Just as people started to lose hope, the Santa Claus rally knocked on the door, and prices are now experiencing a nice green lift. And no, the rally isn’t late. It was actually to occur during the last trading week of the year, as it has.

Interestingly, Bitcoin hit its all-time high of $108,135 just a week ago. However, the subsequent 15% drop in value over the next few days to almost $92,000 triggered a panic in the market.

This is despite the fact that the severity of Bitcoin drawdowns during bull market uptrends has declined, which, as per Glassnode, reflects spot ETF demand and rising institutional interest.

While the crash wasn’t out of the ordinary for crypto markets, especially after a 61.2% uptrend in BTC price since November 5 — which concluded US presidential elections with President-elect Donald Trump winning the race — it was enough to spook market participants.

The correction wasn’t limited to crypto but was also seen in the stock market after US Federal Reserve Chair Jerome Powell shared his cautious outlook on future rate cuts, with key interest rates currently between 4.25% and 4.5%.

This led institutions to sell their Bitcoin exposure, with BTC Spot exchange-traded funds (ETFs) recording just over $1.5 billion in total net outflows over four consecutive days, as per the data from Farside.

The cumulative total net inflow of ETFs, however, is still strong at $35.49 billion, and total net assets are hitting the milestone of $110 billion, according to SoSo Value. BlackRock‘s (BLK -0.05%) IBIT, which is $53.78 billion in net assets, accounts for almost half of the total assets.

Not just institutions but retail panic sold too, especially the new entrants.

“These new traders have not seen mid-sized corrections before and are expressing panic over foreign market conditions to them. Historically, when retail traders begin to sell based on panic and emotion, whales and sharks have opportunities to scoop up more coins with little resistance, creating bounces.”

– Noted crypto data provider Santiment

Microstrategy (MSTR -4.78%) took advantage of the opportunity and bought even more Bitcoin, securing 3,177 BTC last week for $299 million. With this, the largest public holder of Bitcoin now has 444,262 BTC. This has resulted in MSTR stock’s value trading at $359, up nearly 400% YTD but down 33.6% from its November 21 peak of about $541.

MicroStrategy Incorporated (MSTR -4.78%)

The aggressive buying reflects executive chairman Michael Saylor’s belief in the cryptocurrency’s long-term value proposition. A Bitcoin advocate, Saylor believes BTC could reach $49 million by 2045 in a bullish scenario, while his bearish estimate projects its value at $3 million.

For now, BTC is working on retaking $100K after the recent decline. Given the correction came the week before Christmas, the crypto market participants thought the Santa Claus rally would be canceled. But it isn’t as we are currently witnessing. But before getting into that, let’s see what this phenomenon is all about.

The ‘Santa Claus Rally’ – What is it and When Does it Happen?

A Santa Claus rally is nothing but an increase in the prices during the last week of any given year. It actually occurs in the last five trading days of December and continues in the first two trading days of January.

Interestingly, the Santa Claus rally isn’t a crypto phenomenon but rather something that already existed for decades. The term’ Santa Claus rally’ was first recorded by Yale Hirsch in 1972.

Historical data shows that during this window, the S&P 500 experienced a positive performance of 79% of the time, with average gains recorded being 1.3% since 1950. Going back even further to 1928, the average gains have been even stronger at 1.6%.

But what’s the reason for this? Well, several reasons are attributed to the traditional markets seeing positive returns about four-fifths of the time. The reasons include the holiday spirit, seasonal optimism, end-of-tax-year considerations, increased holiday shopping, and, of course, the lack of liquidity during the holidays, making it easy to pump the markets.

So, what does history say about the impact of this seasonal pattern on crypto markets?

As crypto data provider Kaiko noted in its research on the Santa Rally odds, with Bitcoin’s correlation to the S&P 500 coming down, the effect of this phenomenon isn’t as clear-cut for crypto as it is for traditional markets. Also, the fact that the crypto market never sleeps and works round-the-clock means the industry’s “gains and losses aren’t confined to normal trading windows.“

The research further stated that while crypto trade volumes cluster around US trading hours, most of the recent gains have come after the US close. Also, several consecutive record highs of Bitcoin since the election have occurred late into the day in the US, which means early morning in Europe.

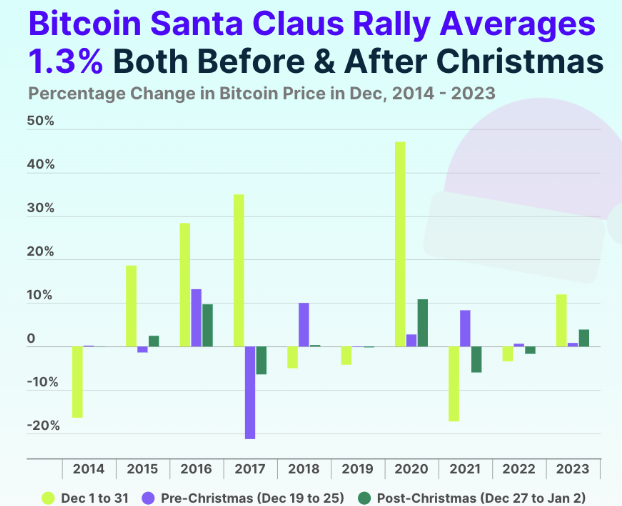

Meanwhile, the recent report from crypto data provider CoinGecko provided a detailed overview of what historical data says about it.

Between 2014 and 2023, the cryptocurrency market has enjoyed the Santa Claus rally effect 8 out of 10 times, but only after Christmas. The total crypto market capitalization has rallied between 0.69% to 11.87% over this one-week timeframe covering December 27 to January 2.

As CoinGecko noted in its report, in the week leading up to Christmas day, the Santa Claus rally has only happened half the time, 5 times over the past 10 years. As for the returns, they were much like the post-Christmas rallies, coming in between 0.15% to 11.56%.

Interestingly, much like this time around, the 2017 bull run saw the largest pullback of 12.12% pre-Christmas before prices skyrocketed and the market topped at the end of the first week of January 2018.

When it comes to corrections before Christmas, 2017 was an outlier, as the drop has rather ranged from 0.74% to 1.25% at other times. Also, much like the broader crypto market, Bitcoin’s biggest pullback was in 2017, when the price dipped 21.30% before Christmas.

Overall, the total crypto market cap has seen both relatively large increases and decreases across the month as a whole, according to CoinGecko.

As for Bitcoin specifically, the trillion-dollar asset experienced the effect of the Santa Claus rally 7 times in the week leading up to Christmas but only 5 times in the period afterward. The gains have been between 0.20% to 13.19% pre-Christmas and 0.33% to 10.86% post-Christmas.

However, given that Bitcoin is already hovering around $100K and is largely driven by institutions via Spot ETFs, BTC may not see a strong rally now that Christmas is here. But this means that altcoins have the perfect opportunity to make the moves after lagging behind BTC all this time.

Kaiko noted:

“Last year’s end of year rally in crypto markets was dominated by BTC and driven by traders anticipating the approval of spot BTC ETFs. This year the setup is a lot different.“

However, it added that:

“Any upcoming rallies will likely be much broader than last year.”

Click here to learn all about investing in Bitcoin (BTC).

The ‘Santa Claus Rally‘ Has Officially Begun

Now, the ‘Santa Claus Rally‘ has made its entry into the traditional market as well as the crypto sphere and is now sending prices higher across the board, including BTC.

For the stock market, Tuesday kicked off a historically merry period for investors. On Christmas Eve, the S&P 500 jumped 1.1% to 6,040.04, the Dow Jones climbed 0.91% to 43,297.03, and the Nasdaq Composite rose roughly 1.4% to 20,031.13. The tech-heavy Nasdaq’s gains were supported by Tesla‘s (TSLA -1.76%) 7.4% spike. As for gold, XAUUSD is at 2,616.875, down from the $2,790 peak on October 30.

2024 has already been a good year for the S&P 500, which has advanced over 25%, putting the index on track for its first two consecutive years of 20% annual gains since 1998.

After relishing in AI mania and then first-rate cuts since 2020, the market is now predicted to enjoy another strong year of returns if we go by the predictions of Morgan Stanley (MS +0.76%), Goldman Sachs (GS -0.27%), and Bank of America (BAC +0.38%), which are forecasting another record run for the S&P.

Now, back to the crypto market. After going to nearly $92K last Friday and then again this Tuesday, the Bitcoin price is now back to making its way to $100K. As of writing, BTC/USD has been trading around $98,500, a jump of 6.5% since this week’s low.

Still, it’s yet to be seen if BTC will be worth six figures again before 2024 is over. According to bettors on prediction market Polymarket, the odds of Bitcoin price hitting $100K again this year is currently at 76%. Some bettors are even more bullish, with a 14% chance given to BTC price surging to $110,000 before the year’s end in a separate event.

For now, Bitcoin’s Q4 2024 returns stand at 54.6%, the second-highest after 1Q24’s 68.68% returns. As for the crypto king’s December performance, it is currently positive at 1.68%, the lowest since Bitcoin started uptrending in September. The best-ever September with 7.29% gains led to only green afterward, with October and November registering 10.76% and 37.29% increases in price, respectively.

But what about altcoins? They are also uptrending nicely, with the likes of ZEC (12%), CRV (9.7%), and VET (9.5%) experiencing significant growth, as per Coinmarketcap.

With that, the total crypto market cap is now standing at $3.59 trillion, up 3.4% from Monday’s low but down from the $3.9 trillion peak hit on December 17. Already, the fear and greed index has reached into the ‘greed‘ territory with a reading of 62.

Earlier this week, when BTC first dropped, altcoins didn’t get dragged along. Usually, altcoins follow Bitcoin’s lead, which means a correction in BTC reflects a crash in altcoins, as we saw last week. This relative strength has the market calling for the altcoin season. But it may be too soon to call for one.

According to the Altcoin Season Index from Blockchain Center, it is right in the middle with a reading of 49. As per the scale, which goes from 0 to 100, a reading of 75 will mark the altcoin season, while below 25, it’s Bitcoin season.

The basis of the index is if 75% of the top 50 coins, excluding stablecoins like USDT and asset-backed tokens like stETH, perform better than Bitcoin over a period of 90 days, then it is considered altcoin season.

However, Bitcoin, with its 61.6% gains during this period, sits about right in the middle. In first place is BGB, with a 475% spike in its price, followed by HBAR (446%), XLM (323%), XRP (315%), OM (220%), DOGE (205%), ENA (205%), ALGO (191%), SUI (189%), ADA (146%), AAVE (144%), WBT (137%), VET (120%), ONDO (119%), and a few others.

Looking Ahead: What to Expect in 2025?

Now, moving into 2025, the first thing the crypto market is looking at is more gains as the ‘Santa Claus rally‘ not only covers the last five trading days of December but also the first two days of January. So, if the rally takes hold, then we can see the market having a green start to a new year.

Interestingly, returns of the stock market are historically higher in January due to investors selling stocks in December for tax benefits and then buying them back the next month. This phenomenon is called the January Effect and is also driven by investors receiving year-end bonuses and putting them on the market.

There are also psychological factors like New Year optimism and new resolutions at play. The January Effect, however, used to be a lot stronger in past decades but has become weaker in recent years. If it does play out, then Bitcoin can benefit from this as it has become an institutional class with the approval of the ETF.

Ethereum is another major crypto and the only one besides Bitcoin to have its Spot ETF approved that can see institutional interest next month. The net inflows of ETH ETF are currently at $2.5 billion, and they are finally seeing some recovery after struggling initially.

ETH is one of the biggest disappointments of this year, with its price yet to make a new ATH, currently down 28.7% from the $4,880 peak from three years ago.

The $420 billion market cap asset did start to see some positive action finally in Q4, recording 34.05% returns after two consecutive red quarters, but the rally didn’t last long. ETHBTC ratio, currently at 0.0354, is still near its multi-year low of 0.032 that was hit on November 18.

ETH is expected to finally see growth as ETF inflows grow and President-elect Trump takes office on January 20. That is expected to bring regulatory clarity to the industry, which is one of the main headwinds the second-largest asset has been facing.

The market is also expecting Trump to come into office for the second time to allow ETF investors to stake their ETH and earn passive income, enhancing the asset’s investment potential.

Currently, 27.90% of the ETH supply is being staked, and the policy movement around staking, taxation, and reward treatment can boost the numbers of locked Ethereum and help to increase prices.

Ethereum actually faces stiff competition from the faster and cheaper Solana, which has overtaken it in terms of on-chain activity, revenue, DEX activity, and other metrics.

Click here to learn all about investing in Ethereum (ETH).

Since the cycle low in Nov. 2022, when SOL dropped below $10, which was a decline of over 96% from that time’s ATH, Solana has made a remarkable recovery in terms of price appreciation as it trades at $196 and relative capital inflows.

While experts are predicting that ETH will hit $10,000 next year, SOL is expected to see $1,000 should the bull market continue and Trump do all that he has promised the crypto community on his campaign trail, which includes a strategic BTC reserve. Polymarket bettors give it a 32% chance that Trump will create a Bitcoin reserve in the first 100 days.

Having said that, he has already announced many crypto-friendly nominations, including Paul Atkins as SEC Chair, David Sacks as the AI and Crypto Czar, Scott Bessent for Treasury Secretary, and Stephen Miran as the chairman of the Council of Economic Advisors.

So, against this backdrop of the most pro-crypto administration, rate cuts, regulatory clarity, and positive momentum, we can expect to see better and bullish things ahead for the crypto market and its participants!

Click here to learn how far we are in this crypto bull market.