Solana launchpads are a mysterious enigma. While other blockchain networks, like Ethereum or BNB Chain, are flush with dozens of different IDO launchpads that help bring cutting-edge new crypto projects to market, Solana (SOL) seems to have opted for a different route.

The Solana blockchain continues to subvert expectations, with ecosystem builders bucking the trend of previous cryptocurrency cycles. The crypto industry’s new ‘build first, raise funds later’ approach has left Solana launchpads redundant, with a fresh, more egalitarian method taking its place.

Why are Solana launchpads and IDO platforms out of fashion, and how do Solana projects complete their fundraising without them?

What are Launchpads?

Launchpads are a tremendously popular way of bridging the gap between early-stage crypto projects and eager investors.

In theory, the relationship benefits both parties: new projects get their token sale presented to a wide pool of investors, while the general public gets the opportunity to invest in innovative Web3 platforms before they hit the public market.

Retail investors were particularly fond of this arrangement because it allowed them to participate in private sales and IDOs that were typically reserved for institutional funds and crypto venture capital firms.

Likewise, launchpad operators were able to generate revenue through platform fees and partnerships with emerging crypto projects.

It seemed like a perfect setup, but crypto launchpads still have their flaws.

The Pitfalls of Launchpads

Most crypto launchpads are businesses in themselves. In addition to their function as incubators, they typically have their own native token. Users need to buy and stake these tokens to secure an allocation or whitelist in upcoming token launches.

Inevitably, this recreated the problem that launchpads were originally built to solve. To access high-quality IDO tokens, investors first must buy large amounts of a launchpad’s native token. This again split the community of investors into separate groups: those who could afford to use IDO platforms and those who could not.

But that’s not the only issue. When the cryptocurrency industry succumbed to bearish forces, most launchpads had dry pipelines and evaporating revenue streams. Launchpads were forced to host sub-standard projects in failing market conditions to make ends meet, leading to years of disappointing results for all parties.

Fortunately for the masses, the Solana ecosystem and the wider crypto market are testing a new approach.

Solana’s Airdrop Revolution

In the past, the development of new crypto projects followed a relatively formulaic process:

- Conceive Idea

- Raise Funds

- Build Product

- Launch Product

Naturally, this formula paved the way for dozens of failed projects and exit scams, leaving investors holding a bag of empty, broken promises.

Fortunately, the crypto space has become vastly more competitive over time, with projects across all sectors needing to prove why their products should be preferred to their rivals.

Investors have become unwilling to throw capital at ideas and promises alone, asking for more tangible things on which to base their theses. This has led to a battle-tested model that holds builders more accountable and opens the door for greater end-user involvement:

- Conceive Idea

- Build Product

- Launch Product

- Attract Users

- Raise Funds

- Reward Users

Before teams can raise capital, they need to prove they can do the job. One way to do so is to incentivize users with generous initiatives. This commonly means giving airdrops to users and providers who boost activity on a certain application.

By providing liquidity pools on DeFi (decentralized finance) apps, executing swaps and trades on DEXes and NFT marketplaces, and interacting with various smart contracts, end-users are rewarded with token allocations from their favorite dApps for free.

Taking part in airdrops is far more cost-effective, because users are able to gain exposure to new protocols without needing to invest capital upfront. Moreover, airdrops are typically KYC-free, making them more popular among the crypto-faithful.

The airdrop model has proven wildly popular on Solana, with dozens of protocols leveraging the method to put tokens in the hands of their most passionate users. Some of the biggest projects in the Solana ecosystem, including Jupiter, Tensor, and Kamino Finance, have used airdrops to spread token distribution.

But what does this mean for Solana launchpads?

Do Solana Launchpads Still Exist?

The prevalence and popularity of Solana’s airdrop revolution have made Solana launchpads redundant.

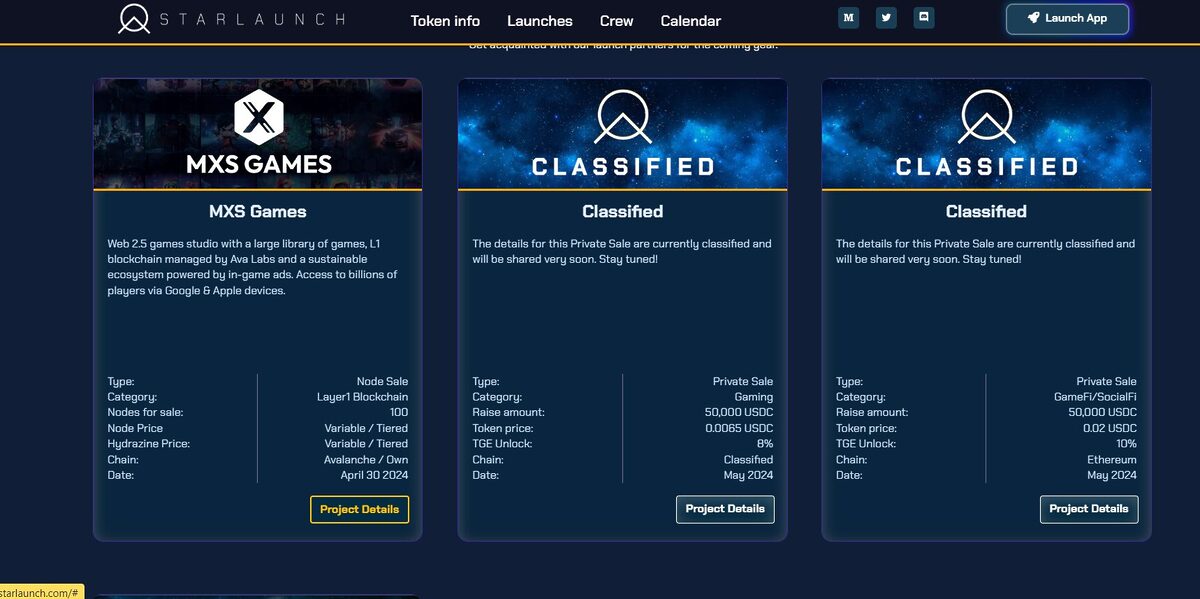

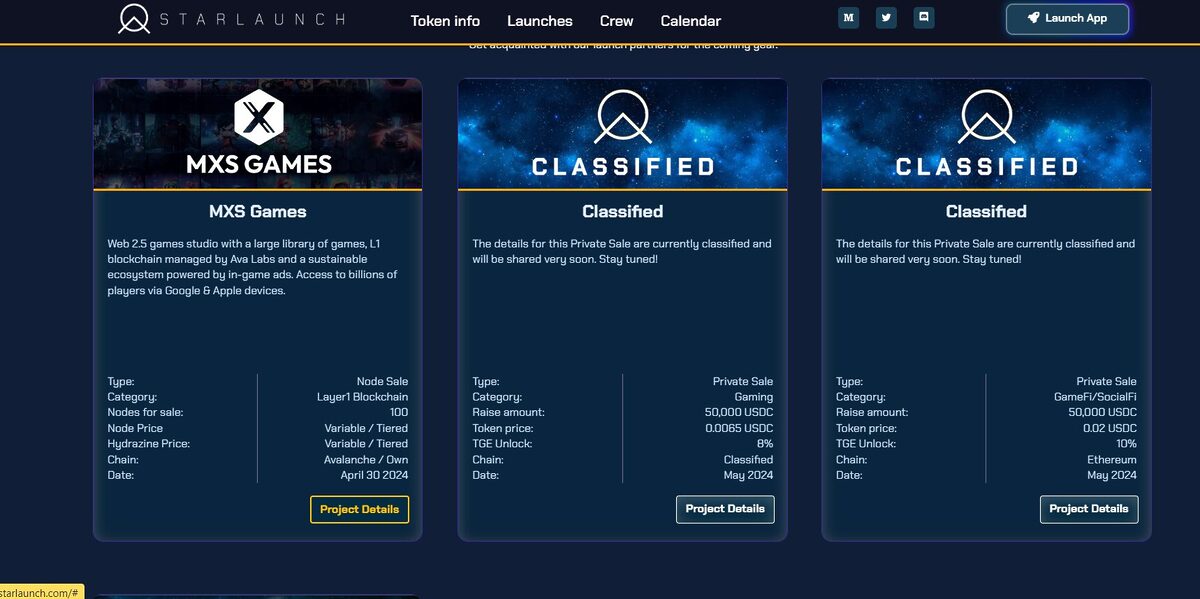

Sure, Solana launchpads like Starlaunch and Solanium still exist, but the proposed deals are largely unknown, and demand is embarrassingly low. To give you an idea, let’s take a look at the Starlaunch homepage:

Despite calling itself “The #1 Launchpad on Solana,” Starlaunch only has one upcoming launch on its calendar. Not only is the project details link broken, but the IDO in question was meant to begin in April and will be launched on Avalanche, not Solana.

Ultimately, Solana launchpads have been replaced by what crypto users and teams have chosen as a better, fairer token distribution method. However, Solana’s airdrops aren’t perfect.

Solana Launch Strategies: Pros and Cons

For all their benefits, Solana airdrops aren’t without their flaws. What are some of the pros and cons of the Solana ecosystem’s launch strategies?

Pros

- ‘Build first, raise later’ – Solana’s airdrop narrative has meant that ecosystem participants have been able to avoid the disappointment of investing significant capital in the failed projects or scams that were commonplace on launchpads hosted by other blockchains.

- User rewards – Large-scale airdrops like JUP and TNSR have rewarded users with significant token allocations, with power users receiving airdrops worth 5-6 figures.

- Healthy competition – With so many quality platforms vying for engaged and active users, Solana-based teams must deliver top-shelf products that make them stand out.

Cons

- Artificial statistics – Airdrop farmers are known to create fake activity and wash trade between their own wallets in the hope of attracting a larger airdrop. This leads to inorganic statistics and skews important blockchain data.

On the Flipside

- While airdrop farming promises ‘free rewards,’ the reality is that transaction and protocol fees can mean that some users spend more than they receive. This begs the question: Are you farming the protocol, or is the protocol farming you?

Why This Matters

Solana launchpads might have once been a key part of the ecosystem, but public airdrop campaigns have largely replaced them.

FAQs

Given that most Solana projects run airdrop campaigns, Solana launchpads have become somewhat redundant. As a result, Solana projects technically launch themselves.

You can buy Solana (SOL) on leading crypto exchanges like Binance.