- The Bitcoin Cash halving occurred on April 4.

- An unusual dynamic between hash rate and price now exists.

- The relationship between hash rate and price is debatable.

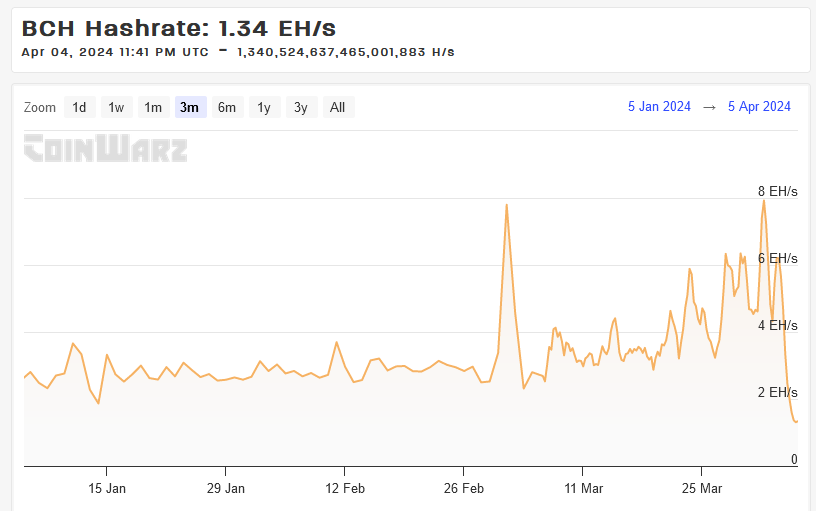

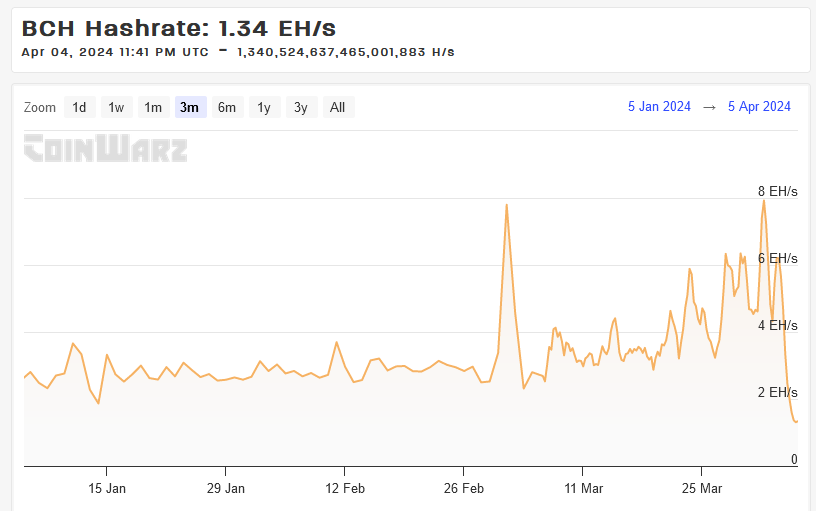

The period leading up to Bitcoin Cash’s halving was marked by optimism, as both hash rate and price surged in anticipation. However, the aftermath of the halving, which occurred on April 4, witnessed a significant drop in the hash rate to hit new lows.

Surprisingly, despite the substantial decline in network computational power, BCH has managed to sustain its price momentum, defying expectations and prompting observers to ponder the implications of this unusual dynamic.

What’s Happening with Bitcoin Cash?

Over the last 24 hours, Bitcoin Cash has been among the best-performing top 100 tokens, gaining 9% to hit a new 28-month high of $720. Meanwhile, the broader market has remained relatively stagnant. This price surge comes amidst a significant decline in the network’s hash rate, prompting analysts to question whether the current price momentum can be sustained as miners exit in their droves.

The Bitcoin Cash hash rate hit a local peak of 8.02 EH/s on April 1 but has since plummeted sharply to just 1.34 EH/s. This represents a staggering 83% decline over the past five days and a 41-week low for the network.

The dramatic decrease in hash rate suggests that BCH miners may lack confidence in the network’s prospects post-halving now that the block rewards have been cut in half to 3.125 BCH.

Despite the exodus of miners, Bitcoin Cash mining revenue has been trending higher throughout 2024, reaching a local top of $960,000 on March 2. This dynamic has puzzled some observers, as the combination of rising mining revenues and declining hash rate contradicts expectations. Compounding confusion further, there is ongoing debate on the relationship between hash rate and price.

Weak Direct Correlation Between Hash Rate and Price

The relationship between hash rate and price is not straightforward due to the multitude of factors involved. These include broader macroeconomic trends, the cost of electricity powering mining rigs, and the constantly shifting break-even price points for miners, among other things.

As noted by CoinDCX, there is not necessarily a direct causal link between hash rate and price. However, a high hash rate can indirectly boost market confidence in the network’s security and resilience. This, in turn, may attract more buyers to an ecosystem, potentially exerting upward pressure on the token’s price.

After the halving, the plummeting Bitcoin Cash hash rate may signal miners’ expectations of reduced future mining revenue. However, it is unclear whether this shift in miner sentiment will result in a downturn in price, particularly as BCH is riding high on a wave of fundamental developments, including Coinbase’s recent rollout of BCH futures trading.

On the Flipside

- Bitcoin Cash’s price momentum may still drop in the near term.

- BCH’s peer-to-peer cash model, which typically has transaction fees under $0.01, is inherently unattractive to miners looking to maximize their returns.

- There are rumors of a BCH ETF in the works.

Why This Matters

The odd dynamic in Bitcoin Cash’s hash rate and price post-halving highlights the unique and unpredictable nature of the cryptocurrency market. While the plummeting hash rate raises questions about the network’s security, the soaring prices suggest that investor sentiment and speculative activity may outweigh technical fundamentals in the short term.

Bitcoin Cash makes a comeback after being written off as irrelevant. Read more here:

Bitcoin Cash Up 55%: What’s Behind Unlikely Comeback?

Crypto VC firms show signs of returning confidence amid market rebound. Read more here:

Crypto VC Investments Rebound, Signaling Market Revival