Lithography, The Core Of Semiconductor Manufacturing

Producing semiconductors has become one of the most profitable and strategic industrial activities in the 21st century, with companies like Nvidia (NVDA -3.7%), Intel (INTC -3.37%), or TSMC (TSM -0.96%) (follow the links for a dedicated report on each of these companies) reaching market capitalization in billions if not several trillions of dollars.

Almost all of them use a process called photolithography. As the name indicates, it uses very powerful light beams to engrave silicon wafers and turn them into computer chips and other semiconductor components.

This requires very specialized machines with plenty of ultra-precise lenses, motors, and a system called a “photomask”.

Source: CopperPod IP

Photomasks are made of quartz or glass substrates coated with an opaque film onto which the pattern of the device being manufactured is etched. This film is essentially the template for the chips that will be engraved on the silicon wafer, although it is miniaturized to a much smaller scale during the engraving process.

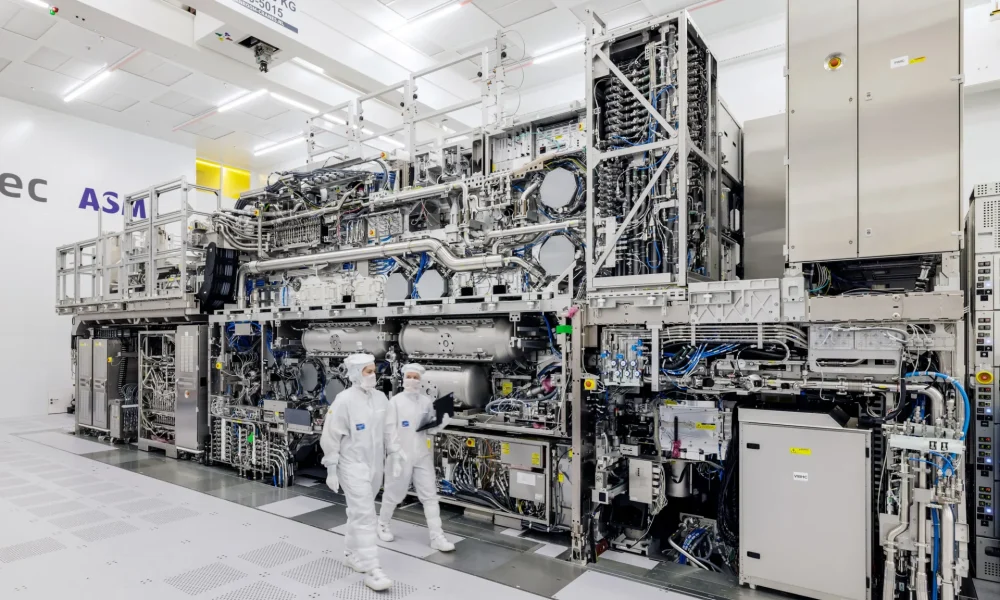

Most chips are manufactured using DUV (Deep Ultra-Violet) lithography machines, which use powerful UV beams to etch the silicon. More advanced chips use EUV (Extreme Ultra-Violet), which uses even more powerful UV light. For now, semiconductor manufacturer ASML (ASML +0.09%) has a monopoly on EUV.

Both DUV and EUV machines are big, expensive, and power-hungry.

Another option is emerging with maskless lithography. This technology might have made a giant jump forward thanks to the world’s first deep-UV microLED display chips invented by Chinese researchers.

Working at the Hong Kong University of Science and Technology and the Southern University of Science and Technology at Shenzhen, they published their results in Nature Photonics under the title “High-power AlGaN deep-ultraviolet micro-light-emitting diode displays for maskless photolithography”.

Maskless Lithography

The main point of using photomasks for lithography is that it allows the DUV machine to use a lot of light, and then focus part of it into the engraving process. This, however, led to low light efficiency, insufficient optical power density, and ultimately low efficiency and high energy consumption.

An alternative could be using a more precise UV light source, like aluminum gallium nitride deep-ultraviolet (UVC) micro-light-emitting diodes (micro-LEDs). However, developing UVC LEDs with enough power output has been an issue until now.

This means that maskless lithography has been used only for lower-resolution substrates, such as printed circuit boards, instead of chip-grade silicon wafers.

Maskless photolithography would drastically reduce the cost of semiconductor manufacturing and offer more customization options. Overall, this technology would make anything electronic cheaper and easier to manufacture.

Better UVC LEDs

A key factor in the underperformance of UVC micro-LEDs is that substantial alignment gaps during the fabrication processes of the LED sub-units cause problems when trying to build large-format UVC micro-LED displays. Not only might a specific LED light not be uniform internally, but different LEDs manufactured at the same time will display different characteristics.

Source: Nature Photonics

The researchers improved the fabrication method to successfully build a uniform 160 × 90 UVC micro-LED array. This array features a pixel size of 6 μm and a pitch of 10 μm

Source: Nature Photonics

Making UVC LEDs Useful

The improved LEDs were then integrated with circuit boards to generate and project digital UV patterns.

The resulting systems could display any complex patterns and drawings in intense UVC light.

Source: Nature Photonics

Due to the small size of the LEDs, there is no need for the complex demagnification lenses used in photolithography using photomasks.

After a 5-second exposure, a mirror-written structure develops on the wafer surface. This could engrave patterns in sizes ranging from 3 μm to 100 μm (micrometers).

Source: Nature Photonics

This deep-UV microLED display chip integrates the ultraviolet light source with the pattern on the mask. It provides sufficient irradiation dose for photoresist exposure in a short time, creating a new path for semiconductor manufacturing.”

Pr. KWOK Hoi-Sing – Founding Director of the State Key Laboratory of Advanced Displays and Optoelectronics Technologies at HKUST

Further Progress

Even Better UVC LEDs

The research team responsible for this achievement thinks they can push the performance of their micro-LEDs even further from the 320 × 140 prototype.

They see a path to develop 1k, 2k, or even 8k high-resolution deep ultraviolet microLED display screens, which would engrave patterns on silicon even more precisely.

“Compared with other representative works, our innovation features smaller device size, lower driving voltage, higher external quantum efficiency, higher optical power density, larger array size, and higher display resolution.

Dr. FENG Feng – Postdoctoral research fellow at HKUST

Extra Support Systems

Although UVC-microLEDs do not require the same array of lenses as classical lithography using photomasks, the researchers’ resolution is not yet enough.

So, related lens and focusing systems, beyond the scope of these researchers’ expertise in LED manufacturing, could significantly improve maskless photolithography. However, this should not be a major technical difficulty for the semiconductor industry, as these are known and commonly used technology.

So, companies already producing DUV machines could easily create a new design using maskless UVC microLEDs and focusing lenses instead of the traditional design requiring expensive photomasks.

Investing In Semiconductor Lithography

As maskless lithography becomes an increasingly common part of the semiconductor industry, this technological shift will likely result in some winners and some losers.

Companies specialized in photomask production like Photronics, Inc. are likely to suffer.

On the other hand, companies producing DUV lithography machines would benefit from a new maskless design. By removing an expensive consumable, it would make the whole lithography operation cheaper. Cheaper semiconductors would boost sales volume, increasing the demand for DUV machines.

You can invest in semiconductor-related companies through many brokers, and you can find here, on securities.io, our recommendations for the best brokers in the USA, Canada, Australia, the UK, as well as many other countries.

Or, if you prefer a more diversified approach, you can invest in semiconductor-related ETFs like the iShares Semiconductor ETF (SOXX), the VanEck Semiconductor ETF (SMH), or the Global X Semiconductor ETF (SEMI).

You can also learn more about the semiconductor manufacturing equipment supply chain and key companies in “Top 10 Semiconductor Equipment Stocks for Manufacturing Support”.

Semiconductor Lithography Company

ASML Holding N.V.

ASML Holding N.V. (ASML +0.09%)

ASML Overview

The world’s largest semiconductor equipment supplier by market cap, Dutch ASML is also the leader in the field, with a quasi-monopoly on a key technology called EUV lithography (Extreme UltraViolet).

EUV allows for ultra-small nodes, up to 7nm, or even 5nm and 3nm. These advanced node levels are often considered necessary for applications like AI, machine learning, 5G, AR/VR, and advanced cloud services.

EUV is currently at the center of the China-USA tensions and trade wars. In the summer of 2022, the USA banned the export of EUV machines to China. This was followed by efforts from Huawei to develop its own EUV solutions, with a patent deposited in December 2022.

By having a de facto monopoly on EUV out of China, ASML is a very prominent chip equipment manufacturer, a status heightened by the US pressure to restrict the export of the technology to its main rival. As a result, ASML is a crucial supplier to all chip manufacturers looking to build the most advanced chips.

EUV is the successor to previous technology, also sold by ASML, the DUV lithography (Deep UltraViolet).

Source: ASML

EUV systems make up only a fraction of the machines sold, but at a much higher price, so a large part of revenues and profits. Still, DUV systems (ArFi, ArF, & KrF) represent the majority of the company sales (61%).

Source: ASML

ASML is not the only DUV machine manufacturer, with competitors like Canon or Nikon active as well, but it is by far the most “focused” company, while its Japanese competitors are conglomerates with multiple other activities.

DUV Machines & China

Chinese competition is growing in DUV, due to the Chinese government’s push for domestic suppliers of semiconductor equipment.

Considering that improved UVC-microLEDs, the latest innovation in making maskless DUV more realistic, came from Hong Kong and Shenzhen researchers, this is something investors should take into account especially as China represents 47% of ASML’s revenues.

Exports of DUV machines to China have also been subjected to US sanctions, but these met significant pushback from the Dutch, Korean, and even Taiwanese governments.

Amsterdam has ruled that from now on ASML will be procuring the necessary license to export their DUV machines to members under the U.S. Bureau of Industry Standards’ Entity List from the Dutch government instead of the U.S. government.

This essentially means that the U.S.-mandated export controls will be under the licensing purview of administrators in the Netherlands instead of the United States.

The Diplomat

Conclusion About ASML

Still, despite potential China-related risks, ASML is the (almost) uncontested leader of the lithography industry and is already moving on to the next level of EUV technology: high-NA EUV systems (High Numerical Aperture).

High-NA EUV machines are now being deployed: to Intel in December 2023, to TSMC a year later, and to Samsung by 2025.

ASML also unveiled in the summer of 2024 its plans for what comes next: “Hyper-NA” EUV technology”. This concept, still in early research stages, would not be deployed until after 2030.

Source: Tech PowerUp

Overall, ASML advances in EUV and expertise in DUV make it a likely winner in any tech war in fields afferent to its expertise, such as maskless DUV.

It might, however, see a period of instability and renewed competition with Chinese manufacturers likely to take market shares of the country’s semiconductor production, especially if helped by the Chinese government or because of US-ordered sanctions regarding ASML’s sales to China.