- The entire crypto market has suffered heavy losses.

- Solana, Avalanche, and Dogecoin have led the decline.

- Fear has gripped investors as crypto and traditional markets have converged.

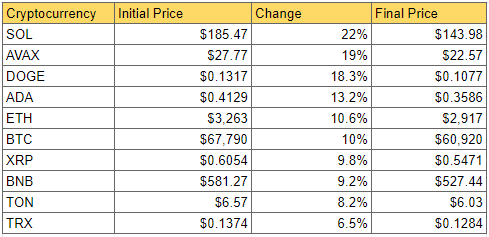

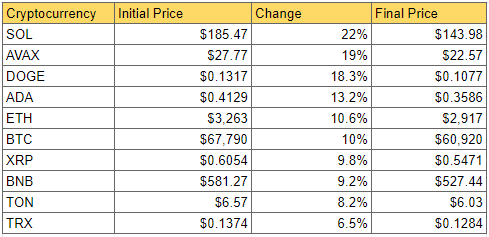

The cryptocurrency market experienced a significant downturn this week, with all ten of the top-ranked digital assets posting losses over the past seven days. The sell-off was particularly harsh for Solana, which plummeted by 22%, leading the pack of underperforming cryptocurrencies.

Entire Crypto Ecosystem Shaken by Market Crash

Close behind Solana was Avalanche, which shed 19% of its value. Dogecoin also took a substantial hit, dropping by 18.3%. Cardano wasn’t spared from the bearish trend, declining by 13.2%. Even the market’s heavyweights, Ethereum and Bitcoin, couldn’t escape the sell-off, with losses of 10.6% and 10%, respectively.

XRP and BNB also faced challenges, falling by 9.8% and 9.2%, respectively. While Toncoin and Tron experienced smaller declines of 8.2% and 6.5%, these losses still represented significant setbacks for the two cryptocurrencies.

The broader crypto market has mirrored this downward trend, with smaller coins and tokens experiencing even more severe losses. The overall market capitalization has contracted by a staggering $260 billion in just a few days.

The cryptocurrency market’s woes were compounded by a broader financial market slump, as tech stocks and the S&P 500 index experienced significant drops. This interconnectedness highlights the growing influence of traditional financial markets on the crypto world.

Losers

All 10 of the top 10 cryptocurrencies experienced price losses over the past week. Here’s a look at them, ranked by their percentage decrease:

This is just a snapshot of the current market conditions at the time of writing. Cryptocurrency prices are constantly fluctuating, so it’s important to do your own research before making any investment decisions.

On the Flipside

- Price fluctuations, both upward and downward, are a common characteristic of the asset class.

- Negative market sentiment can be amplified by fear-driven selling, leading to exaggerated price declines.

Why This Matters

The severe drop in top cryptocurrencies and the $260 billion market cap contraction highlight the increasing link between digital assets and traditional financial markets. This interdependence underscores the need for investors to monitor both markets for a complete risk assessment.

To explore more about the latest on XRP, Doge, and Pepe liquidations, read here:

XRP, DOGE, and PEPE See Major Liquidations: Is the Worst Over?

To understand the implications of the SEC’s stance on Solana and the Sol ETF, check this out:

SEC Concedes on Solana. But a SOL ETF Isn’t Any More Likely: Here’s Why