DeepSeek Wrecking The AI Landscape

For anyone unaware who checked the financial markets on Monday 27th January 2025, the question was probably, “What happened”? The seemingly unstoppable rise of Nvidia stock price – until now – was interrupted by a brutal fall of 18% in just one day.

With a market cap loss of $560B, never has a single company lost so much value in a day. For that matter, Nvidia investors are probably getting used to the extreme volatility of the stock, with it making 8 out of the 10 biggest single-day declines.

Source: Visual Capitalist

The trigger was the release of DeepSeek, a China-made LLM (Large Language Model) rivaling the best products of OpenAI and other leading AI firms in performance. Except it is open-source and giving access for a very low price. It is also claimed to have been developed with only $6M as a “side project” of a quantitative hedge fund.

If true, this could upend the narrative that developing AI will be extremely compute-intensive, and require billions, if not trillions, in AI data centers. As the leader of AI hardware, it is unsurprising that Nvidia was the most impacted by investors panicking.

With the dust settling a bit, let’s examine what DeepSeek can actually do, and what else the Chinese AI industry might do soon.

DeepSeek Background

High-Flyer

DeepSeek was developed by a Chinese financial trading / quantitative hedge fund, High-Flyer, founded by Liang Wenfeng.

Liang is 40 years old and initially worked in machine vision. He founded High-Flyer in 2015, in his 30s, pioneering the use of AI in trading strategies, leveraging machine learning. The fund is now managing $8B of assets.

Usually very discreet, Liang was seen sitting next to Chinese Premier Li Qiang (the second-ranking member on the Politburo Standing Committee of the Chinese Communist Party) at a meeting about AI technology in Beijing on January 20th, 2025.

Source: Nigel D’Souza

It should be pointed out that in the initial confusion and due to Liang’s rare public appearances, a lot of media outlets used the picture of someone with the same name, but completely unrelated to DeepSeek, and who works as an interior designer.

“Not Liang Wenfeng” – Source: Business Day

DeepSeek

In 2021, Liang Wenfeng bought around 10,000 H800 Nvidia chips, before US sanctions hit, to launch what would become DeepSeek, and brought High-Flyer AI top researchers to the project.

The H800 chips are relatively speaking low-performance chips compared to the more advanced H100 and B200, with triple the power consumption.

Source: Technical City

DeepSeek claims to have trained its DeepSeek V3 model in less than 2 months, for $5.58M. So while this does not truly include the cost of the 10,000 H800 chips, it is still several orders of magnitude cheaper than any other LLMs until now.

In fact, this would make DeepSeek V3 training cheaper than only the salary of the leaders of AI teams at OpenAI, Meta, Microsoft, Google, etc.

DeepSeek Performances

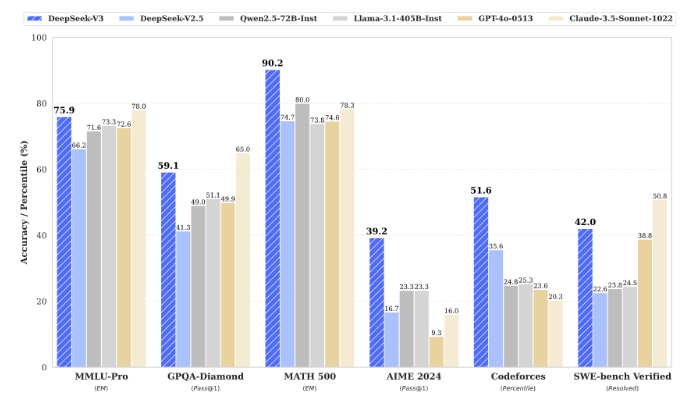

Combined with the low development price, what shocked analysts and investors was that DeepSeek’s performance is similar to or maybe even superior to the latest and best model of OpenAI and other top AI companies, including the just released and acclaimed as a potential AGI o3.

Source: GitHub

The immediate reaction was to suspect foul play and that the time and development costs were fake (more on that below).

But in any case, it is likely that DeepSeek’s method is 10-100x more efficient than what the AI industry has been doing so far.

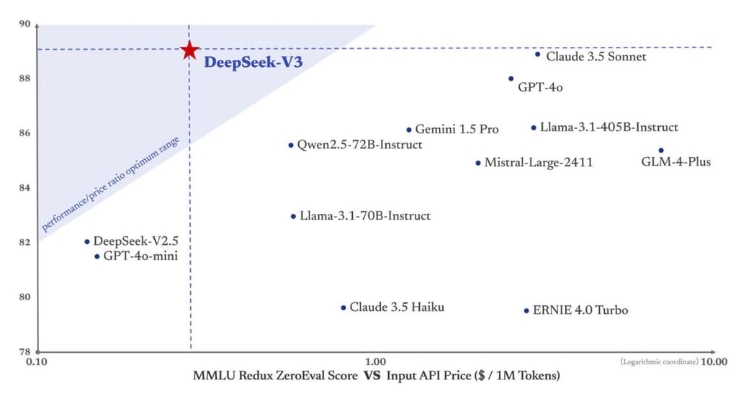

The extra kick in the shin to the American AI industry was DeepSeek pricing. With tokens much below $1, it is around 3%-5% of the price of all its competitors.

Source: Jason Clarck

“We reduced prices because, first, while exploring next-generation model structures, our costs decreased; second, we believe that both AI and API services should be affordable and accessible to everyone.”

Liang Wenfeng

Perfect Timing

The impactful launch of DeepSeek V3 was, obviously, coordinated well by the company for maximum impact.

It came just days after the announcement by President Trump of “Project Stargate”, a $500B initiative to build 20 AI mega-data centers, lead by SoftBank (SFTBY +0%), OpenAI, and Oracle (ORCL +2.98%).

While markets panicked, the US President seems mostly unfazed.

“If you could do it cheaper, if you could do it [for] less [and] get to the same end result. I think that’s a good thing for us.”

He also said he was not concerned about the breakthrough, adding the US will remain a dominant player in the field.

Source: BBC

After LLM, Image Generation

The achievement DeepSeek made in LLM, it is now looking to repeat with AI image generation and the release of Janus-Pro-7B.

Source: Hugging Face

While there is debate if it is actually as good as Midjourney, DALL-E, and other image generators, it is nevertheless impressive.

And if it follows the pattern of DeepSeek v3 LLM, it is likely to be remarkably efficient.

The Immediate Effects

Impact On The AI Industry

As it took the AI industry by storm, DeepSeek had a few immediate consequences:

- Market turbulence: Nvidia stock price and the whole Nasdaq crashed when markets realized the implication of potentially wasting hundreds of billions of dollars in AI hardware (see below for further discussion on this topic).

- Accelerating the AI race: As China moves from being dismissed and “irrelevant” according to US tech moguls a few months ago, a new AI race is now on across the Pacific Ocean.

- Overnight Success: DeepSeek has almost instantly become the most downloaded app in the App Store.

- Offline Testing: Many people are also testing how it can run locally on their high-end home computer, as the computing requirements seem massively lower than previous LLMs.

Collateral damages

The damages caused by DeepSeek were not limited to the image and potential future profits of American AI and tech companies.

For example, innovative nuclear companies expected to form the core of power supply to megawatt-scale AI data centers have been hit even harder: on 27th January 2025, SMR developer Nuscale (SMR -5.09%) was down 27.5% and uranium miner Cameco was down 15%.

Another collateral victim is non-US tech stocks. Japanese tech stocks like Advantest, a supplier of Nvidia also fell 8.6% and Softbank stock fell 8.3%. Meanwhile, Dutch chip-producing manufacturer ASML also fell 6.5%.

How Did DeepSeek Manage It?

No Definitive Answer Yet

This is obviously a still hotly debated topic so little time after the release. We can discuss a few different points of view once we consider a few known facts.

The first fact is that no matter how it got there, DeepSeek V3 is as powerful as the best AI released so far.

Maybe more importantly, as it is open-source, many people are already testing and confirming that it requires much less computing power.

DeepSeek R1 is one of the most amazing and impressive breakthroughs I’ve ever seen – and as open source, a profound gift to the world.

Marc Andreessen

So it should not be dismissed as just “hype” or the result of some conspiracy by the Chinese government. This is also the opinion held by respected Silicon Valley heavyweights like Marc Andreessen and Chamath Palihapitiya.

AI model building is a money trap (…) Open Source is the clear winner.

Closed source AIs will be forced to keep their best models secret and sell to enterprises OR try and create some incredible consumer app with it.

Chamath Palihapitiya

An interview with Liang Wenfeng from July 2024, given just after the release of DeepSeek V2, can also give us some insights.

A Different Approach

The first possible explanation is that DeepSeek just took a different strategy for AI development.

A key factor here is that this is an internal project of Liang Wenfeng’s company, not a VC-funded business. In that respect, it is a little reminiscent of the early days of Tesla and SpaceX, relying on Elon Musk’s own money.

This difference brought to DeepSeek a focus on developing its own model structure, instead of copying Llama’s to quickly produce applications.

“Our goal is AGI (Artificial General Intelligence), which requires us to explore new model structures to achieve superior capabilities within limited resources. This is foundational research for scaling up. Beyond architecture, we’ve studied data curation and human-like reasoning—all reflected in our models.”

Liang Wenfeng

This is also reflected in the company culture, less focused on profit, as this is the “job” of the High-Flyer hedge fund. Instead, innovation itself is the declared goal.

“For three decades, we’ve emphasized profit over innovation. Innovation isn’t purely business-driven; it requires curiosity and creative ambition. We’re shackled by old habits, but this is a phase.

The most enduringly profitable U.S. companies are tech giants built on long-term R&D.”

Liang Wenfeng

From this perspective, DeepSeek culture might be a durable advantage, and it represents a scolding criticism of most AI thought leaders.

“We believe that China’s AI cannot remain a follower forever. Often, we say there’s a one- or two-year gap between Chinese and American AI, but the real gap is between originality and imitation. If this doesn’t change, China will always be a follower. Some explorations are unavoidable.”

Liang Wenfeng

The Natural Evolution Of AI Tech

Another option is simply that as more researchers develop skills at creating AI, innovations keep pushing the field forward. What DeepSeek achieved, some scrappy AI startup was bound to do one day as the technology matures. And due to sanctions limiting access to advanced chips, Chinese AI companies are the first to focus on doing more with less.

It could also be considered as the long-term superiority of open-source software versus closed, for-profit systems looking to maximize profit by creating monopolies.

This point of view is equally not reflecting too well on the hundreds of billions of dollars Big Tech companies had planned to spend just in 2025.

So it would be less an indictment of DeepSeek’s superiority, and more of the bureaucratization of formerly innovative Big Tech companies, both Chinese and American.

A Conspiracy

Probably inevitable in the context of intense Great Powers competition between the West and Eurasia (Russia / China / Iran), many were quick to see in DeepSeek a foreign hostile operation against the most competitive part of the US economy.

One clearly dismissible conspiracy theory is that it is simply a copy of Western AIs or fake its performances, as it is already being confirmed independently. As DeepSeek is an open-source software, it is also rather illogical to attack it as a spyware or as a CCP-censored tool, as literally anyone can deploy it and modify it freely.

However, one valid point is that DeepSeek could have gotten access to more advanced chips, officially sanctioned and forbidden to be exported to China. If that’s the case, it would make sense for the company to not admit it publicly and lie about it.

A possibility is hidden support from the government, from direct funding to giving access to large clusters of smuggled H100 Nvidia chips for the training of the AI. We know for example that a lot of chips are sold to Singapore, and likely re-sold to China.

“The Chinese labs have more H100s than people think. My understanding is that DeepSeek has about 50,000 H100s, which they can’t talk about, obviously, because it’s against the export controls that the US has in place.”

Alexandr Wang, CEO of training data provider Scale AI

Another contention is the cost of training, which has not been independently verified.

One last possibility is that DeepSeek, independently from any geopolitical conspiracy, could have bet massively against Nvidia’s stock before releasing its outstanding claims. High-Flyer is a hedge fund after all, although this might be considered market manipulation and therefore be a risky move.

First Takeaways

AI is a field that is evolving incredibly quickly, and DeepSeek has already changed the game in a few important ways:

- We now have a new method to generate ultra-efficient LLM and likely AI models in general.

- Open-source AI has a solid fighting chance against the more closed model promoted by (ironically named) OpenAI.

- The competition between the USA and China over AI is getting even more intense.

- Sanctions on the export of advanced AI chips to China are a failure, either because DeepSeek accessed them anyway, or because they did not need them at all.

- In the background, Huawei is likely to also be a serious contender in providing DeepSeek with more chips anyway.

- This might not stop some from still trying.

“The fact that DeepSeek managed to build R1 illustrates lagging impact of the failure of the October 2022 export controls. But very soon, we will be living through the success of the October 2023 export controls.

Mr Greg Allen, director of the Wadhwani AI Centre at the Centre for Strategic and International Studies.

Forget DeepSeek, What About TikTok Revenge?

A piece of important news has been missed in the panicked analyses and conspiracy theories surrounding DeepSeek.

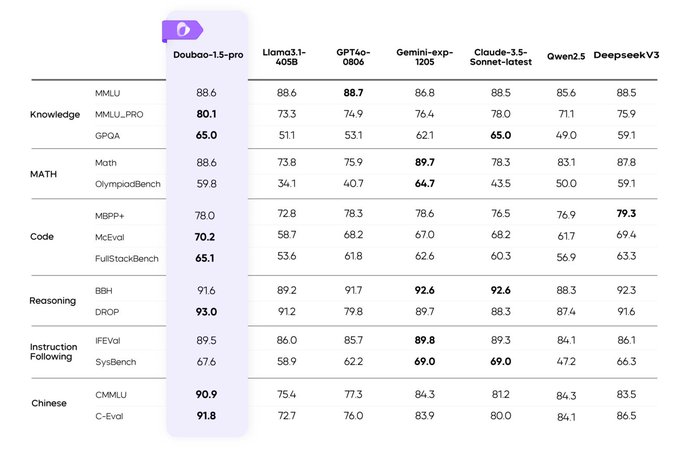

Another Chinese company, TikTok creator ByteDance, released Doubao-1.5-pro on January 24th as well – its own response to ChatGPT-4o.

It is also priced much cheaper than its American counterparts, 5x cheaper than DeepSeek’s model and more than 200x less expensive than OpenAI’s GPT-4o.

The new Doubao 1.5 Pro uses a more efficient approach to training its AI model, which ByteDance says helps balance the system’s performance with lower costs.

This is achieved through a design that combines both training and real-time use of the model, optimizing it for better results while keeping the infrastructure costs low.

Source: Financial Express

This model also beats the leading models from OpenAI, Anthropic, and Alibaba.

Source: AI Entrepreneur

If this is the result of independent effort, it would prove that the chip shortage has if anything forced Chinese companies to compete on efficiency, revealing a certain level of complacency in American AI companies, flushed with seemingly unlimited cash and computing power.

It is also not unlikely that ByteDance, after months of fighting to avoid a ban or a forced sale on TikTok in the USA, looked at ways to compete and fight back.

Other Chinese Models

With 2 companies now seemingly crushing the AI market on price for similar performances, the attention is likely to go to other Chinese AI models as well. This could include:

Looking at it from a bird-eye view instead of focused on DeepSeek, this seems more like a flood of new, enhanced AI models from China, than a surprise strike by DeepSeek alone, as it is often described for now.

Conclusion

As the AI war intensifies, it is not so clear anymore that access to funding and quickly scaling up compute power will be the sole determining factor.

It is also unclear how profitable the sector will actually be in the end, if prices for LLM tokens can crash by 50-200x overnight for the same performance. However, this should not trigger too strong of a reaction. In the end, cheaper and more efficient AI also means AI that will be massively adopted and omnipresent.

This will also mean that the ultimate demand for AI chips will likely stay high, even if slightly less than forecasted initially.

Equally importantly, widespread and ultra-cheap LLMs accessible through open source means an early arrival date for any effects AI is expected to have on job markets, productivity, manufacturing, education, international trade, etc.