A new report by Messari on the state of the Polygon network revealed an increase of new addresses QoQ of 180%. Active addresses also hit an all-time high of 6 million, while total transactions surpassed 2 billion during Q3.

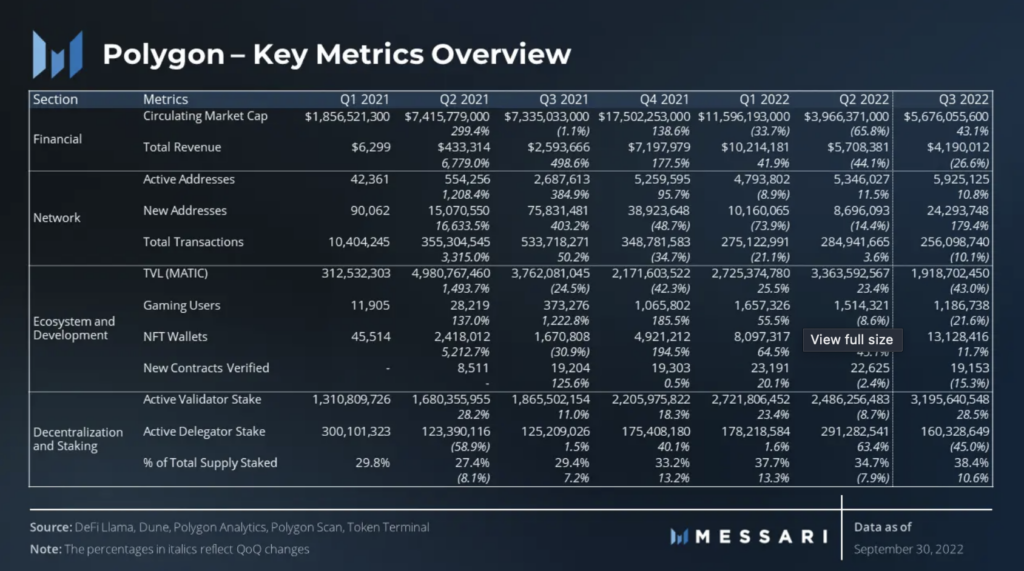

Other critical metrics for Polygon are shown in the table below. Messari’s data shows that the active validator set grew by over 100% since 2021, and the total supply staked rose to 38,4% from 29,8% in 2021.

Polygon invested $1 billion and raised $450 million in ZK-scaling technology as its moves to expand on its successful PoS chain. Additional chains include Supernets, Avail, Zero, Miden, zkEVM, Nightfall, and Edge. Each chain is optimized for different scaling or privacy solutions.

The Polygon PoS Ethereum sidechain is still responsible for the majority of Polygon’s network activity. With core partnerships announced with the likes of Disney, Reddit, and Starbucks, new users were brought into the network to interact with the branded NFTs.

Messari also highlighted that while the global market cap of the crypto industry has been range bound around the $1 trillion mark, Polygon’s market cap is up 43% QoQ.

Further, 14% of the total supply was moved from vesting contracts to staking or Polygon treasury. The remaining 270 million MATIC was earmarked for the Polygon treasury in October, meaning the entire supply is now in circulation.

Polygon ecosystem

Focusing on the Polygon ecosystem, the top 10 DeFi projects made up 70% of the network’s TVL. A fall in TVL by 43% was attributed to the competition of Optimism and Arbitrum’s new liquidity mining campaigns.

Gaming transactions spiked 100% in September as gaming transactions broke 15 million. New games launching on the network, including Arc8, Benji Bananas, Planet IX, and Sunflower Land, are reportedly responsible for the increased activity.

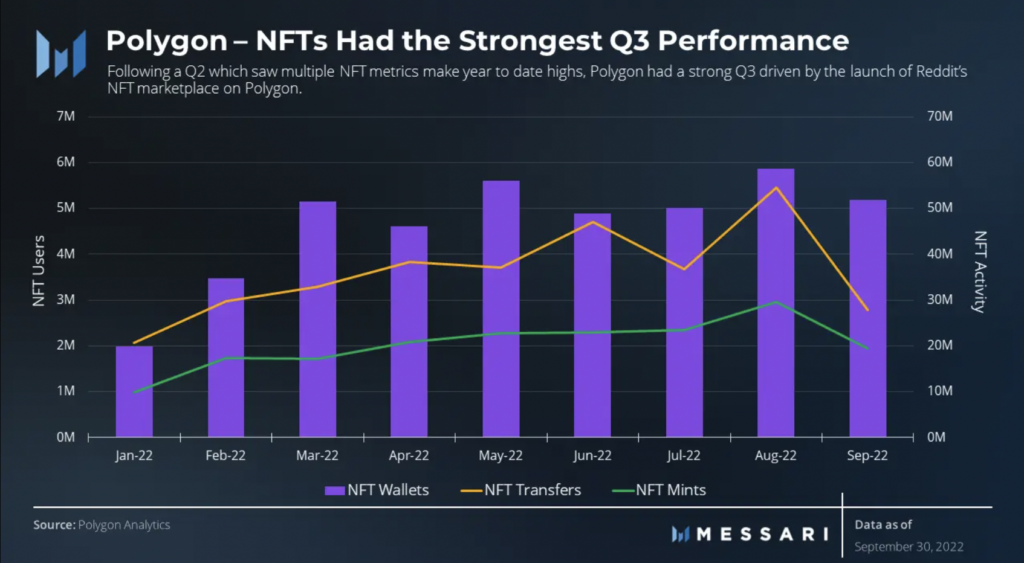

The Polygon NFT ecosystem had the most robust Q3 performance, according to Messari. A horse racing game Zed Run and Reddit’s Collectible Avatars lay the foundation for the growth. The number of NFT users on Polygon broke 5 million in August, while the number of transfers exceeded 50 million.

However, not all aspects of the report revealed bullish data. Polygon’s revenue was down 26% to just $4.2 million for the quarter, as transaction fees fell 51%.

The report concluded by stating.

“Despite the ongoing bear market, Polygon continues to build at a heightened pace… By allowing independent teams to experiment with different scaling approaches, Polygon is fostering intense collaboration and information sharing.”

Each of Polygon’s core solutions was reviewed in detail during the report. The launch of additional scaling solutions on both testnet and mainnet are reasons Messari is bullish on Polygon for Q1 of 2023. However, the report also highlighted that Polygon is betting hard on a ZK-scaling future for Ethereum.

“Polygon is betting the future of Ethereum is ZK-scaling, so Polygon’s success will largely depend on its ability to quickly and effectively deliver its new ZK-solutions.”