The cryptocurrency market is having a great time, with the Bitcoin price hitting $100,000, and the total crypto market capitalization is now closing in at the $4 trillion mark.

BTC has been making new highs every other day ever since Republican president-elect Donald Trump won the US presidential election. In fact, since November 5, BTC price has rallied about 54%, which puts Bitcoin’s all-time high (ATH) at $103,679 on December 5.

With Trump ready to join the office next month, the crypto market is rejoicing with green in anticipation of the most pro-crypto administration ever.

“The anticipation of a more crypto-friendly environment under a Trump administration is driving a surge in crypto business initiatives.”

– J.P. Morgan told its clients recently

The positive momentum is expected given that members of Trump’s prospective cabinet, from Vice President-elect J.D. Vance to Robert F. Kennedy Jr., Tulsi Gabbard, and Pete Hegseth, all own crypto.

The crypto community actually has great expectations from the second term of Trump, who made several promises to the industry on his campaign trail.

Once a Bitcoin skeptic, Trump came in full support of crypto this year when he announced that he would create a strategic national Bitcoin reserve. He also pledged to make the US the crypto capital of the world and declared that all Bitcoin should be mined in the US.

More importantly, Trump has promised to bring more regulatory clarity to the sector by establishing a crypto advisory council.

Last month, Coinbase’s CEO met with Trump to get a seat on this council, something a slew of crypto companies are interested in. The council is expected to advise on crypto policy, work with Congress on crypto legislation, and coordinate between agencies, including the Securities and Exchange Commission (SEC), Commodity Futures Trading Commission (CFTC), and the Treasury.

This week, Trump took another step toward overhauling US policy by announcing former PayPal chief operating officer David Sacks as his “White House A.I. & Crypto Czar.”

“He will work on a legal framework so the Crypto industry has the clarity it has been asking for and can thrive in the U.S..”

– Trump said in a post on his social-media site Truth Social

An early Bitcoin investor, Sacks has been involved in crypto for years, at times holding coins like Solana. Back in 2017, in an interview, he said that the rise of Bitcoin is revolutionizing the internet. He said:

“It feels like we are witnessing the birth of a new kind of web. Some people have called it the decentralized web or the internet of money.”

These moves show that Trump is making good on his promises, which he made this year. But this isn’t all. Another big promise made by the president-elect included firing the SEC chair, Gary Gensler.

Although the President can’t fire an SEC Chair, Gensler’s term ends in 2026. However, the Commissioner has already announced his exit.

The 33rd SEC Chair, who began his tenure in April 2021, will step down from the Commission effective at 12:00 pm on January 20, 2025. The official announcement from the agency noted Gensler’s robust rulemaking enhancing efficiency in the US capital markets, adding that “he also oversaw high-impact enforcement cases to hold wrongdoers accountable and return billions to harmed investors.”

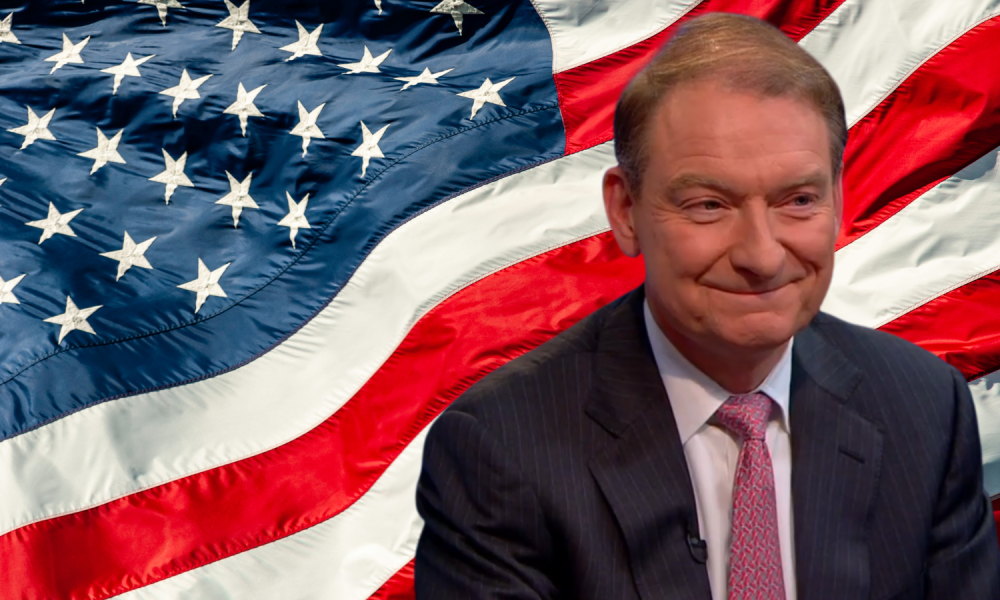

With Gensler to leave the SEC next month, Trump has already announced his replacement to help reshape US policy on crypto. Paul Atkins, a crypto advocate, has been chosen by Trump to lead the securities regulator.

So, Who is Paul Atkins, the New SEC Commissioner?

As Trump promised at the Bitcoin conference in July, “The rules will be written by people who love your industry, not hate your industry,” and he delivered this with his nomination of Atkins to head the SEC.

Paul S. Atkins, Trump’s pick for SEC commissioner and a possible overhaul of the securities agency, is an American lobbyist and businessman.

While making the announcement on Truth Social, Trump said that Atkins is a “proven leader for commonsense regulations” and one who believes in the promise of innovative and robust markets that cater to investors’ needs.

“He also recognizes that digital assets & other innovations are crucial to Making America Greater than Ever Before.”

– wrote Trump

Atkins was also a member of Trump’s transition team last time when he advised on financial regulation. He reportedly worked on the transition landing teams for the Office of the Comptroller of the Currency, Federal Deposit Insurance Corp., and the Consumer Financial Protection Bureau.

Atkins served as Chair of the Securities and Exchange Commission from 2002 to 2008, when President George W. Bush was in office. This will be his second stint as the SEC chair, much like Trump’s presidency.

During his time at the agency, Atkins was known to favor reducing the regulatory burdens of companies. At the same time, he has been very vocal in his encouragement of financial innovation and competition, as well as following free-market principles in his regulatory policy.

As a Republican commissioner, he opposed hefty fines on companies and testified before Congress on ways to restructure the SEC.

He has also stated that the agency is not only required to protect investors, but it must also increase competition and efficiency in the markets. The regulator “must not price those very investors out of our markets through burdensome regulations or eat up the fruits of their investments through nonsensical mandates,” said Atkins in a speech 17 years ago.

Atkins even vowed to dismantle Dodd-Frank legislation, which was enacted after the 2008 financial crisis, to give enhanced federal regulatory authority. He has also talked about the agency offering companies more transparency and predictability over enforcement probes and penalties.

After leaving the SEC at the end of the Bush administration, Atkins founded Patomak Global Partners, a consulting firm for major financial industry clients, including banks, trading firms, crypto companies, fintechs, and other companies.

Interestingly, Atkins is no stranger to crypto; rather, his connection with the industry is much deeper. He is actually the co-chair of the Token Alliance along with Dr. Jim Newsome, who was the CFTC Chairman from 2000 to 2004.

Token Alliance is a crypto lobbying group of the Chamber of Digital Commerce, which comprises 400+ industry thought leaders, innovators, and technologists.

Atkins first joined this crypto initiative back in 2017 and started working towards the Chamber’s mission to promote the use and acceptance of crypto and blockchain technology. He is also a member of the advisory board of the Chamber of Digital Commerce, an advocacy group that calls for balanced digital asset regulations.

The Crypto Market is Already Celebrating

The nomination of Atkins has the crypto market feeling good about what’s to come for the industry in the next few years in terms of regulation, innovation, and adoption.

“New administration, new energy,” posted Mike Novogratz, founder and CEO of crypto asset manager Galaxy Digital, on X (previously Twitter), which, according to him, would build a bullish moment for the industry.

He added:

“We’re witnessing a paradigm shift. After four years of political purgatory, bitcoin and the entire digital asset ecosystem are on the brink of entering the financial mainstream,” said Novogratz elsewhere. “This momentum is fueled by institutional adoption, advancements in tokenization and payments, and a clearer regulatory path.”

The market participants’ exuberance on Atkins’ nomination certainly makes sense given that over the last four years, it was bogged down by the lack of clarity from the regulators, which has many entrepreneurs and innovators considering moving offshore.

But with Atkins, this may finally change. As Hunter Horsley, CEO of Bitwise’s $10 billion asset manager, noted:

“After 16 years, regulatory headwinds are becoming tailwinds.”

Just last month, Bitwise’s chief investment officer, Matt Hougan, wrote a memo in which he made the case for half a million per BTC. This target is “based on Bitcoin eating into gold’s market share” as governments continue to print money.

For the $2 trillion market cap, Bitcoin needs to close the gap with gold, which has a market cap of about $18 trillion. BTC needs to be part of the country’s reserves, much like the precious metal. This may actually happen with Trump, as the president-elect has been talking about creating a national BTC stockpile.

Then there’s the Bitcoin Act from Senator Cynthia Lummis (R-WY), which puts forward the idea of adopting Bitcoin as a national reserve asset with the goal of buying over $80 billion worth of BTC using government funds.

While the US using Bitcoin to diversify its reserves remains an idea still, the local crypto market is surely ready to see a boost with a new SEC chair, who also has the support of fellow commissioners.

“We have a lot of work to do at the SEC to advance free markets, capital formation, investor choice, and innovation. I’m delighted that Paul Atkins will be returning to lead the effort. Having worked for him during his last stint at the agency, I cannot think of a better person for the job.”

– Republican SEC Commissioner Hester Peirce, aka ‘Crypto Mom.’

Peirce reiterated her views during a recent panel discussion at the American Bar Association’s Federal Regulation of Securities Meeting, where she said she looks forward to “providing more clarity.”

According to her, crypto and blockchain are “probably going to be used in lots of areas of our lives,” and regulators shouldn’t “pigeonhole everything into the financial regulatory structure.”

For the chairperson position, the team vetting candidates actually reached out to crypto industry leaders in recent weeks, asking for their preferences. This shows just how unpopular Gensler is in the crypto industry and the part it played in Trump’s crypto approach and latest nomination.

“It’s impossible to express the magnitude of the shift we’re likely to see at an SEC run by Paul Atkins. Crypto has literally never existed without the overhang of uncertainty or hostility from US regulators. This moment is a regulatory singularity before a new era for crypto.“

– Jaker Chervinsky, a chief legal officer at crypto venture capital firm Variant.

Experts believe the change in power may even result in the agency dropping the outstanding lawsuits, including the one against Ripple, which is currently making its way through appeals court after a judge sided in favor of the crypto remittance company.

The ruling in the SEC vs Ripple case came in August this year when the judge ordered the company to pay a $125 million fine instead of the $2 billion the SEC was seeking. This win came after last year Ripple’s sales of its digital asset, XRP, weren’t found to be secure in secondary market transactions when sold to retail investors via exchanges.

“An outstanding choice – Paul Atkins at the helm of the SEC will bring common sense back to the agency,“ said Ripple CEO Brad Garlinghouse on X. “Along with Hester Peirce and Mark Uyeda, it’s time to swiftly and definitively end the prohibition era on crypto, restoring freedom of choice, economic growth, and innovation.”

But It’s Too Early to be Excited

So, Atkins can prove to be a positive pick for crypto; hence, the industry is celebrating Trump’s SEC Chair pick. However, it might be too soon, as Gensler’s pick by the Biden administration was also initially seen as a boom for the sector only to turn out to be a bust.

Before heading the SEC, Gensler acted as the Chair of the CFTC under the Obama administration and led the swaps market reform. Prior to that, he had acted as the undersecretary of the Treasury for Domestic Finance and assistant secretary of the Treasury. Before joining the government, Gensler worked at the leading banker, Goldman Sachs, where he became a partner in the Mergers & Acquisition department.

The crypto market’s bullishness for Gensler came from his time at the MIT Sloan School of Management as the professor of the Practice of Global Economics and Management, where he was a senior advisor to the MIT Media Lab Digital Currency Initiative and taught about blockchain technology.

Despite having a deeper understanding of the crypto market and supporting Bitcoin for years, Gensler took an aggressive approach to crypto oversight. Under his leadership, the SEC brought several actions against crypto players, including Ripple, Kraken, and Coinbase, the US’s largest crypto exchange.

During his Senate confirmation hearing in March 2021, Gensler described crypto as “catalysts for change“ that raise “new issues of investor protection.“ A few months later, he called crypto “highly speculative stores of value,“ which is “rife with fraud, scam, and abuse,“ and that while he’s “technology-neutral,“ he can’t be public policy-neutral.

At the time, Gensler said, crypto continues to be “the Wild West,“ with many tokens being unregistered securities, without required disclosures or market oversight and open to manipulation.

Having said that, it was under Gensler that Bitcoin finally, after a decade-long battle, got a spot exchange-traded fund (ETF) approved this year, which made BTC accessible to institutional investors.

Ever since Spot Bitcoin ETFs got greenlit in January, $33.43 billion has been recorded in total net inflows, as per SoSo Value. Six months after the Bitcoin ETF, the Ethereum ETF was also approved, and since late July, they have captured $1.41 billion in total net inflow.

Genselr’s appointment certainly has been a lesson to the industry, and while Atkins seems to be a good choice for crypto, only time will tell whether he turns out to be a positive one for the industry, if he does get appointed, that is, as that would need Senate approval.

“I don’t think there will be under-regulation,“ said Anthony Scaramucci, the founder of asset manager SkyBridge, who briefly served as White House Director of Communications in Trump’s first administration. “I don’t think it will create fraud, but I think it will help the United States maintain what it should be, which is our mantle of financial services leadership.”

Click here to learn how far are we into the crypto market bull run.

Conclusion

Bitcoin’s price and the total crypto market have already been enjoying an uptrend ever since Trump’s win. The market is now expecting good things ahead from the incoming Trump administration as it realizes Trump’s promises haven’t been empty ones just to win elections. Rather, they are all fast becoming a reality.

With Gensler set to leave, Atkins’ appointment could put an end to the crypto crackdown as well and create a much-needed crypto regulatory framework to address the issue of when a token gets classified as securities and when commodities.

Known for reducing regulatory burdens, he can bring a shift to the SEC’s overall aggressive approach, helping the agency to refocus on keeping markets fair, boosting competition, and promoting innovation in crypto.

With pro-crypto policies and a Bitcoin strategic reserve in the pipeline, the next four years will surely be exciting ones for crypto, promising a transformation for the entire digital asset industry!

Click here to learn all about investing in Bitcoin (BTC).