The fourth Bitcoin halving has been completed, and the crypto market is gearing up for another bull cycle and the next altcoin season rally.

However, with the crypto market flooded with coins, the biggest question for those looking to enter is finding the right coins to invest in: ones with low risk, but high potential for gains.

DailyCoin looked into how seasoned investors plan to capitalize on the bull cycle and what strategies they use to research the crypto market.

Crypto Market Is a Game of Liquidity

The crypto market is unique in its volatility. Asset prices may swing 20% or more on hourly timeframes. With countless altcoins having low or even micro-sized market capitalizations, a substantial influx of funds can significantly boost their prices.

The idea of fast and significant gains brings such altcoins into the focus of traders during the bull cycle rally. Where there is demand, there is always volume, liquidity, and gains. However, there is also significant risk.

As markets move fast and violently, failing to join them ahead of the rally and being too late can result in dramatic losses.

Therefore, the primary task of every crypto investor aiming to capitalize on a bull cycle is to carefully examine the forces that fuel and drive the market before selecting particular coins.

Here are some strategies for where seasoned crypto investors and traders begin their market research.

1. Follow the Narrative

First of all, before and during the bull run, many crypto traders search for the coins that align with the popular narratives.

Narratives are the driving force behind every bull market. Basically, they are the prevailing themes or concepts that impact investor sentiment, catalyze growth and enthusiasm, and shape the direction of the cryptocurrency market.

The narratives, though, are constantly changing. In the 2017 bull cycle, it was ICOs. Then, we saw DeFi and NFTs lead the way with the highest returns in the 2020/21 market rally. During this bull market cycle, the new narratives are gaining traction.

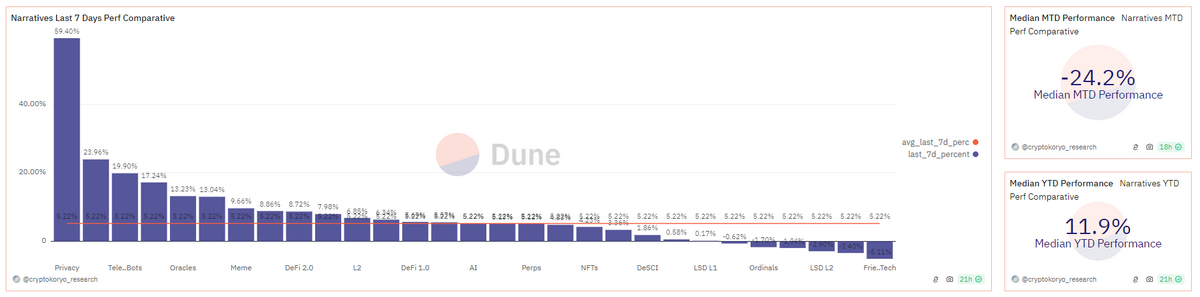

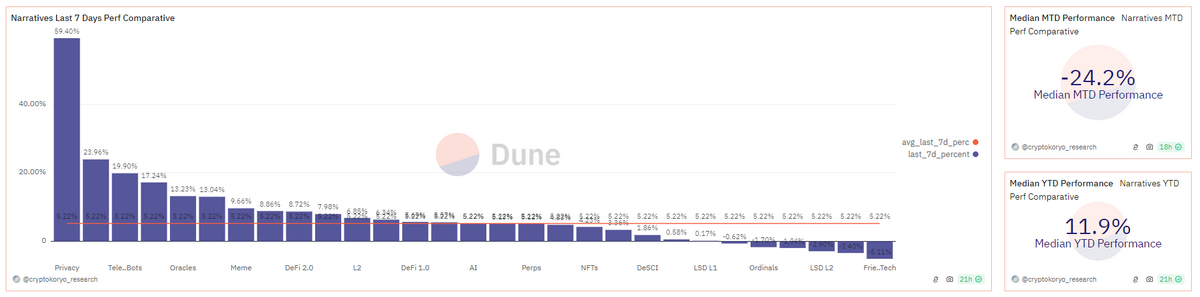

“Being early to a narrative is crucial for success, and if it’s already buzzing on Twitter, chances are you’re not as early as you’d like to be,” says @CryptoKoryo.

According to him, spotting global trends among new projects and identifying outliers is a way to find untapped opportunities.

Therefore, traders should closely monitor the dynamics of narrative changes, identify patterns of how trends move, and spotlight the hot narratives with their aligning coins.

The trick here is to understand why certain narratives pump more than others: Is it because of their fundamentals or because of short-term events like big announcements or launches?

Then, once you’ve determined which narrative best suits your interests, it’s time to thoroughly research the coins that align with said narrative.

Examining the technical price analysis of a particular coin can provide valuable insights into whether the asset performs better than the overall market, says crypto investor @malworwarl, whose investment strategies brought him significant gains during the past bull cycle.

“Look at the chart. Look at what you think it can do on its narrative based on the project type. Find projects that are similar. Check the MC’s [market caps] of these projects and what stage they are at.”

At this point, he recommends carefully researching the project’s fundamentals, including its purpose, metrics, team, funding, roadmap, and token distribution schedule, when assessing the potential for a price surge.

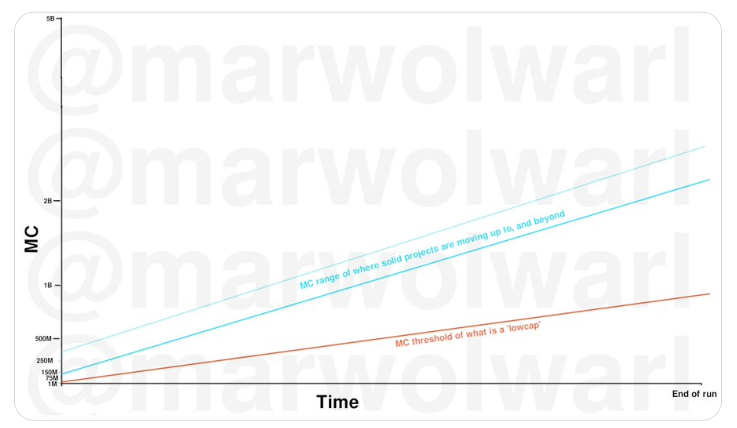

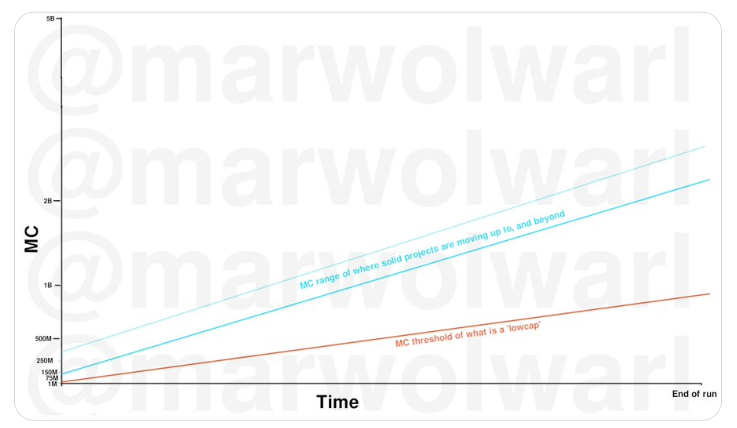

According to him, traders aiming for higher gains in the current bull cycle should seek out projects that are not easily replicated and are currently undervalued but have the potential to surpass today’s market capitalization of similar solid projects.

For instance, during the bull cycle, Coin A, initially valued at $50 million, could potentially reach the market capitalization of a similar but higher-priced Coin B, currently valued at $500 million. Since market capitalization fluctuates, Coin B’s value could also exceed $500 million by the end of the bull cycle, and Coin A will still be undervalued compared to it.

However, if we compare the current market values of Coin A and Coin B, we would probably see what Coin A’s upside growth potential is.

According to @marwolwalr, understanding that market capitalizations keep changing over time allows us to see and set the price targets more clearly.

“Last year a lowcap was 800K, it then moved to a few million, then to 10 million, now a lowcap is considered as under 50M. In a few weeks or months a low cap will be 250M. This run we will expect a lowcap to end up being defined as something under 900M-1B,” claims a crypto trader.

2. Follow the VC Funding

Sometimes new narratives arise from projects that don’t fit into any popular narrative category. Fortunately, there is another tactic for finding those outliers: tracking fundraising habits and monitoring where market leaders are investing their capital.

“Cryptos don’t just 100x out of nowhere. VCs usually invest in a sector, pay cash or allocate marketing funds and pump projects 100x,” says a full-time crypto trader, investor, and social media personality @LadyofCrypto, who grew her crypto portfolio from $6.5K to $1 million in three years of active trading.

Venture capital firms are a top choice for crypto startups to secure funding. VCs invest in new and early-stage projects, and their backing reflects investor confidence in a project’s concept or technology.

Investors, such as VCs, aim to make money and employ expert teams to find projects that can grow. They also consider the future dynamics of the industry, anticipate the market’s dominant trends years in advance, and position themselves accordingly. Knowing where VCs are investing can give insights into narratives before they get mainstream.

There are various platforms to track VC investments in cryptocurrency projects, including Messari, Coinlaunch, DefiLlama, Cryptorank, or Crypto-Fundraising. Scroll through their websites, and look at the global trends and categories.

On the other hand, search for outliers. These projects don’t belong to any existing category of narratives.

They bring something new, and the fact that reputable VCs back them could probably indicate the birth of new future trends and an opportunity to jump on the bandwagon early.

3. Follow the Whales

If closely following fundraisings is not your cup of tea, there is another way to search for effective gains: tracking the movements of large, wealthy wallets, known as whales.

Whales are individuals or entities that hold large amounts of crypto. They typically play with large volumes and often have significant influence over market sentiment. Tracking their movements can help assess overall market sentiment and potential price trends.

“If you see top wallets suddenly buying six figures worth of an alt, it might mean it has an upcoming catalyst that will pump it,” believes Lady of Crypto.

But how does one find whales with a successful investment history worth tracking?

One of the tactics could be monitoring large holders, especially those who bought in the early stage.

On blockchain explorer websites like EtherScan or SolScan, open the trading pair that interests you and select the particular token. You will see lots of related data: holders and their percentage of tokens’ total supply, transactions, and trading volumes on DEXes.

Another way would be looking for tokens that have experienced significant growth in recent days. Use DEX trade trackers, such as ChainEdge or DexScreener, as many emerging lowcaps might not yet be listed on centralized platforms.

“Check for trending tokens or ones with significant growth and identify wallets that bought into them with large amounts,” advises on-chain alpha seeker @zeroXhopper, who studied the investments of several hundred whale wallets.

For deeper insights into traders’ behavior, copy the addresses and use wallet trackers like Cielo Finance or Alpha Trace. By examining holders more closely, it is easy to identify those who bought at an early stage.

Check their trades, realized profit and loss, or the traders’ win rate. Add wallets with 50% and higher win rates to your watchlist and further observe.

Final Thoughts

In the world of cryptocurrencies, having access to valuable data is often the key to success. Working with data is an absolute must if you want to enter an altcoin rally as early as possible and maximize profits.

However, understanding the tactics and strategies of experienced investors is just one way to navigate the oversaturated crypto market more effectively.

The crucial step is to allocate time for your own research. It is the only way to uncover low caps with the maximum potential to outperform their competitors during the bull market.

Find out more about key on-chain metrics for traders to follow:

Bitcoin Price: Where Next, According to On-Chain Metrics?

Check out what every trader should know about stablecoin trading volumes:

Solana Stablecoins Volumes Are Not Fully Genuine. Here’s Why