OpenSea, the leading NFT marketplace, announced in a Tweet on Feb. 17 that it would be adopting a controversial move to temporarily waive its marketplace fee, ramping up the battle for market share with zero-fee platform Blur.

Main changes to OpenSea

- A temporary 0% marketplace fee, default on all collections without on-chain royalty enforcement.

- Optional creator royalties starting at 0.5%

- A change to OpenSea’s operator allowing for interoperable market activity between Blur, ultimately allowing creators to receive earnings on both platforms.

OpenSea cited the cut-throat competition across the NFT space as a reason for its policy reversal.

“There’s been a massive shift in the NFT ecosystem,” it said on Twitter.

“In October, we started to see meaningful volume and users move to NFT marketplaces that don’t fully enforce creator earnings. Today, that shift has accelerated dramatically despite our best efforts.”

OpenSea also announced they would revise its blocklist of other marketplaces that fail to honor full royalty payments to creators, now permitting sales on NFT marketplaces with similar policies, including Blur.

$BLUR style economics

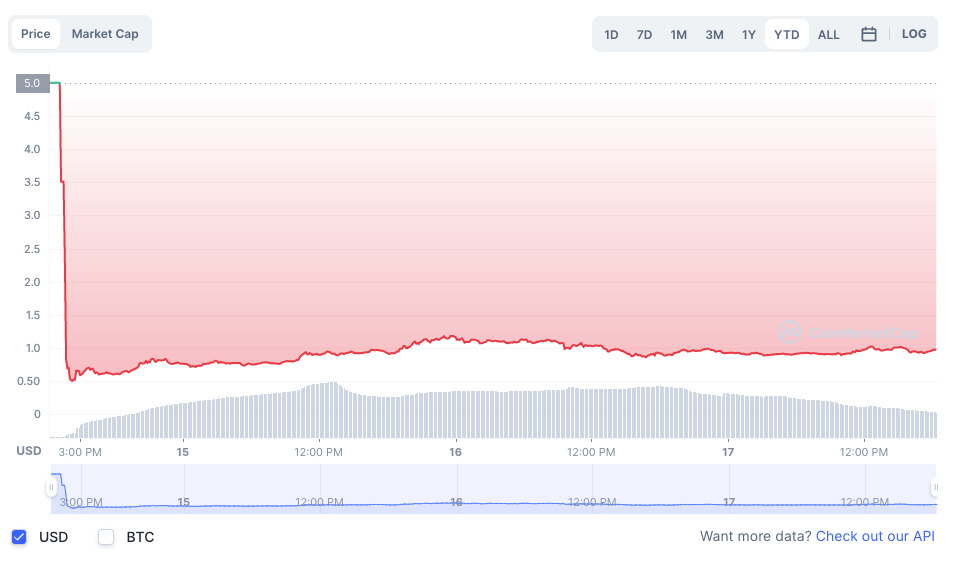

The competition between OpenSea and Blur has intensified since Blur’s native token was launched on Tuesday.

BLUR is currently ranked by CoinMarketCap as #117 of all cryptos, with a 24-hour trading volume of $509 million; the coin is currently trading at $0.0976 after launching on Feb. 14 at $0.50.

Shortly after the airdrop, the token reached $500 million in trading volume.

The battle for NFT marketplace share heats up

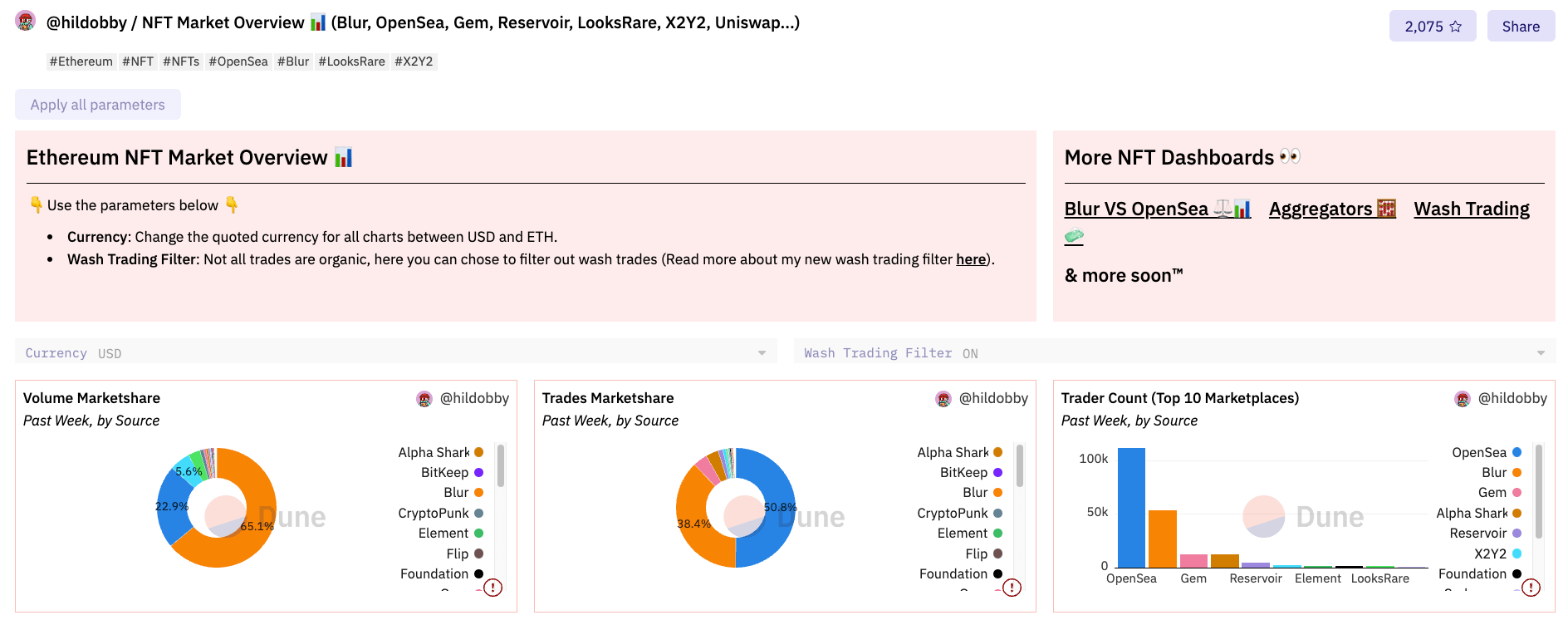

On Feb. 15, Blur passed OpenSea in trading volume for the first time since its inception in October.

Despite the day loss to Blur, OpeaSea’s weekly volume was much higher. According to recent data from Nansen, OpenSea’s weekly volume was 36,608 ETH. In comparison, Blur’s weekly volume was only 11,424 ETH. Between Feb. 7 and Feb. 14, OpenSea had an average of 8.37 times more sales than Blur, and roughly eight times more wallets. However, the gap between the two platforms decreased and was the smallest on Wednesday.

On that day, OpenSea had 19,908 total sales, which was only 1.63 times more than Blur’s 12,185 sales. A similar trend can be observed with the number of active wallets on each platform. The difference between the two is now only two-fold, demonstrating that the competition between the two largest marketplaces is becoming increasingly intense.

The debate over NFT royalties

On Wednesday, Blur published a blog post aimed at NFT creators, outlining the differences in royalty payment options between the two platforms and encouraging its users to blocklist OpenSea so that creators can receive full royalties.

The debate over creator royalties has caused a rift between the two platforms, with OpenSea taking a hardline stance on the matter by launching a royalty enforcement tool in November, a move they have since backtracked on, despite widespread calls from artists who argue that royalties function as their de facto pensions in the Web3 digital economy.

In theory, royalties were once thought to be the holy grail for NFT advocates, touted as one of the significant reasons artists should adopt blockchain technology. In practice, this is under threat as a race to the bottom has seen many NFT platforms remove fees and royalties.

“Today, ~80% of total ecosystem volume does not pay full creator earnings, and the majority of the volume (even accounting for inorganic activity) has moved to a zero-fee environment,” OpenSea admitted on Friday.