The Need For More Energy

As climate change becomes a growing concern in most countries, decarbonizing our energy supply is becoming more pressing. A lot is being done with renewables, but still not enough. The issue of renewables intermittency will still take a while to be solved with utility-scale battery storage.

The problem is compounded by growing energy demand from AI and the electrification of everything, from transportation to industry and heating/cooling. This means that not only do we need to decarbonize power generation, but we likely need to at least double or triple electricity generation as well for our future energy mix to work.

Overall, we are likely to need all the possible low-carbon solutions we can deploy sooner rather than later. Part of this growing electricity production will need to be very stable baseload generation.

This demand will most likely need to be satisfied with nuclear power. And no other company in North America (or even the West at large) will be as instrumental in making it happen as Cameco.

Cameco Corporation (CCJ -2.41%)

Nuclear Industry’s Outlook

For a while, the incidents of Chernobyl and Fukushima were seen as proof nuclear energy was just too dangerous. Still, before them, there was a time when it seemed clear that the future was nuclear and that burning coal, oil, and gas would soon be as obsolete as the Netherlands’ picturesque windmills.

Source: Nuclear Energy – Our World in Data

Nuclear power production stopped growing in the late 1990s post-Chernobyl and has stagnated globally since, with China’s growing production compensating for the declining European nuclear industry.

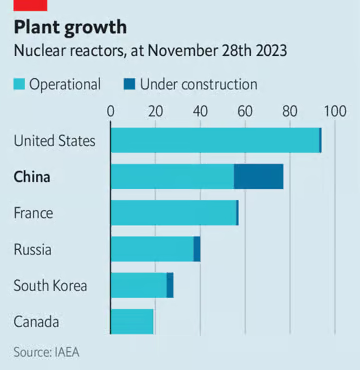

For many years, only China and Russia seemed willing to develop nuclear energy. Especially China, which is, as The Economist put it, “building nuclear reactors faster than any other country”.

Source: The Economist

The Ukraine war, a global energy crisis, and the realization that decarbonization with renewables only will take too long is quickly changing the perception of nuclear.

So today, nuclear energy is making a comeback globally, at a scale unimaginable a few years ago, with many news pointing at a change in policies throughout most of the world:

New Technologies Boosting Nuclear

All this talk about a nuclear renaissance was before the AI craze leading companies like Microsoft to eagerly lock in the future 20 years of energy production of an entire nuclear power plant for its AI datacenters.

Not long after, Amazon was rejected from securing a similar deal, on the grounds that tech companies cannot be allowed to absorb all the nuclear power available:

We are on the cusp of a new phase in the energy transition, one that is characterized as much by soaring energy demand, due in large part to AI, as it is by rapid changes in the resource mix.

Co-location arrangements of the type presented here present an array of complicated, nuanced, and multifaceted issues, which collectively could have huge ramifications for both grid reliability and consumer costs.”

Democratic chair Willie Phillips

Another boost to nuclear energy is the emergence of new technology to make it a lot safer, especially:

Overall, China has been leading in this field, notably with the first 4th generation nuclear power plant launched in 2023. Western countries are now starting to pick up as well, as most likely to look at streamlining some regulations to bring the cost of new reactors down.

Another key factor in decreasing costs will be to build in series the new reactors, whether traditional design or SMRs, in order to achieve economy of scale instead of the one-of-a-kind designs that have been built so far.

Nuclear Trump Effect?

With Trump elected president for a second time, it makes sense to look back at his position on energy. On the one hand, strong support for fossil fuel extraction is to be expected.

“You are looking at, overall, a ‘drill baby drill’ philosophy. You are going to see offshore lease sales, you are going to see pipelines move much quicker, you are going to see fracking on federal lands and a mindset that is focused on lowering energy costs for consumers,”

Dan Eberhart – CEO of Canary LLC, an oilfield services company.

However, it will also likely include nuclear energy. The overall goal is to get the cost of energy to go down. His own campaign emphasized its 1st term activity in favor of nuclear energy:

- Billions in loan guarantees to facilitate the construction of Plant Vogtle units 3 and 4.

- Supported the Carbon Free Power Project at Idaho National Laboratory.

- Advanced the pro-nuclear Partnership for Transatlantic Energy Cooperation.

There is little reason to expect less about nuclear from a candidate who has been enthusiastically looking to reduce dependency on foreign powers, massive infrastructure spending, and a focus on re-industrialization.

So while Trump’s election might be bad news for renewables, it could be a good one for the nuclear industry.

Cameco

Cameco is the world’s second-largest uranium miner, with mines mainly producing in Canada. This puts it just behind Kazatomprom in Kazakhstan. Its main mines are Cigar Lake and McArthur River/Key Lake in the Province of Saskatchewan.

Source: Cameco

As a result, Cameco will be at the center of supplying the raw materials required by existing and future nuclear power plants.

Since 2022, Cameco also owns 49% of Westinghouse, the historical builder of most of the US nuclear power plant parks, and the designer of many European reactors as well. This means that Cameco could benefit from the renaissance of nuclear power in multiple time frames.

In the short term, deficits and risks over uranium supplies can boost the company’s immediate profit and mining profitability.

In the long term, Westinghouse could be a major beneficiary of a massive program to build more nuclear power plants, both in the USA and its allies, especially in Europe which is still suffering from a severe energy crisis damaging its economy.

Uranium Supply Deficits

Uranium has suffered as a commodity for a long time as a result of the end of the Cold War. Nuclear weapons were dismantled by both the USA and Russia and turned back into nuclear fuel.

In addition, the sudden interruption of adding new build reactors, followed by the closing of all Japanese nuclear reactors after Fukushima, did hurt demand growth.

As a result, uranium prices have mostly stagnated in the last decade, causing supply to decline accordingly.

Source: Cameco

This creates an issue, as the long-term supply of uranium does not match the future demand, even without taking into account the recent push for more and quicker construction of new reactors.

Cameco estimates that a massive amount of uranium will be needed soon, and there are not many new sources to come online any time soon.

Source: Cameco

Lastly, it should be noted that fuel is a very small portion of a nuclear power plant’s operating costs. So in case of shortages, paying more is not an issue, as long as fuel can be secured to keep the plant running. This is obviously an ideal situation for uranium miners.

Uranium Supply Geopolitics

As almost half of the world’s uranium is coming from Kazakhstan (45%), this makes the Central Asian country suddenly very strategic, especially in the context of a potential global supply deficit.

Overall, Kazasthan has tried to strike a middle ground between the West and its much more powerful and locally very influential neighbors to the North (Russia) and the East (China).

There are, however, indications that the country might ultimately see most of its uranium supply mostly go to the Eurasian superpowers instead of the global market. For example, Kazatomprom recently hinted that it might stop exporting to the West altogether due to sanctions on Russia making exports difficult logistically:

“It is much easier for us to sell most, if not all, of our production to our Asian partners — I wouldn’t call [out] the specific country . . . They can eat up almost all of our production or our partners to the north.”

Meirzhan Yussupov – Kazatomprom’s CEO

In addition, already in 2022, Kazatomprom discreetly announced in a footnote that the ownership of the company holding a 49 percent stake in Budenovskoye, a giant deposit that Kazatomprom is developing, was transferred to entities including Rosatom’s subsidiary Uranium One.

Meanwhile, the US banned the import of Russian uranium in May 2024, Niger (the world’s 7th largest producer) revoked the license of a major uranium mine belonging to the French company Orano after a pro-Russian coup in the country, and Putin said Russia is considering uranium export restrictions in September 2024.

So let’s just say that the uranium supply news have been more than a little geopolitically charged lately, and unlikely to cool down any time soon.

This should benefit suppliers from much safer and more stable sources, especially the only one running at a large scale: Cameco.

Westinghouse

In 2022, Cameco took the decision to acquire majority control in Westinghouse, the leading builder of nuclear power plants in the US, together with a giant investment firm, Brookfield.

The company has a massive renewable/low carbon power generation division in the form of $19B Brookfield Renewable Partners (BEP -0.25%). Brookfield Corporation as a whole is a massive asset management company with almost a trillion dollars under management.

This means that Westinghouse is now going to be able to access a very deep pool of capital, something that is often an issue for nuclear reactor builders, as new projects require years of investment before bringing revenues.

While longer to materialize into revenues, once in construction, a new reactor generates revenues for Westinghouse from the 6th year after design and engineering studies and will keep doing so for the entirety of the construction project for a period more than 10 years long.

Source: Cameco

Westinghouse’s horse-work is the tried and tested AP1000 reactor design (6 in operations and 6 in construction), using the company’s CANDU standard, one of the most common in the world.

It is also working on the AP300 small modular reactor, which is likely to be deployed in Slovakia, Finland, and Sweden, and the microreactor e-Vinci, illustrating the company’s continuous innovations and how it is keeping up with the industry’s latest trends.

Source: Westinghouse

Westinghouse is instrumental in a large part of the nuclear supply chain. Due to tight regulations, such parts and equipment will be required for any new power plant, traditional or SMR alike.

Overall, even if the supply issue around uranium gets solved and uranium prices crash, the ownership of Westinghouse should allow Cameco to benefit from the ongoing nuclear renaissance for several decades at least.

Conclusion

Cameco is not the only uranium miner, nor is Westinghouse the only nuclear reactor builder. However, in both segments, the company is the leader of the Western world, only matched by foreign competitors like Kazatoprom or China’s nuclear reactor builders or domestically by smaller and younger companies.

As nuclear energy and uranium supply is increasingly the topic of great power competition, we can assume that large efforts will be made to secure the supply of the currently operating nuclear power plants. This should put Cameco’s uranium production at a premium for several years.

In the long run, the ownership of Westinghouse might be equally important for sustaining the stock market capitalization. As the world is rushing to electrify energy systems and decarbonize power production, the reliability of nuclear energy will put it in high demand; especially for activities requiring perfectly continuous supply like AI datacenters.

And maybe as a cherry on the cake, nuclear power will likely become one of the rare consensus points between all elements of the political spectrum in a time of deep divisions:

- The left can appreciate its low carbon emissions as an intermediary solution to climate emergency.

- The right can appreciate its technological prowess, geopolitical relevance, and role in re-industrialization.

- Technologists see it as a perfect solution to power AI systems.

So from Microsoft lobbyists to Trump supporters and climate activists, nuclear energy will likely find in the near future the economic and political support it needs to restart an aggressive growth cycle in the West, China, and the rest of the world.