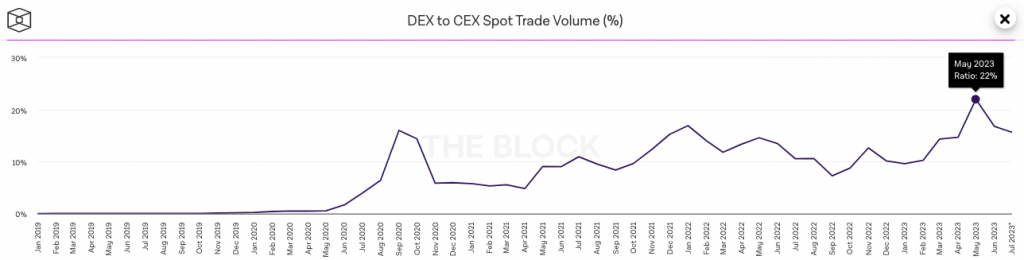

During the initial few months of 2023, users were seen experimenting with DeFi. The collapse of several prominent lenders and well-established centralized exchanges, including FTX, triggered the gravitation. Users’ clear-cut about-turn proved to be a boon for DeFi. As depicted below, the activity on decentralized exchanges gradually started ascending in 2023. In fact, when the spot trade volumes of DEXes and CEXes are compared, the ratio peaked at 22% in H1 2023.

Along with the organic rise, the brief meme-coin season instigated by Pepe Coin also contributed to the cause and helped DeFi thrive. Contrarily, CEXes like Coinbase and Binance, continued to bear the brunt, with volumes on their platforms slashing down by more than half.

Also Read: Is Pepe Coin & Co. Helping DeFi Thrive?

DEX volume and Ethereum’s price

Evidently, the DeFi landscape has evolved with time. The refinement of activity has positively rubbed off on Ethereum’s value. A recent analysis by CryptoQuant underlined that the volume of ETH traded on DEXes had been moving in the same direction as Ethereum.

The reaction has seldom been immediate, but a passive correlation has always been maintained. As depicted below, the DEX activity spike involving ETH was eventually followed by a rise in the asset’s price in H1. In fact, this was the time when Ether’s price went on to script a fresh 2023 peak at $2138. However now, DeFi activity has been shrinking, but Ether’s price has been rising. Does this mean the correlation has been broken? Well, likely not.

From the aforementioned peak, ETH’s value was corrected by around 24% and dropped to $1627 by June. As of now, DEX activity remains to be malnourished. If the state of affairs does not improve, then this could likely hinder ETH’s bullish narrative. However, if the activity refines, the current stage could signify a bottom signal. This, according to CryptoQuant, would prove to be a “good buying opportunity” that market participants could capitalize on.