Bitcoin sceptics frequently argue that bitcoin lacks intrinsic value, claiming that investments like real estate, with their tangible cash flows, are superior.

In this article, I will debunk the myth of ‘intrinsic value’ and illustrate why cash flow has no direct impact on an asset’s ability to serve as a reliable store of value, even in the context of real estate.

The myth of intrinsic value

The idea that value is inherently embedded in objects is a misconception. This common belief, influenced by the labor theory of value (LTV) – a flawed concept used in classical economics, Marxism and modern economic theories, which posits that value is inherently tied to labor, energy invested or output, misinterprets how value is perceived in the economy. This belief extends to real estate, with the notion that its ability to generate cash flow through rentals or its utility as a living and production space imbues it with intrinsic value. But, the concept of intrinsic value is fundamentally flawed.

Subjectivity of value

In a free market, characterized by voluntary exchanges, it’s evident that value is subjective. Both parties involved in a transaction believe that what they receive is of greater value than what they give up, indicating that value is determined by individual perception rather than inherent qualities.

Take the Rolex watch as an example: its value is not merely a reflection of the extensive labor involved in its craftsmanship but is significantly influenced by its scarcity and the aspiration among individuals to own it. This principle of subjective valuation extends across the board; the worth of assets, including bitcoin and real estate, is not predetermined but fluctuates based on personal perceptions.

Understanding the subjectivity of value is crucial for grasping the true essence of bitcoin’s value, illustrating that its significance, much like that of luxury watches or real estate, is deeply rooted in the collective demand and limited availability, rather than inherent properties. Carl Menger, a pioneer of the Austrian School of Economics and arguably an inspiration behind the Cypherpunks creation of Bitcoin, demonstrated already in the 19th century that prices are a reflection of subjective valuation.

Recognizing the importance of subjective valuation is key to appreciating the advantages bitcoin holds over real estate as a store of value. Menger pointed out that value can only come into existence once human beings realize that economic goods exist and that the reach of them has a personal (subjective) importance. The Subjective Theory of Value parallels the perception of beauty, which is also in the eye of the beholder. Just as beauty standards vary, so does the value of objects like bitcoin or real estate, which are coveted not for their inherent value but for people’s collective desire or need to possess them.

Bitcoin’s value proposition

The value of bitcoin does not come from the difficulty of its production, but from the unparalleled protection the Bitcoin network gives to the value (productivity) stored in it and the network’s final settlement capabilities. This creates demand for bitcoin, which is, besides time, the first absolute scarce commodity that we discovered in this universe. This scarcity, highlighted by a limited supply and a disinflationary issuance schedule, as well as the indestructible nature of the network, is driving demand for bitcoin.

Real Estate’s value proposition

In numerous real estate transactions, I experienced that investors typically assume the majority of profits originate from price appreciation rather than direct cash flow. This observation underscores a critical insight: real estate’s high valuation is less about the immediate income it can generate and more about its scarcity and ability to hedge against inflation. This observation can be confirmed when one looks at the data on the increase in the price of houses and the money supply, M2, in the U.S.

The following chart, depicting the average sales price of houses sold in the U.S., illustrates a sharp increase in housing prices since 1971. The average sales price of a house in the U.S. rose from ≈$27,000 in 1971 to ≈$492,000 in the third quarter of 2023, indicating a substantial appreciation in property values over this period (≈1,700%).

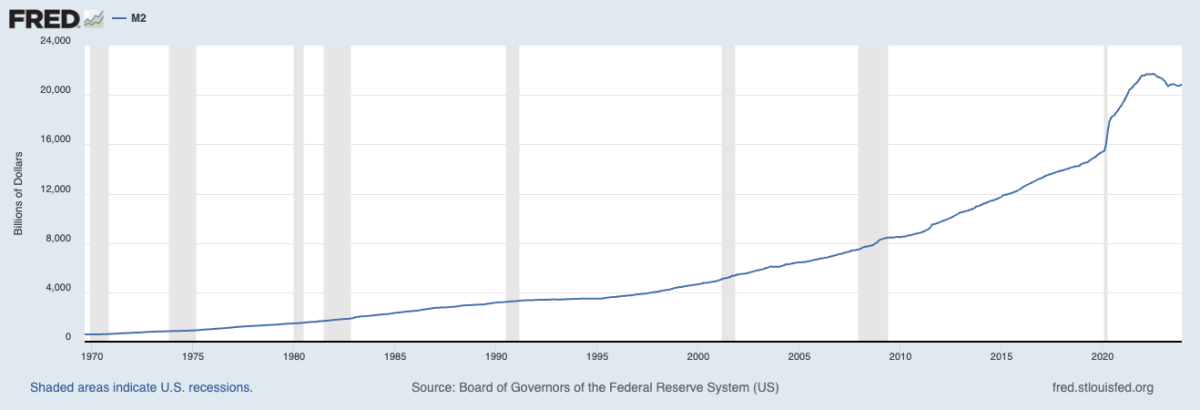

This period follows the Federal Reserve’s transition to a fiat currency system initiated on August 15, 1971, when U.S. President Richard Nixon announced the United States would end the convertibility of the dollar into gold. Subsequently, central banks globally adopted a fiat-based monetary system characterized by floating exchange rates and the absence of any currency standards. As shown in the chart below, the money supply M2, which as defined by the Federal Reserve, includes cash, checking deposits, and easily convertible liquid assets such as certificates of deposit (CDs), which reflects the comprehensive scope of funds readily accessible for spending and investment, has exhibited a consistent increase since the detachment of the U.S. dollar from gold. This vividly illustrates the striking correlation between the escalation of housing prices and the concurrent expansion of the U.S. money supply.

Analyzing the compound annual growth rates (CAGR) of these two metrics shows a clear connection between them. Since 1971, the money supply, M2, has experienced a CAGR of 6.9%, closely paralleled by housing prices, which have risen at a CAGR of 5.7% (for the detailed calculation breakdown, please see the appendix). Why did this happen ?

The increase in the money supply forced market participants to look for ways to invest their money to protect against this monetary inflation and one of the most popular investments has been real estate.

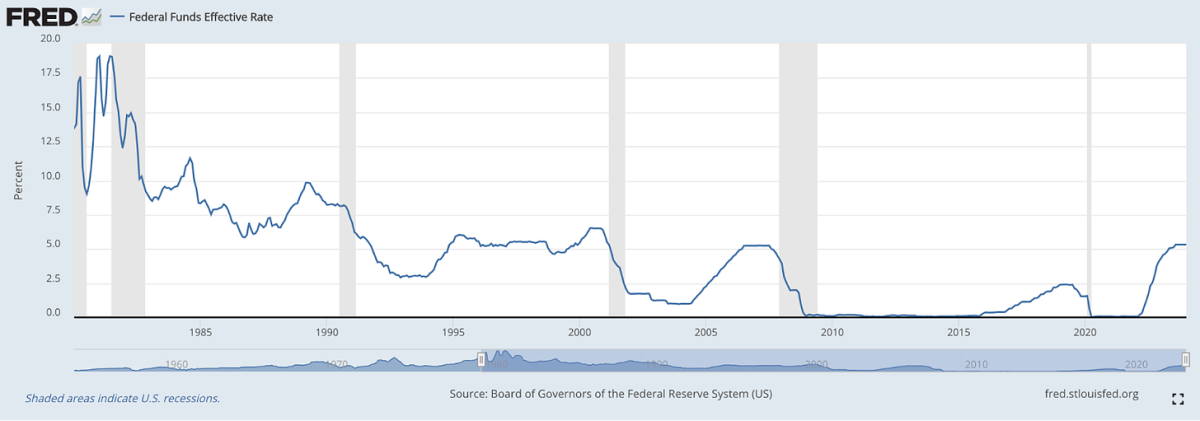

The correlation between the expansion of the money supply and rising housing prices is influenced by several factors, including interest rates, economic growth, and housing supply dynamics. However, since 1971, phases of rapid monetary expansion have usually been accompanied by low interest rates and increased borrowing. As illustrated in the following chart, showing the Federal Funds Effective Rate.

The availability of affordable financing increases buyers’ purchasing power and, consequently, demand for real estate, particularly because it is predominantly acquired through loans. This surge in demand, in turn, drives up real estate prices. The phenomenon of an increasing supply of currency units coupled with low interest rates has been a global trend in recent decades. Influenced by the historical role of the United States as the leading world power, setting a precedent with the dollar as the world reserve currency.

Although there are exceptions to how real estate markets have responded in the long term, such as Japan, where an aging population combined with decades of low-interest rate policy have led to malinvestment, an oversupply of housing and declining prices. Only in some metropolitan regions such as Tokyo is real estate still used to store value. Despite these regional differences, a global trend emerges, real estate is used as a store of value in response to diminishing purchasing power caused by monetary expansion. It follows that the primary appeal of real estate, especially in high-demand locations, lies in its perceived ability to maintain value over time, a characteristic now challenged by bitcoin’s emergence.

The primary role of a property’s cash flow is in the repayment of loans, a topic I will explore in detail later.

Real Estate vs. Bitcoin

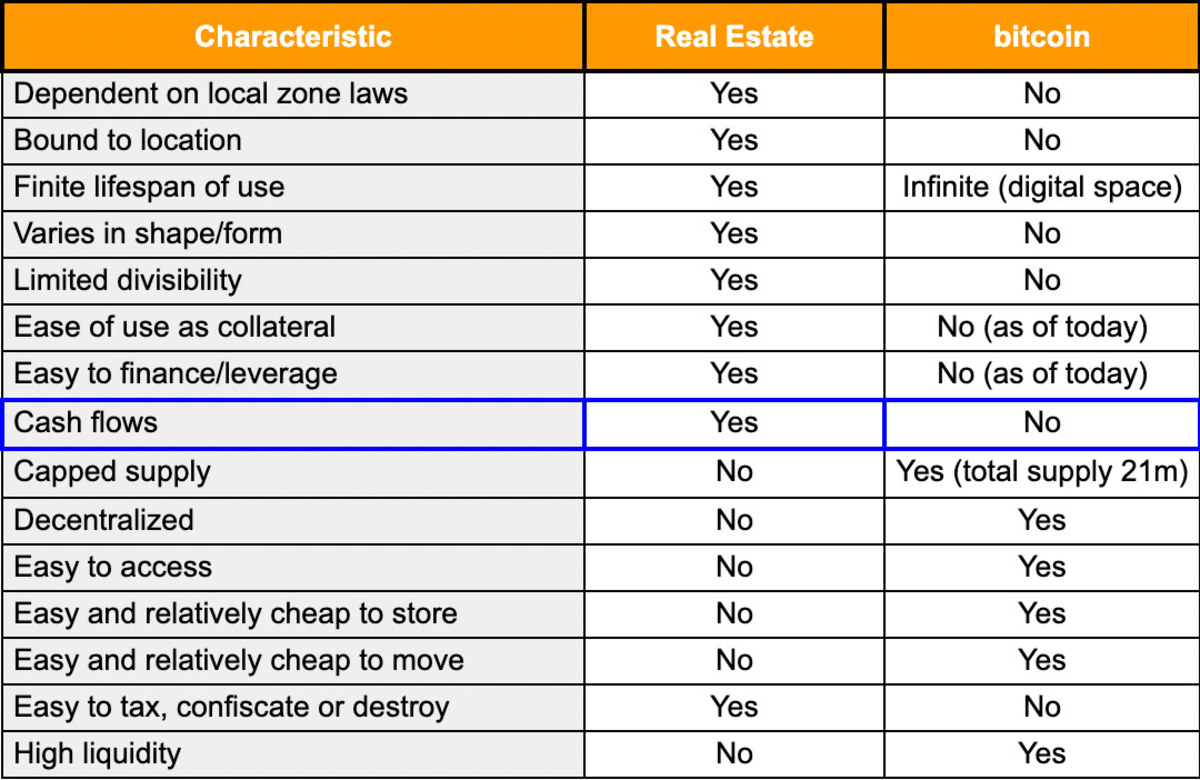

As the data shows, the excessive demand for real estate is due to monetary inflation, which has led people to invest in scarce assets such as real estate to protect their wealth. The development of real estate prices reflects the financialization of the asset class, a development that was significantly influenced by the departure of central banks globally from a gold standard, marked by the “Nixon shock” in 1971. In its function as a store of value, real estate is facing direct competition from bitcoin. A near perfect digital store of value. Real estate cannot compete with bitcoin as a store of value. The latter is rarer (fixed in supply), cheaper to maintain, more liquid, easier to move and harder to confiscate, tax or destroy.

A comparative analysis between bitcoin and real estate as stores of value reveals bitcoin’s unique advantages. The following table highlights these distinctions, showcasing why bitcoin is increasingly recognized as a powerful contender in the arena of wealth preservation:

The table further highlights that the popularity of real estate as an investment choice is largely due to affordable financing options and its ability to generate cash flows that make debt repayment easier, rather than its exceptional qualities as a store of value. Given that real estate acquisitions are largely financed through credit, this appears to have been a major factor in widespread purchasing since 1971, along with scarcity. From this perspective, cash flow neither gives real estate any intrinsic value (which does not exist) nor does it act as a phenomenal store of value. This observation can be proven statistically.

Bitcoin analyst Rapha Zagury (aka Alpha Zeta) has found that the Composite 20 Case-Shiller Home Price Index, which tracks home prices in 20 metropolitan areas across the U.S., rose just 2.3% in value when prices are adjusted for inflation. This does not account for the deduction of taxes, transaction costs, and maintenance fees. Zagury discovered that only in some metropolitan areas, such as the South Florida metropolitan area and Greater Los Angeles, real estate prices have significantly outpaced inflation, exhibiting growth rates that surpass inflation by approximately 3.6%. In contrast, regions like Greater Cleveland and metropolitan Detroit experienced negative inflation-adjusted real returns.

Bitcoin vs Fiat

It cannot be denied that real estate as an asset class offers certain advantages in the existing fiat system, since it has become increasingly important for the global financial system.

After all, it is the world’s number one store of value (≈67% of global wealth is stored in real estate) and collateral accepted by banks when granting loans. Therefore, many jurisdictions offer more robust financial infrastructures and tax advantages for purchasing real estate and utilizing it as collateral.

However, as bitcoin’s role as an indestructible, absolutely scarce store of value in the global financial system will become increasingly important, this is also expected to have a positive impact on its use as collateral. Both functions, store of value and collateral for lending, are closely linked.

Why would a bank (or anyone else) accept collateral that loses value over the long term?

The infrastructure around access to financial services related to bitcoin and its use as collateral is still in its infancy. But the possibilities are extremely promising.

The recalibration of the cash flow investment thesis on a Fiat standard

During MicroStrategy’s Q4 2023 earnings call, Chairman Michael Saylor highlighted the growing difficulty of generating cash flow that exceeds the rate of monetary inflation.

He argued that in the context of the fiat system’s widespread monetary inflation, relying on cash flow as an investment metric appears increasingly untenable. He further underscored bitcoin’s distinct role as a digital scarce asset, combining the value preservation qualities of real estate without its inherent drawbacks, thereby establishing it as an unparalleled store of value for the digital era.

One of bitcoin’s greatest strengths lies in its valuation not being tethered to cash flow, rendering it immune to the adverse effects of inflation and quarterly financial reporting. On the contrary, bitcoin thrives in an environment of escalating fiat inflation, as it becomes a more attractive repository for capital.

Bitcoin’s valuation mirrors the influx of capital flows, benefitting from the increased desire to safeguard wealth against the diminishing purchasing power of traditional fiat currencies.

The revaluation of real estate on a Bitcoin standard

Real estate, while tangible and potentially yielding regular cash flow, is subject to regulatory changes, and physical degradation, factors that bitcoin inherently resists. If real estate is not properly cared for, its value will literally degrade over time. Bitcoin on the other hand provides the ultimate form of transferable value because it preserves the encapsulated wealth. If stored properly, its value will increase over time without high maintenance costs. In fact, bitcoin’s qualities reflect many of real estate’s value offers on top of fundamentally more secure and easier custody, cheaper maintenance, absolute scarcity, resilience against inflation and most importantly the ability to protect, liquidate or move your wealth in times of crisis.

As a real estate developer, I have grappled with the question of how bitcoin as a digital store of value challenges real estate’s dominant position as a store of value. This realization initially unsettled me. However, I’ve come to see that bitcoin and real estate can coexist and even thrive together.

In my opinion, bitcoin enhances the real estate industry by offering a reliable store of value, safeguarding cash flows against monetary inflation. This advantage extends beyond real estate to encompass all sectors. As Michael Saylor puts it, bitcoin represents the digital transformation of capital, marking a pivotal shift in how value is preserved across all industries. As a result, bitcoin is likely to attract the monetary premium currently held by real estate, potentially recalibrating real estate values more closely to their utility value. Yet, the realm of real estate development and the business of real estate will continue to hold appeal. People will always require spaces to live and work in. From this perspective, real estate is not just an asset but a service—one that provides housing and production spaces in exchange for rental income.

The cash flow generated from this service represents the return on investment, similar to what the renowned Austrian economist Ludwig von Mises called “originary interest”, which is the difference between the cost of production and the expected revenue from the sale of the finished product. But, it is obvious that real estate cannot compete with bitcoin in its capacity to store value. However, even if the value proposition of real estate as a store of value has changed due to the discovery of Bitcoin, the development of real estate will continue to be economically feasible going forward, if the digital paradigm shift that Bitcoin brings to the financial world is properly maneuvered.

Conclusion

In conclusion, the narrative of cash flow and intrinsic value in investment strategies is being reevaluated in the face of Bitcoin’s emergence. This digital asset, free from the constraints of traditional monetary systems, offers a glimpse into the future of finance, where value is preserved not in bricks but in bits.

As we navigate this paradigm shift, the lessons learned from the comparison between real estate and bitcoin will undoubtedly shape our approach to investment, wealth preservation, and the very fabric of the global financial system. While real estate brings the opportunity to borrow money for the foreseeable future, it’s importance as a store of value should decline over time, while bitcoin, with its fixed supply and decentralized nature, is poised to become an increasingly preferred method for preserving wealth, offering unparalleled security and global accessibility without the constraints of traditional financial systems.

0A79 E94F A590 C7C3 3769 3689 ACC0 14EF 663C C80B

Appendix—To calculate the Compound Annual Growth Rate (CAGR) for both the Money Supply (M2) and housing prices, we used the formula:

CAGR = (Ending Value/Beginning Value)^(1/Number of Years)

For Money Supply (M2) from January 1971 to December 2023:

- Beginning Value (Jan. 1971): $632.9 billion

- Ending Value (Dec. 2023): $20,865 billion

- Number of Years: 52

Substituting these values into the CAGR formula gives: CAGR= 6.9532%. Reflecting the annualized average growth rate of the total dollar money supply over this period.

Source: Growth Money Supply (M2) St. Louis FED

For housing prices from January 1971 to December 2023:

- Beginning Value (Jan. 1971): $ 27,300

Ending Value (Dec. 2023): $ 492,300 - Number of Years: 52

Substituting these values into the CAGR formula gives: CAGR= 5.7195%. Reflecting the annualized average growth rate of housing prices in the U.S. over this period.

This is a guest post by Leon Wankum. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.