Iron Is Still The King Of Metals

When discussing manufacturing innovation, the attention tends to be concentrated on high tech (robotics, 3D printing) or on rare metals and materials, like tungsten, titanium, rhodium, etc. (follow the links for detailed investment reports for each).

In the end, while important, these advancements do not change the fact that the bulk of the materials we use are much simpler—and no metal is as essential to modern life as iron.

Iron and steel are key materials required in massive quantities for infrastructure (bridges, reinforced concrete, etc.), logistics and transportation (cars, railroads, trains, harbors, ships), and countless industrial uses (pipes, storage tanks, furnaces, etc.).

Iron oxides can come from minerals like hematite, limonite, magnetite, pyrite, goethite, and more, and approximately 90% of all metal that is refined nowadays is iron.

Source: FTM Machinery

Luckily, iron is very abundant on Earth (5% of the Earth’s crust by weight) and in the universe at large. However, turning it into a usable form can be a very energy-intensive and time-consuming process. So it is big news that Chinese researchers have announced that they found a method to boost a central step in iron making, with productivity up 3,600 fold.

How Is Iron Made?

Pure iron is produced from iron-rich ore, which is turned into purer metal through the process of smelting.

From the primitive, low-temperature smelter of Antiquity, more advanced furnaces were developed in the Middle Ages and in modern times to produce iron more efficiently at temperatures as high as 1,400° to 1,500° C (2,550° to 2,700° F). This hot, purified iron is often directly sent to the steel plant for steel production, reducing heat loss.

Even with modern methods, iron smelting in blast furnaces is a long process, which takes 5-6 hours. This makes it very energy-consuming, with the high temperature needed to be maintained throughout the entire process, usually done with coal or natural gas.

This also makes iron and steel production a large consumer of fossil fuels and an equally large emitter of greenhouse gases. Iron and steel production are responsible for as much as 7% of total CO2 emissions, more than the entire EU emissions.

Today, most of the global steel production is located in China, which produces more than 55% of the world’s total steel production, followed by India (7% of total steel production).

Source: GMK Center

Both China and India mostly use coal to produce iron and steel, making their production processes particularly large emitters of CO2.

Hydrogen To Replace Coal?

In order to replace coal, green steel manufacturing methods have been proposed, with the best candidate being using hydrogen instead of coal to reach the required high temperatures.

The problem is that so far, only very high-quality iron ore can be used with hydrogen. Cheaper ore with lower iron content would be required to compensate for the higher costs of hydrogen compared to coal.

This is true, at least in blast furnaces, but a new process, called flash iron smelting, could be different.

Flash Iron

The process was described by Chinese researcher Professor Zhang Wenhai and his team in a paper published in the peer-reviewed journal Nonferrous Metals. It claims to complete the iron-making process in just three to six seconds, compared to the five to six hours required by traditional blast furnaces.

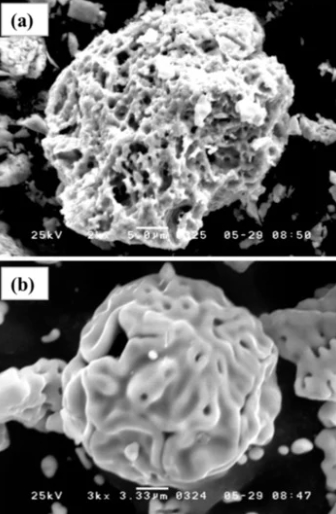

The key idea is that instead of using small pellets of iron ore, it grinds it into a dust of very small particles. This allows for the reaction turning iron ore into pure iron to be near instantaneous, more akin to an explosion than a slow melting of the ore.

This results in a flash oxidation of the particle in a few seconds.

Source: MDPI

Iron Vortex Lance

Reducing the iron ore into fine particles is not a very difficult step or complex technology. What is a lot more tricky is injecting it into the smelter safely and efficiently.

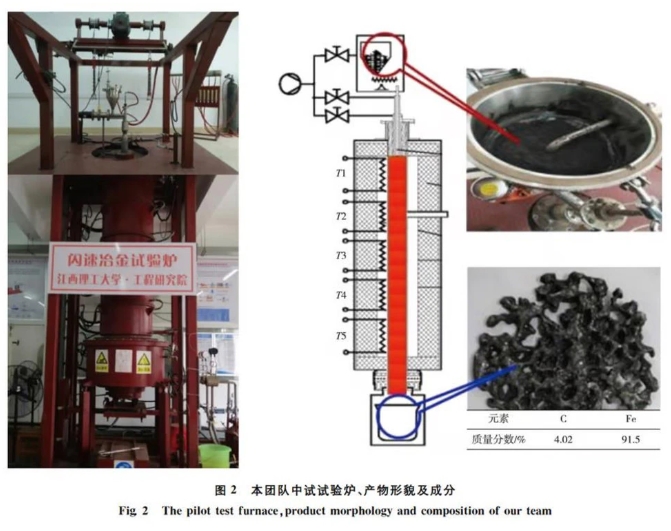

To solve this issue, Pr. Zhang’s team has developed a vortex lance that can inject 450 tonnes of iron ore particles per hour. A reactor equipped with three such lances produces 7.11 million tonnes of iron annually.

More importantly, this technology is not just a laboratory experiment but is already entering commercial production.

This has not been an overnight success, but the result of long-term efforts started in 2013 when Zhang’s team obtained a patent for a flash smelting technology capable of directly producing liquid iron. It took ten years to refine the method and scale it up to a pilot plant, demonstrating that safe, large-scale production was possible.

Source: News.com.au

It should also be noted that Professor Zhang has experience in changing metallurgical science. He revolutionized copper production with a similar flash smelting technique he applied to copper in the 1970s. He was handed the first prize of the National Science and Technology Progress Award in 2000 and elected to the Chinese Academy of Engineering in 2003.

China’s Strategic Goals

Carbon Emissions

As China is the global leader in steel making, the over-reliance of this process on coal has hindered the country’s ambitions to reduce carbon emissions. It also makes its industry highly reliant on imported coal, especially from Australia.

So, China has a strong incentive to develop alternative methods and deploy them quickly, especially if it allows the use of hydrogen instead. Combined with its role as a leader in green energy production, China is in a good place to become the leader in green steel production.

Reshaping Global Iron Markets?

Another thing that makes this method unique is that it works very well for low or medium-yield ores. This could completely reshape the global iron markets.

Currently, high-quality, iron-rich ore from Australia is the primary supply of iron to Chinese smelters and steel plants.

Source: S&P Global

If flash iron smelting with hydrogen is used to replace coal-powered blast furnaces, the domestic supply of lower-quality iron ore could be used instead.

The relationship between China and Australia has steadily degraded in the past decade, despite China’s dependence on Australian iron. For example, in the 2020 trade war with Australia, iron was excluded from sanctions due to the country’s high dependence on it. So, solving this vulnerability could be seen as a strategic imperative by China, regardless of the economic calculus.

Iron Mining Company

Vale

A decrease in iron smelting costs and carbon emissions could make steel an even more popular material than it is today. When it comes to mining, scale and good geology are everything, with low production costs allowing for higher profits and safety during downturns, which are inevitable in commodity markets.

The Brazilian company Vale is the largest producer of iron and nickel in the world, with a total of 323-330 million tons produced in 2024.

The company is also a producer of metals relevant to the “energy transitions,” like copper. While these metals might be important for the future, for now, iron is the core of the company.

The company used to be more diversified but re-centered around iron in recent years, having divested $2B worth of various other metal mines and other commodities like palm oil.

Source: Vale

Large Asset Base

Vale qualifies as a medium-sized utility company, operating its own railroad, trains, harbors, and ships to transport ore from extraction to delivery to customers.

It also produces a lot of its own energy, as it operates in remote regions and cannot depend on the Brazilian government to do its job properly, especially considering its massive power requirements.

This was commonly done with hydropower, as the business of mining is not so different from hydropower construction (earthworks, digging rock with explosives, massive amounts of concrete, heavy machinery, mega construction projects, managing rain, etc.).

These infrastructures are complemented by the company’s R&D center, laboratories, hundreds of geologists, training centers, etc.

Getting Over Past Liabilities

One big risk with a massive mining company like Vale is a massive accident causing massive damage.

This is what happened in 2015, with a massive disaster that occurred after a Vale-built dam collapsed. And then a similar incident in 2019.

The flooding caused Brazil’s worst environmental disaster to date, killed 19 people, and affected 39 municipalities across two states, burying them in mining waste products.

Since then, a lot of similar dams have been repaired and/or improved to avoid another catastrophe during the rainy season.

The company has also changed how it operates, having invested $2.5B in four filtration plants to create dry tailing (the crushed rock, dust, and mud) instead of wet tailing requiring dams. So in the future, iron mining activity will no longer create the sort of waste that requires dams at all.

The company is also actively repairing its image, insisting on how its mining activity, combined with a large natural reserve financed by the company, is a major contributor in preserving the Brazilian rainforest, others turned into pasturelands in the region.

Source: Vale

Overall, Vale is now getting over its past trouble with ecological disasters and turning into one of Brazil’s most valuable assets and a central supplier of iron to the world, and China in particular, a country with whom Brazil is forging deeper ties through the BRICS commercial network.