Not All Tech Giants Are American

E-commerce is often seen as synonymous with Amazon in Western countries. However, Jeff Bezos’ company has actually been facing increasing competition in markets abroad. For example, in South-East Asia, it is SEA that is increasingly becoming the dominant player in the region, and China’s e-commerce is controlled by Alibaba, JD, and Pinduoduo.

Combined with a lingering low level of Internet & e-commerce penetration in many parts of the world, this can give investors an opportunity to replicate the success of Amazon’s early investors.

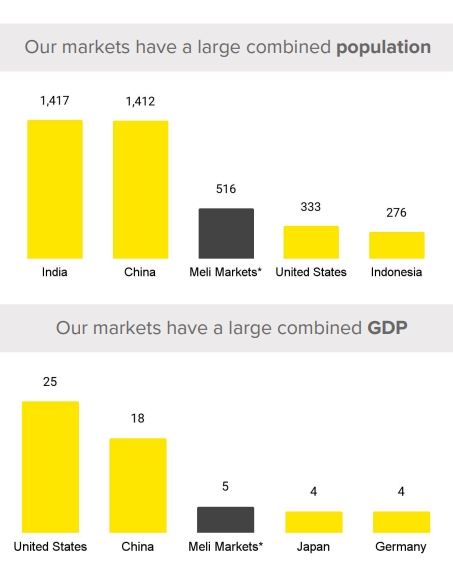

Source: Mercado Libre

A similar phenomenon is occurring in South America. Latin America is home to 656 million people, double the population of the USA. It is also quickly developing and modernizing, increasing the number of Internet users and purchasing power.

On paper, Latin America is an impressive market for e-commerce companies, especially today. It is larger than the USA by population and than Japan or Germany by GDP.

Source: Mercado Libre

And one company is slowly starting to dominate the region: Mercado Libre

MercadoLibre, Inc. (MELI -2.16%)

Mercado Libre’s Origins

The company started like many other non-American e-commerce platforms, trying to imitate Amazon in its home country.

Source: Mercado Libre

What made Mercado Libre special is the country in question.

Many would have expected a Latin American tech success story to have started in a large and relatively rich country, like Mexico or Brazil. Instead, it was in the economic basket case of Argentina that Mercado Libre launched first.

To add to a potentially difficult start, Mercado Libre was founded in 1999, just two years before Argentina defaulted on its debt, and before a long series of debt restructurings in 2005, 2010, and 2015. It defaulted again in 2020.

This quickly gave the company’s culture a completely different DNA. While Amazon had access to a massive, stable, and rich market, Mercado Libre had to deal with currency collapse, poor infrastructure, and impoverished consumers.

As a result, the company has developed a reputation for ultra-efficient operations, as well as extreme resilience.

This idea of staying lean and savvy actually made the company survive an early price war with a much better-funded competitor in DeRemate, later acquired by Mercado Libre, and is still fixed in the company’s DNA.

E-Commerce In Latin America

Contrary to e-commerce operations in the USA, Latin America suffered from a few critical problems:

- Low Internet penetration and user count.

- Poor infrastructure (warehouses, harbors, trains, roads, postal services).

- Often incomplete or undefined addresses.

- A lot of the economy operates on a cash-only basis, with almost no credit cards, and very little trust in unknown sellers and remote sales.

Each of these points makes e-commerce much harder to launch. Not only can few people visit the website, but transportation, delivery, and payment are all required to build an infrastructure from scratch.

If There’s A Problem, There’s A Solution

To solve these, Mercado Libre went on to create its payment system in 2003, Mercado Pago (Mercado Pay in Spanish). This department would become a segment of the company as much, if not more important, than the e-commerce segment (see below).

To solve delivery point issues, it partnered with local shops for them to become delivery points, where people could come and pick up their orders.

In 2009, the company noticed early that wider Internet adoption in Latin America was not through computers and broadband, but smartphones and mobile networks. Following its tradition of developing its IT solution internally, it would rebuild its website from scratch to adapt to mobile users.

Initially, the region’s poor transport infrastructure would be dealt with by focusing more on urban users, who are also more likely to be early Internet users and IT proficient.

Later, some temporary options were adopted to reach more rural areas, like a fleet of motorbikes for deliveries or local subcontractors. Ultimately, Mercado Libre spent 10 years building its own advanced logistical network of warehouses, airplanes, trucks, etc. to fully solve the problem.

Latin America Dominance

Mercado Libre has constantly grown its GMV (Gross Merchandise Value – the total amount of sales a platform makes over a specified period of time) over the past years, multiplying it by 5.6x since 2016.

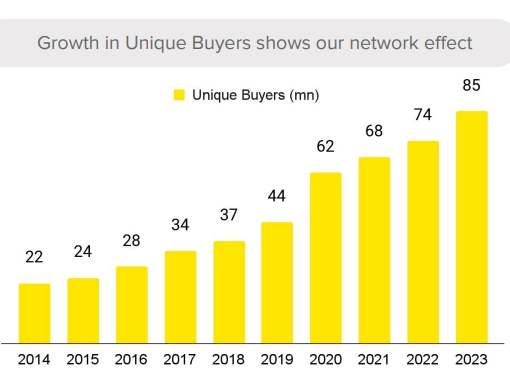

Source: Mercado Libre

This growth was driven by new buyer acquisitions with higher sales per user, and unique buyers almost up 3x since 2016, for a total of 85 million unique buyers, doing on average a purchase 7.1 times per quarter.

Source: Mercado Libre

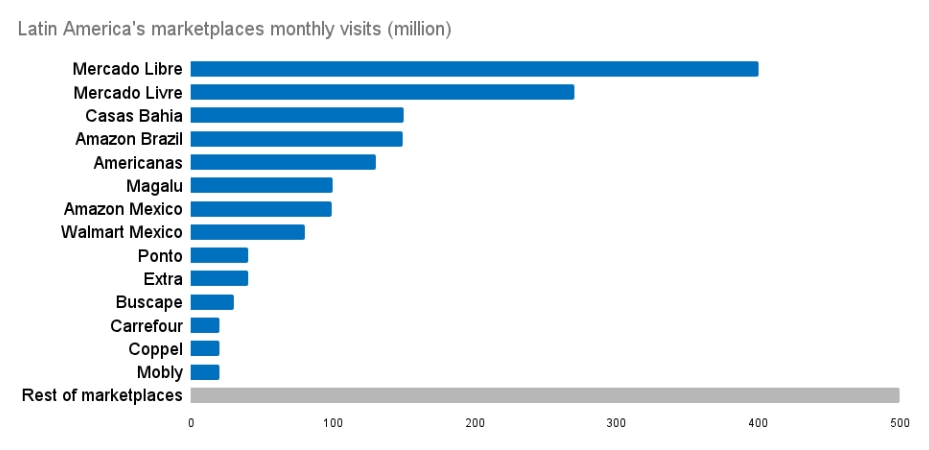

After 2 decades of progress and specialization in the Latin American market, Mercado Libre is emerging as the winner of the competition with Amazon and other local actors for the region:

Source: NocNoc Store

Overall, the growth in all of the company’s main markets has been explosive, except for Argentina, as the country is going through a series of painful reforms and budget cuts after 2 decades of economic turmoil, even if some improvements are starting to appear.

Source: Mercado Libre

“We are optimistic about the economy in Argentina in the medium term. So that has led us to invest again.

In Q2 we saw growth in terms of transactions and items sold. So the economy is turning around, although the recovery will take time.

Marcos Galperin – Co-founder & Chief executive of Mercado Libre

Pushing Its Advantage

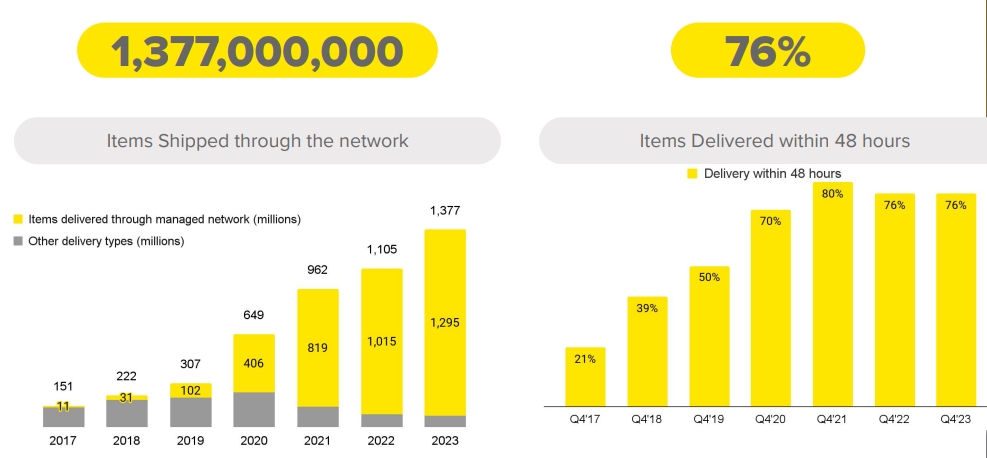

Deliveries

The company’s economies of scale allow it to offer unprecedented services in the region, such as same-day or 48-hour deliveries.

This brings us back to what Jeff Bezos has always described as Amazon’s focus: to do what never changes in people’s preferences for their purchases:

“At Amazon, I know what the big ideas are: low prices, fast delivery and vast, huge selection”

Jeff Bezos

3/4th of Mercado Libre orders are now delivered within 48 hours, and since 2022, almost exclusively by the company’s logistical network, reducing greatly its dependence on local providers.

Source: Mercado Libre

Consumer Protection

Mercado Libre offers its users a purchase protection program. If they have not received the order, they can initiate a claim within ten days of receiving the product or 21 days from the date of purchase.

This might not sound special to Western Internet users, but this is a relatively new level of service in Latin America.

Ads

As mentioned before, Mercado Libre is also making a lot of money from ads on its platform. This is a relatively new income source, which has quickly exploded since 2019 and brought $705M in 2023. With a market share of 5%, this likely still has quite a space to grow, especially as the segment itself is also still growing quickly.

Source: Mercado Libre

A FinTech Company

FinTech’s Importance In Latin America

Even if it built its business around e-commerce excellence, Mercado Libre is also leading the FinTech revolution in a region where half of the population has no bank account.

So Mercado Libre is maybe best described as early Amazon + early Paypal merged into one company, with the potential to grow into THE tech company of the region and become the first LATAM super app.

A Wide Offer

Since the early PayPal equivalent was created to facilitate online purchases, Mercado Libre now offers all kinds of digital financial services. This was built on the accumulated trust earned by the e-commerce platform, the experience with a difficult-to-enter market, and the in-house available skills in programming and web development.

Source: Mercado Libre

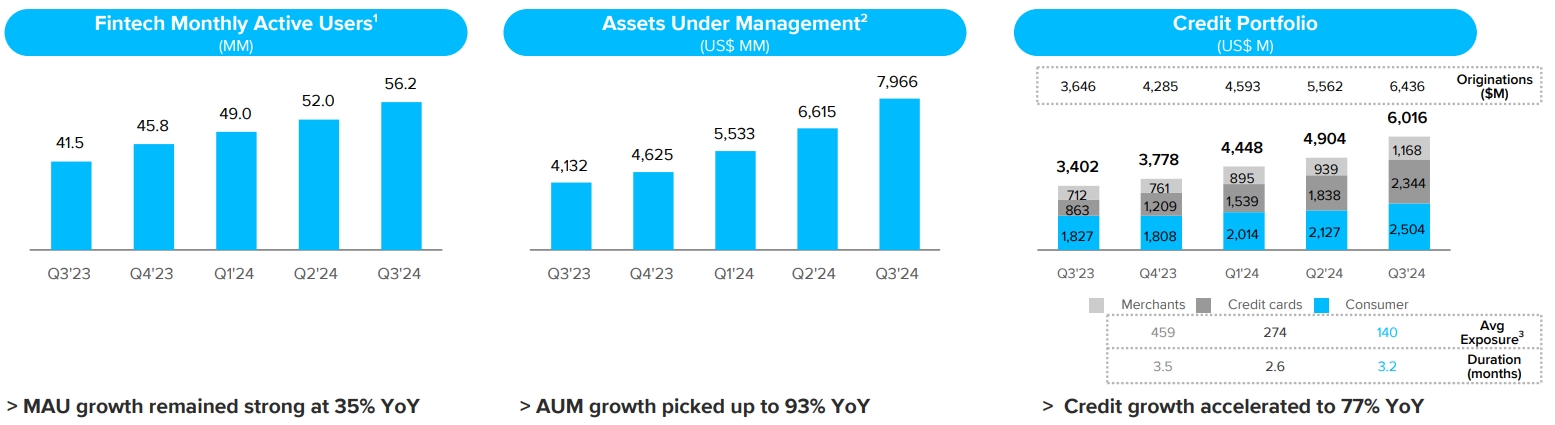

Year-to-year, the monthly user count has risen by 1/3rd, and both assets under management and the credit portfolio almost doubled.

Source: Mercado Libre

The revenues from this segment are split between financial services (payment, insurance, investment accounts, etc.) and credit (mostly credit cards and pay-now-buy-later).

In general, the FinTech segment is growing the quickest in Brazil, followed by Argentina.

Around 20 million users are using credit from Mercado Libre. The credit card segment has grown 172% year-to-year in Q3 2024.

Source: Mercado Libre

Loyalty Program & Streaming

The large presence of Mercado Libre in the online payment system puts it in an advantageous spot for building a strong loyalty program and presence in payment systems.

It is now one of the largest independent acquirers in Latin America (acquirers are a financial institution that processes credit and debit card transactions on behalf of the card issuers).

The MELI+ loyalty program is split between “MELI+ Essencial” and “MELI+ Total”.

MELI+ Essencial costs just $2/month, a lower threshold for free shipping, extra installments on purchases in Mercado Libre, and cashback on purchases on and off Mercado Libre.

“MELI+ Total”, at $5/month is closer to an Amazon Prime subscription, notably adding access to content from Disney+ and Deezer, and a 30% discount on HBO Max and Paramount+.

Launched initially in Brazil and Mexico, Meli+ subscribers can access millions of products with free shipping and scheduled deliveries at their convenience, along with content from the best streaming and music platforms in an exclusive membership system. For many people, this is their first opportunity to access a subscription channel.

Mercado Libre

The company is now looking to also offer a free constant streaming format with advertisers called Mercado Play.

Mercado Libre’s Future

Growth Runway

Despite impressive growth in the past, the company still has a while to go before reaching most of the 656 million people living in the region. The next target is to triple the user base.

This expansion is planned to work organically, more than by buying out the competition.

“We have a lot of room to continue growing in e-commerce. We wanted to boost users from around 100 million now to 300 million, without giving a specific time frame.

We don’t like buying market share, we like building market share,”

Marcos Galperin – Co-founder & Chief executive of Mercado Libre

Mercado Libre & AI

There is no tech company today not implementing AI in its operations or, at the very least, considering doing so.

Mercado Libre is no different, with a dedicated website to AI, as well as with the integration of OpenAI Verdi, an AI developer platform powered by GPT-4o.

Previously, Mercado Libre already used OpenAI tools for:

- GPT-4 Vision tags and complete listing, boosting 100xMercado Libre cataloging capacity.

- 99% accurate fraud detection.

- Translation to Spanish and Portuguese dialects, an important extra for a not-so-homogeneous region when it comes to idioms.

- Personalized notifications, boosting engagement and orders.

“In 2023, we considerably improved the navigation in fashion, apparel, and sports, with standardized filters across brand sellers.

This enables consumers to find what they need more quickly on the product pages. Users can also see the ‘more like this’ section to find similar items or products that you’ve clicked on, rather than simply going back to the search results. This feature is powered by artificial intelligence.”

Marcos Galperin – Co-founder & Chief executive of Mercado Libre

Verdi allows any developer to build with LLMs. As the company employs 17,000 developers, any gain in productivity is obviously welcome.

Machine learning and Verdi are also used by the customer service department (9,000 people) to speed up and improve answers’ quality, and help sellers create better listings and premade answers to buyers’ requests.

Conclusion

Mercado Libre is shaping up to become the dominant e-commerce platform for Latin America, beating its local and foreign (SEA, Amazon, Walmart) competitors in terms of revenues, engagement, reach, and depth of the ecosystem.

It is also now a massive FinTech company, in a region with the perfect conditions for non-bank alternatives to thrive.

While expanding, it seems to take a more cautious approach than other large e-commerce platforms when it comes to entering unrelated activities, with, for example, no equivalent of SEA’s presence in video games, Amazon in cloud computing and space telecom, or Alibaba’s in AI.

In large part, this is because it is still growing quickly in its main activities, with plenty of space to expand, thanks to still low e-commerce & Internet penetration in the region’s market, and growing income & middle class. A stronger presence in smaller countries like Peru, Ecuador, Colombia, and Central America, will also be a contributor to future growth.