The Spectacular Rise Of Semaglutide

Seemingly out of nowhere, semaglutide has become the blockbuster drug of the decade. It was first developed by Novo Nordisk (NVO +0.35%) in 2012 and mimics a weight-related hormone called GLP-1 (glucagon-like peptide-1).

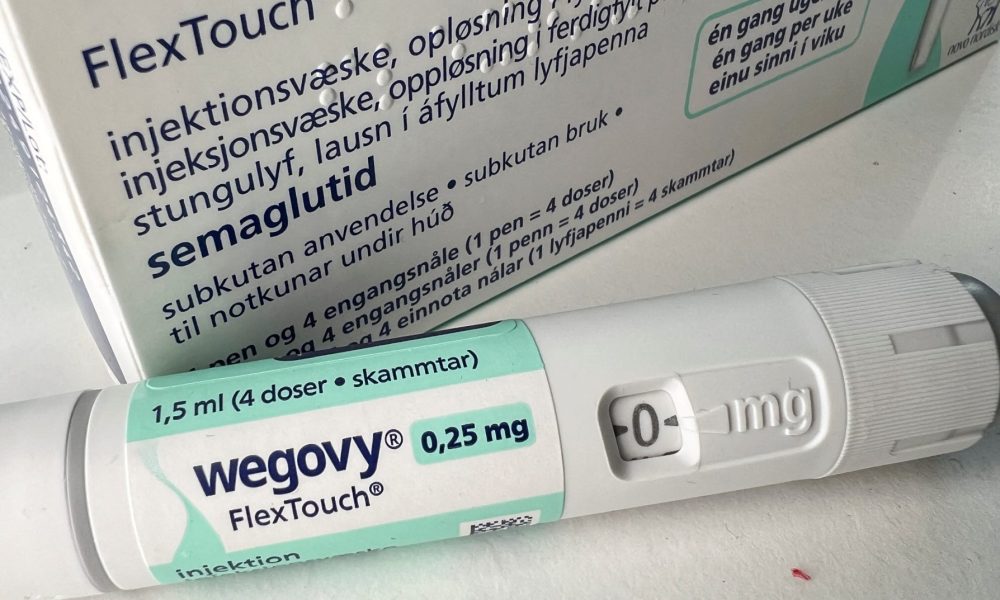

From its initial use as a diabetes drug, it was recently approved and repackaged under the brand Wegovy for a new application: weight loss. The commercial relaunch of Wegovy in January 2023 has been nothing short of spectacular, with sales exploding in a line straight up and only hindered by supply constraints.

It actually caught Novo Nordisk by surprise, with the company ramping up production regularly and still seeing recurring shortages from a constantly growing demand.

Source: Novo Nordisk

Wegovy’s success made Novo Nordisk’s valuation skyrocket, going above the entire GDP of its home country of Denmark.

The Wegovy / GLP-1 drugs’ effects go beyond diabetes or obesity. It is now shown to reduce heart disease risks, through a yet-to-be-elucidated mechanism that is different than just the weight loss. It has even been linked to a dramatic decline in heart failure and other cardiovascular disease-related deaths.

Semaglutide was linked to a 28% reduction in major adverse cardiac events, as well as a 24% reduction in cardiovascular disease-related deaths for this subgroup of people with preexisting heart failure, and a 19% reduction in deaths of any cause.

Decline In Other Obesity Treatment

The consequences of this instant success are still hard to understand fully. In a study by researchers at the Harvard Medical School, Brown School of Public Health, and Brigham and Women’s Hospital, published under the title “Metabolic Bariatric Surgery in the Era of GLP-1 Receptor Agonists for Obesity Management”, it was found that while the use of GLP-1 drugs to treat obesity more than doubled from 2022 to 2023, the rates of obesity-related surgery (bariatric surgeries) dropped by one quarter.

This clearly indicates that people are picking drugs over more invasive surgeries like gastric sleeve and bypass.

Source: GI Society

This was done using older data, where “only” 5.0% of patients received GLP-1 RAs and 0.3% received surgery. So, it is likely that 2024 data will see a much higher number receiving GLP-1.

This sparks some concerns from doctors that surgery might decline in popularity, despite being the most efficient treatment against obesity.

“With the national decline in utilization of metabolic bariatric surgery and potential closure of bariatric surgery programs, there is a concern that access to comprehensive multidisciplinary treatment of obesity involving pharmacologic, endoscopic, or surgical interventions may become more limited.”

Thomas C. Tsai, MD, MPH – Metabolic bariatric surgeon in the Department of Surgery at Brigham and Women’s Hospital.

It also illustrates the large market yet to be captured by GLP-1 drugs. In the future, this could include other drugs, like Amycretin, also researched by Wegovy producer, Novo Nordisk, which targets both GLP-1 and amylin, a pancreas hormone controlling hunger.

Is Semaglutide Really Harmless?

Any new wonder drug like semaglutide has to be pretty powerful, especially when it affects the entirety of the body’s metabolism. This naturally raises some alarm bells for doctors, wary of yet-unknown side effects.

In fact, an array of rare but serious side effects has already been identified and are listed on Wegovy’s dedicated web page, including thyroid cancer, pancreas inflammation, kidney failure, depression or thoughts of suicide, and gallstones.

A new potential risk to monitor is now being identified: skeletal muscle loss.

In a study by researchers at the University of Alberta, McMaster University (Canada), Federal University of Pelotas, and Louisiana State University System, it was revealed that muscle loss with GLP-1 receptor agonists ranges from 25% to 39% of the total weight lost over 36–72 weeks.

It was published in the prestigious medical publication The Lancet under the title “Muscle matters: the effects of medically induced weight loss on skeletal muscle.”

This is a concern, as skeletal muscles (the one allowing us to move) play critical roles not only in physical strength and function but also in metabolic health and immune system regulation.

A decline in muscle mass has been linked to decreased immunity, increased risk of infections, poor glucose regulation, and other health risks. The authors suggest that muscle loss due to weight reduction may exacerbate conditions like sarcopenic obesity, which is prevalent among individuals with obesity and contributes to poorer health outcomes, including cardiovascular disease and higher mortality rates.

Dr. Steven Heymsfield – professor of metabolism and body composition – Pennington Biomedical Research Center

This illustrates how GLP-1 drug should not be seen as a magic pill but be combined with exercise and nutritional intervention to preserve or even build muscle mass while losing fat.

On an annual basis, the decline in muscle mass with GLP-1 receptor agonists is several times greater than what would be expected from age-related muscle loss (0·8% per year based on 8% muscle loss per decade from ages 40–70 years).

Dr. M. Cristina Gonzalez, adjunct professor in metabolism-body composition – Pennington Biomedical Research Center

This is part of a larger concern that exists with drugs reducing appetite, as a person eating less might not be getting the appropriate amount of dietary vitamins and minerals either, nor change his/her behavior in a way conducive to a healthier lifestyle.

What Is The Best Way To Tackle Obesity

The commercial success, but more contrasted health effects of semaglutide, raise serious questions: Is the medical approach to treating obesity flawed, and are such drugs just a band-aid not really solving the problem?

Both surgery and drugs treat people who are already obese while preventing obesity in the first place would be preferable.

As obesity has become a true global epidemic, we should ask what changed since the 1960s and 1970s, when it was much less a problem. And for that matter, why some countries are affected differently, with the USA or Mexico way ahead of countries like France or Japan?

Source: Data Is Beautiful

It does not seem likely this is “just” an effect of the population getting more obese when getting richer, as indicated by the presence of rich & low-obesity countries like France and Japan, or poorer and more obese countries like Mexico.

Starting From Childhood

A new study published in JAMA Pediatrics under the title “Neighborhood Food Access in Early Life and Trajectories of Child Body Mass Index and Obesity” links neighborhood food access to child obesity risk.

As child obesity is a very strong predictor of adult obesity, understanding what causes it could have a major impact on the overall population obesity rate.

The study paints a rather dire situation regarding food and childhood in the USA:

- The prevalence of food insecurity in U.S. households with children under 18 years increased from 12.5% in 2021 to 17.3% in 2022.

- Residence in low-income, low–food access (vs non–low-income, low–food access) neighborhoods in pregnancy was associated with higher BMI z scores and higher obesity risk (including severe obesity) for 5, 10, and 15-year-old children.

From this study, it appears that residence in these neighborhoods during pregnancy was associated with >50% higher risk of obesity and severe obesity from childhood to adolescence.

This indicates that socio-economic factors impacting early childhood are likely the main culprits of later adult obesity. So, acting early could avoid the deadly impact of excess weight, as well as the massive healthcare costs associated with the obesity pandemic.

“Our findings support a focus on investments or strategies to improve healthful food access in early life. This includes incentivizing new supermarkets in existing low-income-low-food-access neighborhoods, providing healthy-choice pantries, and improving access to healthier food choices in small retail corner and convenience stores. Such investments could play a crucial role in preventing child obesity and promoting healthier communities.”

Dr. Izzuddin Aris – Harvard Medical School assistant professor of population medicine

Properly Using Semaglutide

That obesity is a disease caused by a multitude of factors is a well-known fact.

The problem is that so far, just education on nutrition and social measures have utterly failed to prevent its expansion into a global epidemic.

Even if prevention could prove more efficient, it would still not be very helpful for the hundreds of millions already obese globally. Obesity can also be linked to metabolic disorders, genetic factors, and other elements that are out of the control of patients.

So most likely, we should see semaglutide and similar molecules stay a major drug category in the near and medium-term future. It could be very important in reducing the health and financial impacts of the obesity epidemic on both individual patients and society as a whole.

Investing In Semaglutide

Semaglutide and Novo Nordisk stock has already been a major money maker for investors since the release of GLP-1 for treating obesity, which we discussed back in 2023 in “The New Blockbuster Drug: Wegovy”.

With the treatment seemingly a lifelong requirement to avoid regaining the weight, new patients enrolling, and the obesity epidemic showing no signs of stopping its growth, this is likely to continue.

Semaglutide is also likely to be approved in the EU soon for reducing cardiovascular risks, with the announcement in July 2024 of a “positive opinion for an update of the Wegovy label to reflect risk reduction of major adverse cardiovascular events”.

You can invest in GLP-1 companies through many brokers, and you can find here, on securities.io, our recommendations for the best brokers in the USA, Canada, Australia, the UK, as well as many other countries.

If you are not interested in GLP-1 companies solely, you can also look into biotech ETFs like WisdomTree BioRevolution UCITS ETF (WBIO), VanEck Biotech ETF (BBH), or First Trust NYSE Arca Biotechnology Index Fund (FBT) which will provide a more diversified exposure to capitalize on the growing biotech economy.

Novo Nordisk was historically mostly known for its diabetes therapies, which represented the bulk of its revenues. It was a company we covered in “Top 5 Blue Chip Pharmaceutical Companies”.

A smaller part of Novo Nordisk’s activity is obesity, but together with GLP-1 diabetes, semaglutide is now the majority of the business. In addition, some of the GLP-1 diabetes sales might be off-prescription obesity therapy.

It is worth noticing that the on-prescription obesity business has been growing at 37% globally and 47% in “international operations” (non-North American operations). In comparison, insulin is looking almost stagnant, with “only” a 10% growth in the first 6 months of 2024, leading to an overall sales growth of 25%.

The company’s main market is North America, a geography growing at 36% and already much larger than the rest of the world.

Source: Novo Nordisk

The company’s growth is coming partially from the growth of the overall market with the obesity and diabetes epidemic, but also due to growing market share in diabetes and GLP-1 markets.

Source: Novo Nordisk

The stellar launch of Wegovy (the commercial name of semaglutide for obesity) led to the issue of producing enough to satisfy the market.

When Wegovy disappeared from inventory, the other Novo Nordisk treatment for type 2 diabetes, the drug Ozempic, using the same molecule, was often used as a substitute. Even Elon Musk referred to Wegovy as a way for him to lose unwanted weight.

Novo Nordisk has partially solved these supply issues through increased production, through the $16.5B acquisition of drug manufacturer Catalent, and a $8B investment in expanding its production facilities.

From now on, Novo Nordisk’s main task is mostly to ensure a smooth supply, in order to avoid any consumer switching to its competitors’ alternative. And soldier on with getting amecrytin approved as soon as possible, in order to solidify its control of the GLP-1 market.