- Global macroeconomic headwinds rattle crypto markets.

- Crypto prices stage late-week recovery.

- Macroeconomic factors continue to cloud the crypto outlook.

This week, the crypto market faced renewed volatility as broader economic factors weighed heavily on digital assets. A mid-week sell-off pushed the total market cap below $2 trillion, highlighting the market’s sensitivity to external pressures.

However, Thursday saw a modest recovery, bringing the total crypto market cap above $2 trillion. This provided temporary relief, but it remains unclear if the momentum will be sustained or if more volatility is on the horizon, especially with significant economic events scheduled for this month.

Crypto Market Cap Recovers $2T

Crypto markets experienced a significant drop in September, losing $110 billion from peak to trough as macroeconomic pressures persisted. CoinMarketCap data showed that the market bottomed out at $1.96 trillion on Wednesday, underscoring the challenges facing digital assets in the current environment.

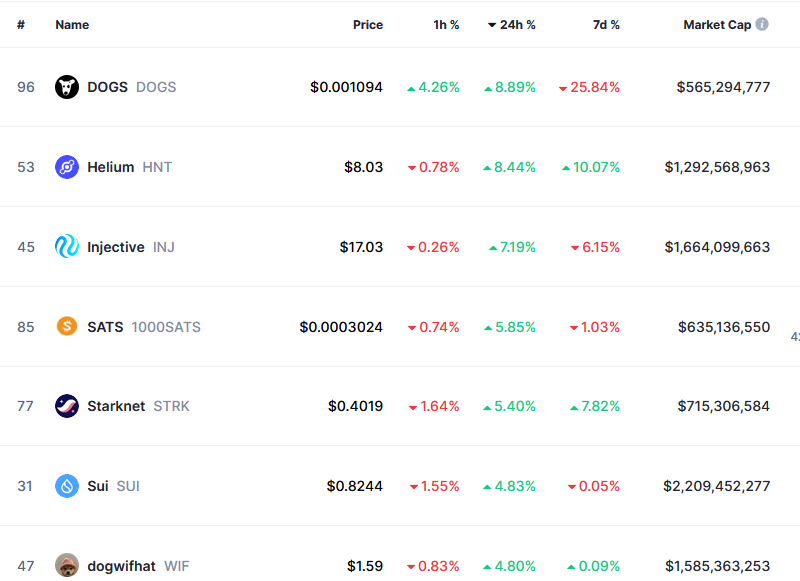

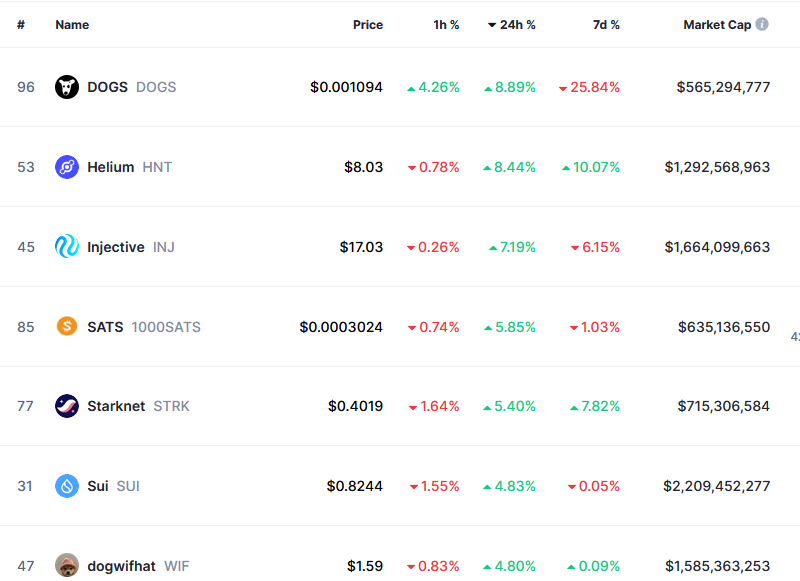

By Thursday morning, the market showed signs of recovery, reclaiming the $2 trillion mark. DOGS, Helium, and Injective led this rebound, with 24-hour gains of 8.9%, 8.4%, and 7.2%, respectively. However, the top 10 remained mostly flat, still struggling to recover from the mid-week sell-off.

Analysts linked the sell-off to further unwinding of yen carry trades following speculation of potential interest rate hikes by the Bank of Japan (BoJ). August saw Bitcoin crash to a 26-week low as yen-carry traders sold assets to repay their yen-denominated loans following the second BoJ rate hike this year.

The recent decline in U.S. stock markets has exacerbated the downward pressure on crypto assets, further highlighting the interconnectedness of digital assets, traditional financial markets, and the economy.

Economic Outlook Uncertain

With the total crypto market cap reclaiming $2 trillion, market sentiment saw a slight improvement as the Fear and Greed Index rose from 27 to 29 over the past day, reflecting cautious optimism. Nonetheless, with economic events ahead the potential for further downturns cannot be ignored.

The U.S. economy faces a busy month ahead. Employment data will be released on September 6, and CPI figures will be released on September 11. The Fed’s FOMC meeting on September 18 will also be closely watched, with a 25 basis point rate cut currently seen as likely.

Despite the generally positive impact of rate cuts on asset prices, BitMEX co-founder Arthur Hayes cautioned that a surge in Reverse Repo Program balances could lead to a liquidity crunch, potentially driving Bitcoin down to $50,000 in the short term.

On the Flipside

- Crypto prices, and therefore the total market cap, are highly changeable.

- Downward revisions in employment data months after release have added to skepticism about government data.

- The correlation between Bitcoin and tech stocks is rising.

Why This Matters

Despite the resilience demonstrated by the market’s return to a $2 trillion valuation, the prevailing macroeconomic uncertainty, which has an increasingly significant influence on crypto, continues to pose a challenge.

Investors stick with gold over Bitcoin amid economic uncertainty:

Bitcoin Struggles as Investors Seek Safety in Gold

Economic factors significantly impact the Bitcoin price:

Bitcoin Sinks to 27-Day Low: What Caused the Drop?