- The FOMC is cautiously optimistic about driving inflation down to 2% by 2025.

- The crypto market rallied after a tumultuous week in the wake of the Fed chair’s dovish speech.

- With days left until the halving, concerns of another deep pullback remain despite the overall optimism.

Market participants were on pins and needles, awaiting the Federal Reserve’s second policy meeting of the year, with all eyes fixed on Fed chair Jerome Powell’s decision on interest rates. After an intense two-day meeting, the FOMC announced a hold on rates, maintaining them at a 23-year high of 5.5%.

While the decision to keep rates unchanged usually signals ongoing concerns about inflation, financial markets, including the crypto industry, experienced a meteoric rise following the FOMC’s subtle hints at potential rate cuts before year-end.

Crypto Markets Rejoice

Following the FOMC’s decision, the crypto market breathed a collective sigh of relief, shaking off the gloom of a dismal week by gaining 8.18%. While this number might not seem earth-shattering on the surface, the market added over $300 billion to its market cap, bringing the total to over $2.5 trillion at press time.

Bitcoin, which had tumbled over 8% in the past week, swiftly regained its footing, bouncing from $60,000 to $68,000 hours after the FOMC’s meeting. Ethereum, Solana, and Dogecoin joined in the rally, each posting gains of at least 11%.

In a different vein, Ripple, Cardano, and BNB saw more modest 7% gains.

Interestingly, the euphoria wasn’t confined to cryptocurrencies alone; traditional stock markets, including the DOW, also soared to record highs in the wake of the FOMC’s meeting.

The FOMC’s Decision Doesn’t Surprise

The FOMC’s decision to maintain interest rates at their 23-year high doesn’t come as a surprise, given the lukewarm PPI and CPI numbers seen in January and February. However, Powell remains cautiously dovish about the year ahead, expressing hope for improvement by year-end.

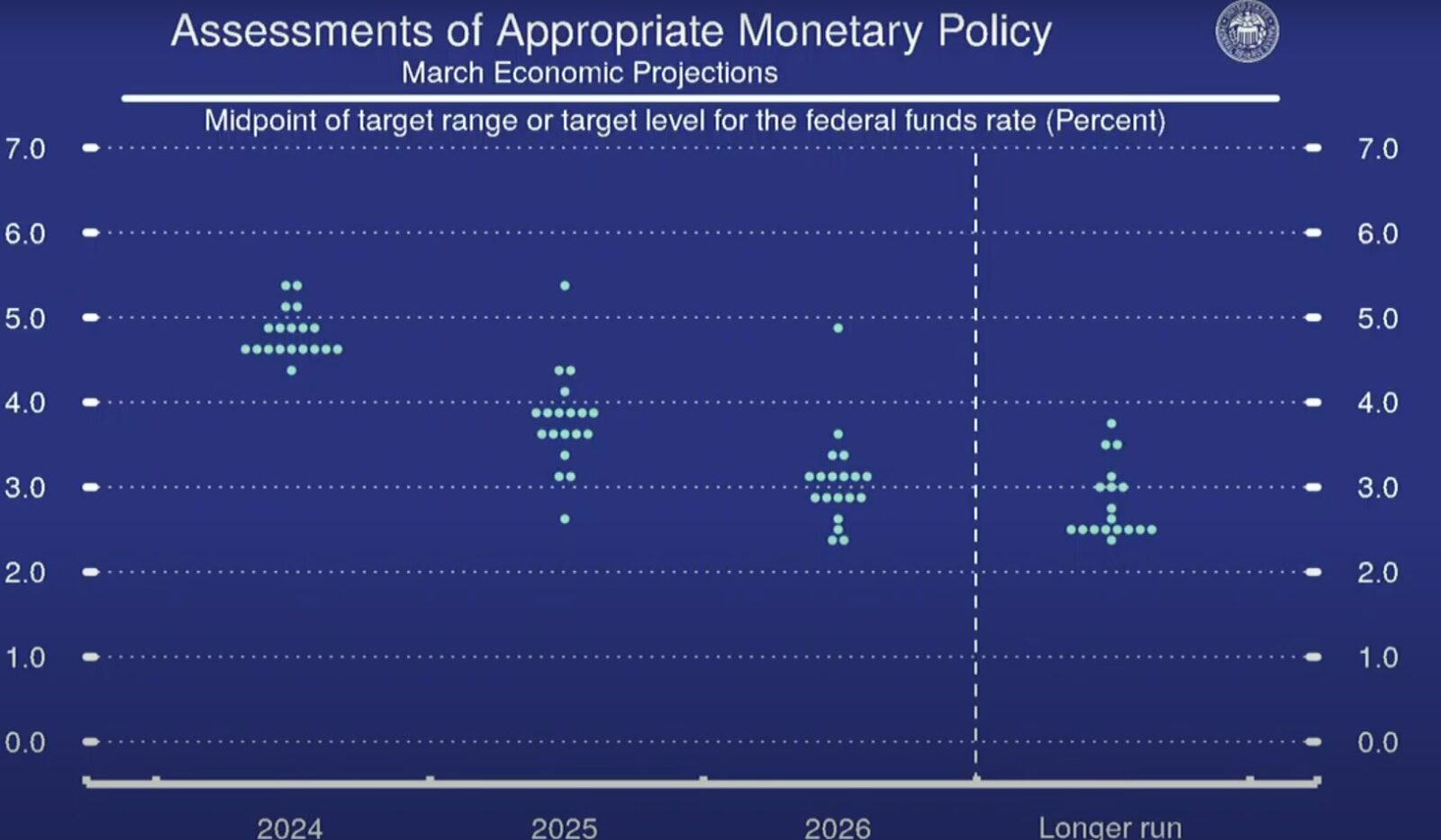

During his address, Powell outlined Fed officials penciling in around a 75 bps cut by the end of the year, marking the first reduction since the early days of the COVID pandemic in March 2020.

While emphasizing the Fed’s commitment to bringing inflation below 2%, Powell projected reaching this goal by the end of 2026. While avoiding specifics on the timing, Powell emphasized data’s importance in guiding decisions, hinting at a more favorable outlook in the year’s second half.

"We believe our policy rate has likely peaked for this cycle, and if the economy progresses as anticipated, we may begin easing policy restraint later this year," Powell stated during his post-meeting press briefing. "However, we're prepared to maintain the current federal funds rate range for an extended period if necessary."

The Fed chair also clarified that the FOMC doesn’t want to get the timing wrong when introducing rate cuts and will try to find the opportune moment for the decision.

Is Bitcoin Out of the Danger Zone?

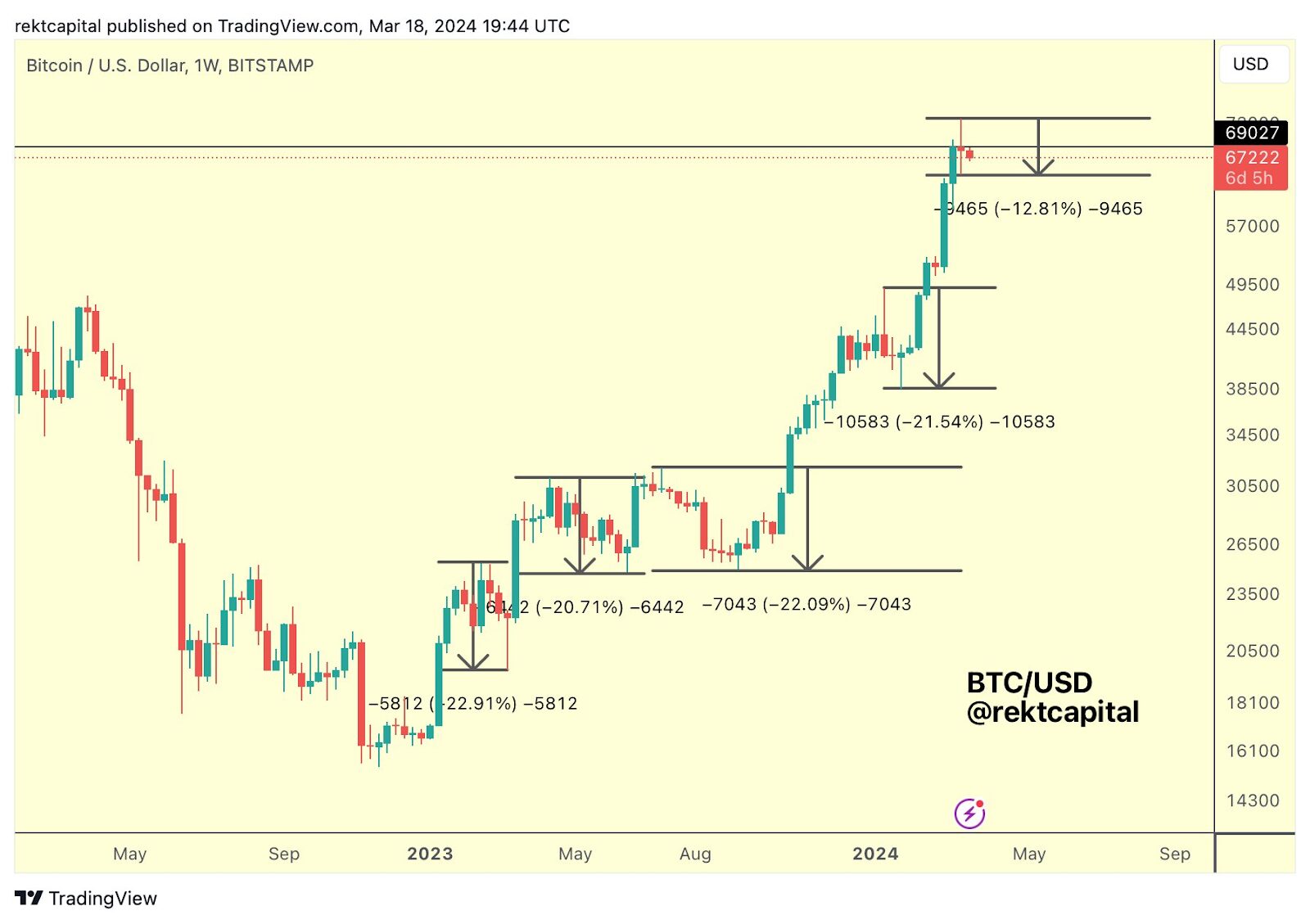

Last week, on Thursday, 14 March, Bitcoin began charting a concerning course, spiraling in search of support toward $60,000 and triggering chaos across the market, leading to altcoin experiencing drops as high as 30%.

Experts brushed off Bitcoin’s turbulent descent as another correction, pointing to historical patterns. Data suggests that it typically retraces by at least 20% over two weeks whenever Bitcoin hits a new high.

As Bitcoin flirted with the $60,000 mark, it dangerously approached the $58,000 price level, which could have spelled disaster for many altcoins, potentially wiping out gains made since February and early March.

Fortunately, just as Bitcoin and the broader crypto market teetered on the brink, FOMC’s bell intervened, providing a lifeline by prompting a swift rebound with renewed aggression. Still, concerns about revisiting liquidity below $60,000 linger.

This is because, typically, market retracements require time to mature fully, spanning anywhere from two weeks to two months. Yet, Bitcoin’s recent tumultuous journey lasted just a week. However, the abrupt turnaround could be attributed to heightened demand from ETF issuers and institutions and the FOMC’s decision, disrupting the crypto market’s bearish trajectory.

Should Bitcoin maintain its rally in the weeks leading up to the halving slated between April 12 and 16, concerns of approaching $58,000 can take a break. However, should it falter, the liquidity at the level is likely to be swept.

On the Flipside

- MicroStrategy and ETF issuers bought at least $1.5 billion worth of Bitcoin as it approached $60,000.

- Historically, Bitcoin prices retrace 14-28 days before the halving. With 25 days left until the halving, likely, the event has already been priced in.

Why This Matters

The FOMC’s decision to introduce rate cuts later in the year signals that inflation in the country is cooling down, leading to positive market sentiment and confidence among market participants to invest in assets rather than staying sidelined due to high borrowing costs.

Read about EOS’ new updates:

EOS Updates RAM System: Here’s What It Improves

What is Sam Bankman-Fried up to?

Lawyers Reveal SBF’s Get-out-of-Jail Plans as Sentencing Nears