With years of historical data, we can observe the patterns from past bull cycles to become increasingly capable of making predictions about our current cycle. In this analysis, we take a deep dive into when the next Bitcoin peak may occur and at what price level.

The Pi Cycle

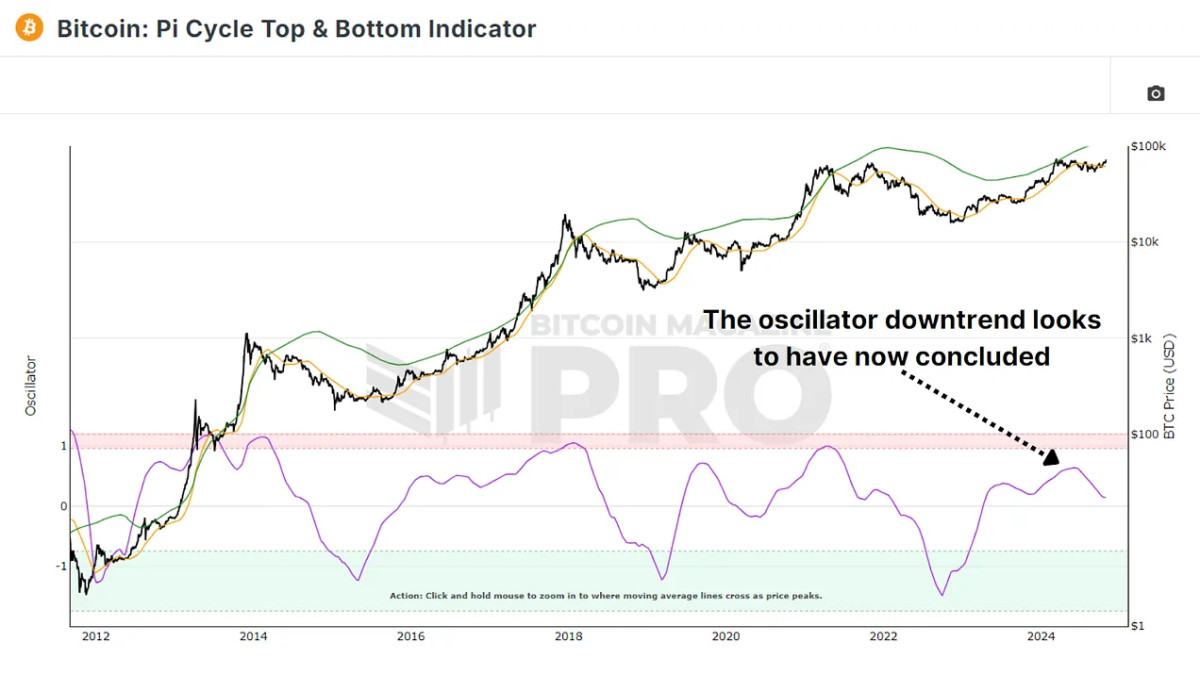

The Pi Cycle Top Indicator is one of our most popular tools for analyzing Bitcoin’s cycles. This indicator monitors the 111-day and 350-day (multiplied by 2) moving averages, and when these two lines cross, it has historically been a reliable sign of Bitcoin reaching a cycle peak, typically within just a few days. After multiple months of these two levels drifting apart due to the sideways price action, we’ve just begun to see the 111-day trending back up again to begin closing the gap.

We can measure the difference between the two averages to better define Bitcoin’s position within bull and bear cycles with the Pi Cycle Top & Bottom Indicator. This oscillator trending up again hints that Bitcoin’s next bull run may be just around the corner, with parallels to previous cycles seen in 2016 and 2020.

Previous Bitcoin Cycles

Historically, Bitcoin’s bull cycles exhibit similar phases: initial rapid growth, a cooling-off period, a second peak, and finally, a significant retracement followed by a new surge.

2016 Cycle: This cycle saw a first peak, a dip, a second peak, and then a full-blown bull market. It’s very similar to the trend we’re currently seeing. Bitcoin’s price reached new highs after these two retracements.

2020-2021 Cycle: The pattern was slightly less pronounced, but a similar trajectory was observed. Bitcoin’s price peaked twice, once during the initial surge and again at the peak of the bull run as BTC was reaching an all-time.

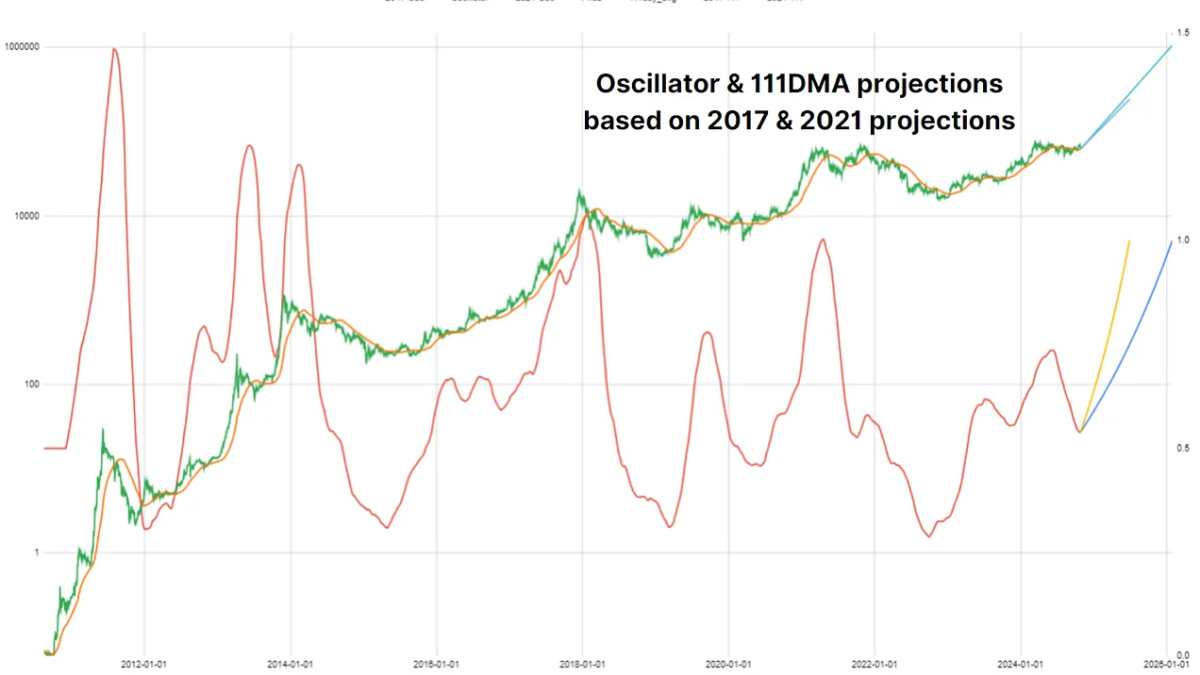

Using the Bitcoin Magazine Pro API, we can simulate different growth scenarios based on past cycles. Since the Pi Cycle Top and Bottom oscillator recently turned upward we can overlay the rate of change in the oscillator from the previous cycles to see potential route this cycle.

If the 2021 cycle repeats, the 111-day and 350-day moving averages may cross around June 29, 2025, signaling a potential Bitcoin peak. If the 2017 cycle is mirrored, the moving averages might not cross until January 28, 2026, suggesting a later peak.

Price Projections

Using these dates, we can also attempt to estimate potential price levels. Historically, Bitcoin’s price exceeded the moving averages significantly at its peak. During the 2017 bull run, Bitcoin’s price was three times the value of these moving averages at the peak. However, as the market matures, we’ve seen diminishing returns in each cycle, meaning Bitcoin’s price might not increase as dramatically compared to its moving averages as it has historically.

If Bitcoin follows a pattern similar to the 2021 cycle, with an increase of about 40% above its moving averages, this would place Bitcoin’s peak at approximately $339,000. Assuming diminishing returns, Bitcoin’s price might only rise about 20% above the moving averages. In this case, the peak price would be closer to $200,000 by mid-2025.

Similarly, if the 2017 extended cycle repeats with diminishing returns, Bitcoin could peak at $466,000 in early 2026, while a more moderate increase might result in a peak price of around $388,000. Although it’s unlikely Bitcoin will hit one million dollars in this cycle, these more tempered projections could still represent substantial gains.

Conclusion

While these projections use well-established data, they’re not guarantees. Every cycle has its unique dynamics influenced by economic conditions, investor sentiment, and regulatory changes. Diminishing returns and potentially even lengthening cycles are likely, reflecting the maturation of Bitcoin’s market.

As Bitcoin’s bull cycle continues to develop, these predictive tools could provide increasingly accurate insights, particularly as the data evolves. However, analysis such as this provides potential outcomes to assist in your risk management and prepare for every outcome.

For a more in-depth look into this topic, check out a recent YouTube video here: Mathematically Predicting The Next Bitcoin All Time High