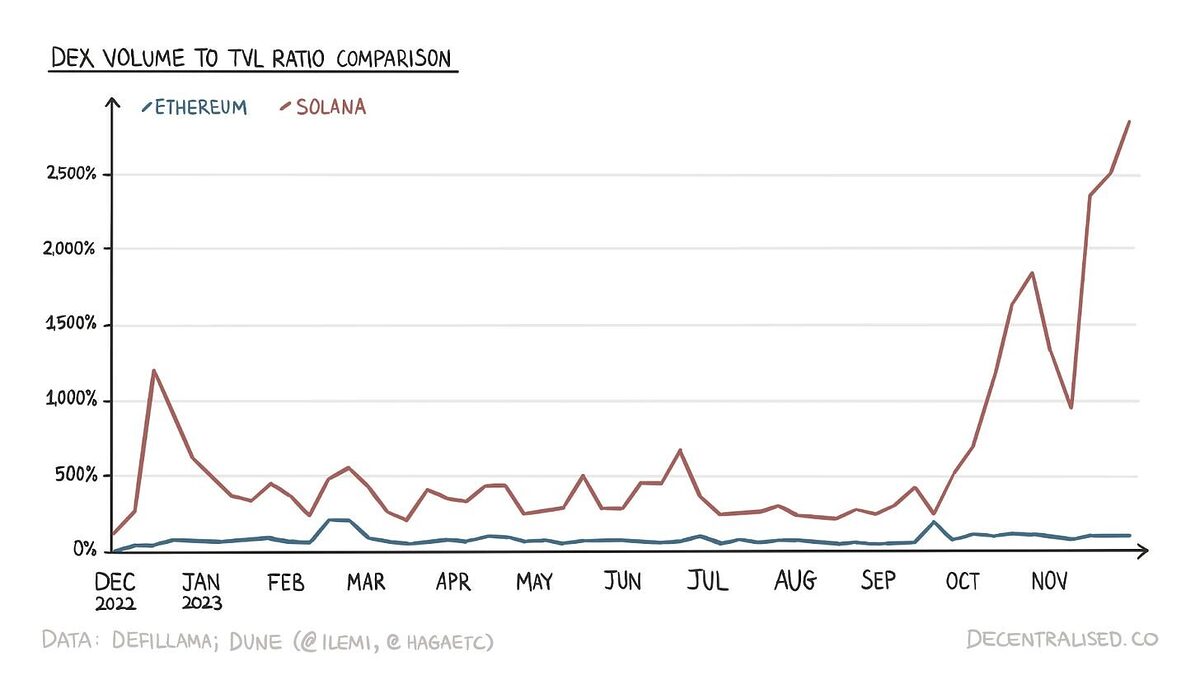

In March 2024, Reflexivity Research published an analysis highlighting Solana’s significant lead in capital efficiency over Ethereum. This metric is essential in the DeFi space as it indicates how well a blockchain utilizes locked-up value to facilitate economic activity and growth.

Capital efficiency, a key metric in TradFi, measures how effectively capital is used to generate revenue and facilitate economic activity. In DeFi, the metric measures the relationship between the total value locked (TVL) and the platform’s economic output, such as trading volume or generated fees.

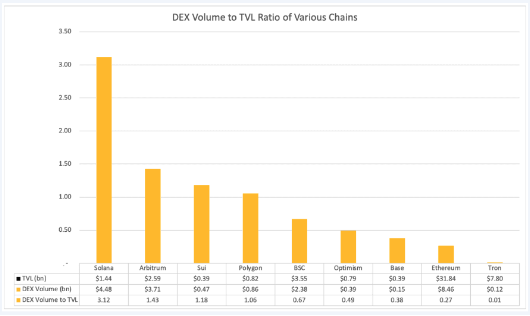

In the first quarter of 2024, Solana was ahead of other chains in terms of the relationship between its DEX volume and TVL. In fact, DEX volume to TVL in that period was at 3.12, compared to Ethereum’s 0.27. This indicates strong capital efficiency.

This metric soared in recent months, thanks to a significant increase in DEX volume, without a comparative increase in TVL. This was in contrast to Ethereum, for which DEX volume to TVL remained largely unchanged.

The report suggests that one of the reasons behind this change is Solana’s architecture. The network supports faster transactions and reduced fees, which means less capital is tied up in transactions waiting for confirmation. Additionally, Solana’s ability to process transactions in parallel significantly boosts its DeFi operations’ efficiency.

By requiring less capital to achieve higher levels of economic activity, Solana can potentially attract a wider array of developers and users. In fact, the latest data suggests that Solana is attracting even more activity.

Solana’s DeFi Volume Surges in 2024

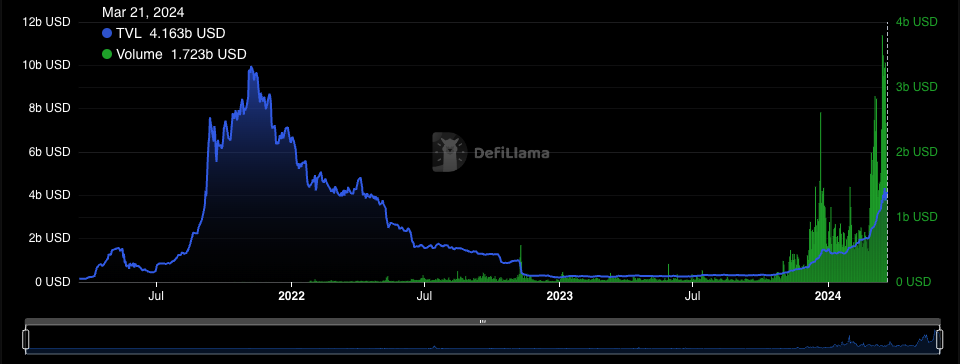

High capital efficiency has already propelled Solana forward, and it has seen a meteoric rise in its ecosystem and trading volume. Solana’s TVL stands at an impressive $3.913 billion, underscoring the substantial amount of assets pouring into its ecosystem.

Trading volume has seen a substantial rise, currently standing at $1.792 billion. Moreover, the network collected $4.39 million in fees and generated $2.2 million in revenue over the last 24 hours.

Solana’s impressive metrics in TVL, fees, revenue, and DeFi volume illustrate the platform’s significant competitive edge in the DeFi space. These figures are a testament to Solana’s capital efficiency, where less capital is needed to unlock higher economic activity compared to other platforms.

On the Flipside

- Low fees on Solana means that many of Solana’s transactions are spam. While this contributes to capital efficiency, it also showcases an issue with the network.

- Reflexivity Research’s report acknowledges that Ethereum’s DeFi ecosystem should include the activity on both the mainnet and L2 rollups for a complete picture.

Why This Matters

The competition between Solana and Ethereum underscores the importance of continuous improvement and innovation within the blockchain space.

Read more about Solana’s performance:

Solana’s Stellar Rise in 2024: What’s Behind the Success?

Read more about Polkadot’s ecosystem: