- Solana (SOL) records a 6.5% fall, reflecting broader market volatility.

- BTC’s downturn triggers a ripple effect, impacting major altcoins, including SOL.

- Technicals for SOL are shifting in a less favorable direction.

The cryptocurrency market is experiencing another wave of volatility, with Bitcoin (BTC) leading a downturn that has swept across the sector. Among the notable cryptocurrencies leading this drop is Solana (SOL), which has seen a 6.5% decrease in value.

Solana, known for its high throughput and low transaction costs, has recently seen a major surge in value. However, technical indicators for SOL are starting to diverge, potentially setting the stage for a new chapter.

Solana Hit In Market Downturn

On Tuesday, April 2, the cryptocurrency market was under significant pressure, with Bitcoin’s sudden crash acting as a catalyst for widespread losses across various digital assets. In just 24 hours, Bitcoin lost 5%, dropping from around $69,800 to $66,100. Among the affected, Solana (SOL) experienced a notable decline of 6.5%, adjusting its market price from $193 to $183.11.

This drop in Solana’s value reflects the broader market sentiment, heavily influenced by Bitcoin’s market movements. Notably, the top ten major cryptos have all experienced losses, with Solana and Dogecoin leading with losses. Dogecoin, in particular, has lost 10% of its value, dropping from $0.2 to $0.184.

However, Solana’s downturn was accompanied by a shift in technical indicators towards a less favorable position.

What Technicals Say About SOL

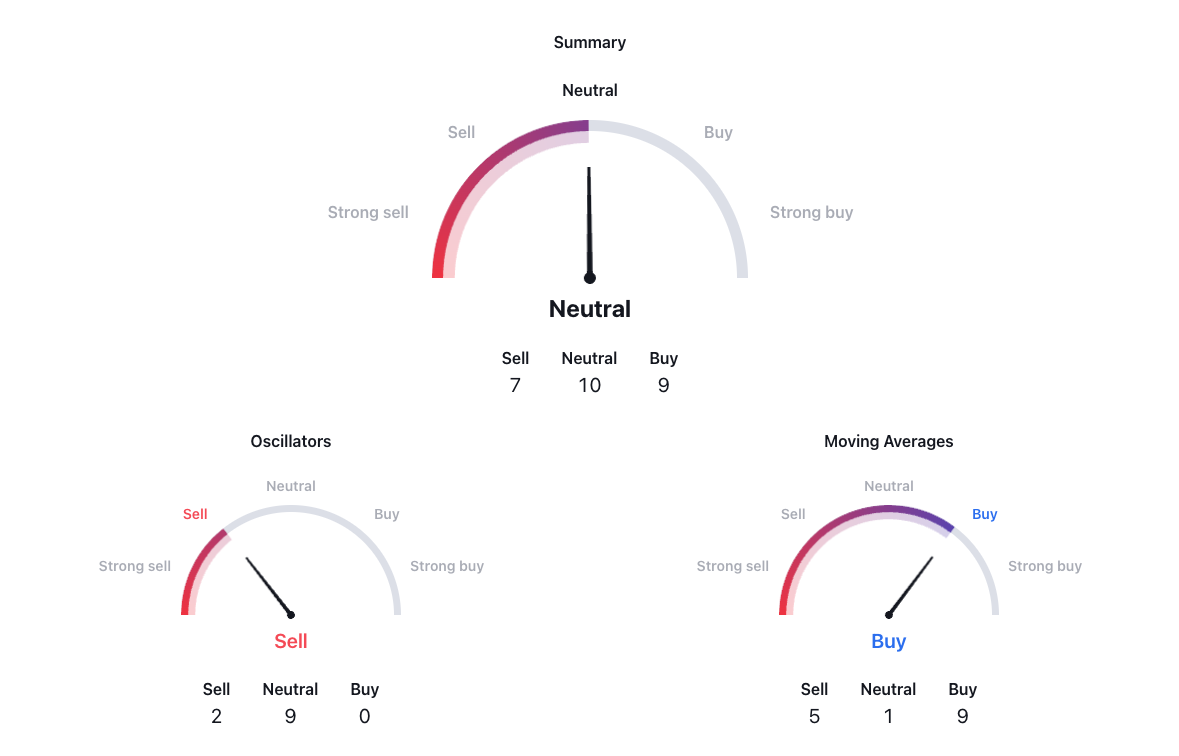

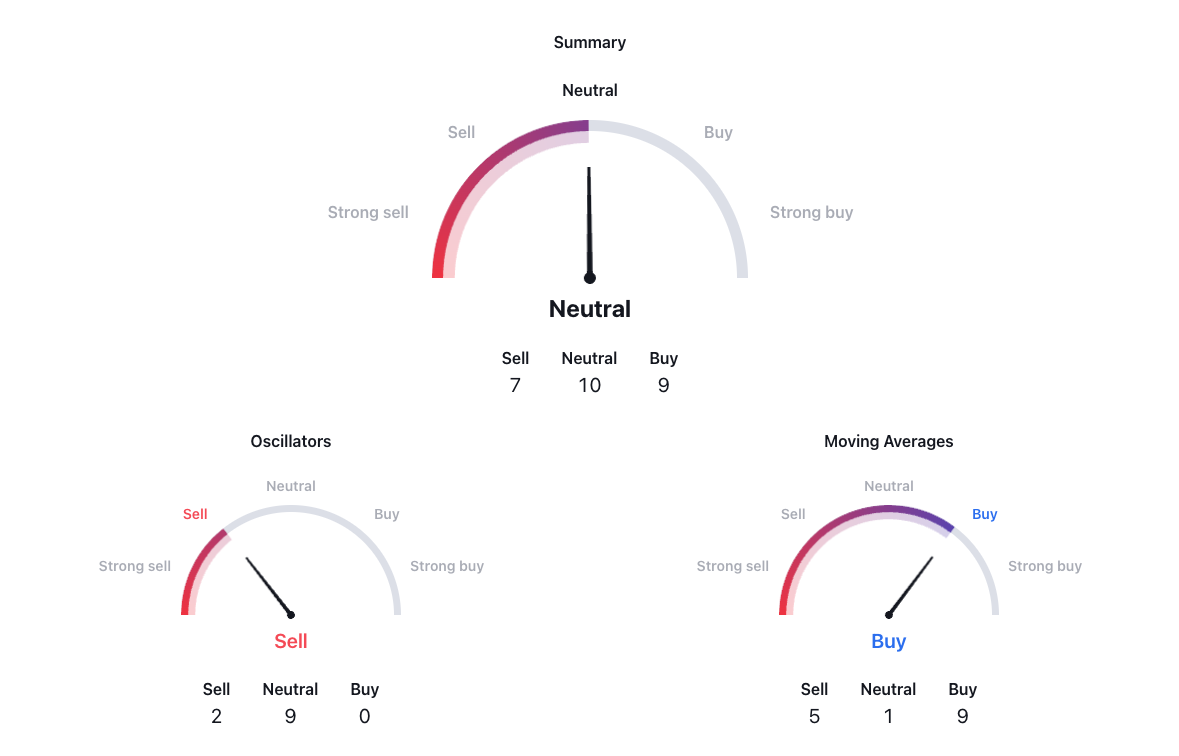

After consistently reporting positive market sentiment for months, Solana’s technicals are now starting to diverge, moving away from their strong buy position.

The aggregate oscillator data presents a predominantly neutral stance, with 9 out of 11 indicators, including the Relative Strength Index (RSI) at 53.97 and the Commodity Channel Index (CCI) at -14.68, suggesting no strong buy or sell pressure.

The moving averages offer a mixed but slightly more optimistic view. With nine buy signals against five sell signals among the evaluated averages, there’s a tilt towards a positive outlook in the medium to long term. Notably, the Exponential Moving Average (EMA) and Simple Moving Average (SMA) for longer periods (50, 100, and 200 days) are all in the buy zone.

The Volume Weighted Moving Average (VWMA) at 185.68 and the Hull Moving Average (HMA) at 194.30 suggest sell signals, reflecting the short-term bearish sentiment. These indicators and the recent price drop suggest that Solana might face immediate downward pressure but retains the potential for recovery based on longer-term moving averages.

On the Flipside

- The solid buy signals from longer-term moving averages and the neutral stance of oscillators could indicate the potential for recovery.

- The broader market sentiment, heavily influenced by Bitcoin’s dynamics, remains a critical external factor affecting SOL’s price.

Why This Matters

For investors and enthusiasts alike, monitoring these indicators closely can provide valuable insights into their investment strategies.

Read more about Solana’s strong performance in 2024:

Solana’s Stellar Rise in 2024: What’s Behind the Success?

Read more about China leveraging blockchain tech:

How China Will Use Blockchain in its Belt and Road Initiative