The New Space Race

Since the last landing on the Moon by Apollo 17 in 1972, men have not ventured into space further than near-Earth orbit. This can also be considered the date at which space technology started a long era of stagnation.

Many factors have driven this relative regression after the spectacular progress of the USA-Soviet space race.

One was simply the end of said space race. With the American landing on the Moon and any further progress technically difficult to achieve at the time, both competing geopolitical blocks cut funding and scaled down their space ambitions.

Another reason was the collapse of the Soviet Union in 1989, leading to an even less competitive landscape for space exploration.

Lastly, another less often admitted reason is the growing bureaucracy of NASA and other space agencies. Without the hurry of a rival, space travel became a very routine and less ambitious endeavor. NASA became risk-averse and never really looked to replace the retired space shuttle. Contractors like Boeing would still provide rocket engines and launches but without much of a drive to push for new capacities or take any significant risks.

This was until 2002, when a relatively unknown tech entrepreneur named Elon Musk would create SpaceX. In more than 2 decades, the company has reignited interest in space exploration, demonstrated reusable rockets were possible, and radically cut costs to reach orbit.

Source: Ark Invest

This not only had the effect of bringing the fresh air of private enterprise and competition into the space sector. It also demonstrated to investors that it was actually possible, and that space was a perfectly valid new segment of “tech” ventures.

And this also ignited a new space race, this time between the USA and China, which is only starting to heat up.

While SpaceX is still not publicly traded (see here how to buy SpaceX’s pre-IPO shares), another company is quickly catching up to Musk’s brainchild: Rocket Lab.

Rocket Lab USA, Inc. (RKLB -10.61%)

Rocket Lab History

Rocket Lab was founded in 2006, 4 years after SpaceX. It quickly became the first private company in the Southern Hemisphere to reach space after launching its Ātea-1 suborbital rocket from New Zealand in November 2009. After 2013, the company moved to Huntington Beach, California, USA.

It seems that the company took a more cautious approach overall than SpaceX, likely because it depended on regular funding rounds to keep growing and improving its tech, which required showing results very regularly. Hence, the focus on smaller, non-reusable rockets in the earlier years.

So it only started to develop its own reusable technology in 2018, once SpaceX had definitively proved it was a viable technological option, and actually likely the only one commercially viable in the long run.

Rocket Lab became a public company through an IPO using a SPAC in 2021.

Over its history, Rocket Lab has launched 203 satellites. It is also a manufacturer of components for satellites, with a total of 1700+ satellites in orbit using Rocket Lab technology.

Rocket Lab Launchers

Electron

The main asset of Rocket Lab is of course its rockets. Over its history, the company performed 56 launches of its Electron rocket, making Electron the second most frequently launched U.S. rocket and the 3rd most frequently launched rocket globally in 2024 (behind China’s state rocket Long March 2).

Source: Rocket Lab

The first stage of the Electron is reusable, and it is collected back by a dedicated Rocket Lab boat after landing in the ocean.

Electron has given the company a strong focus on small launches as the payload is 300 kg / 660 pounds, a segment that has essentially been abandoned by SpaceX after the development of the Falcon 9 and Falcon Heavy. This is also reflected in the pricing power of the company, with Electron’s average sale price since its debut launch in 2017 increasing from $5M to $8.4M.

The rocket and Rocket Lab’s facilities are remarkable for a few features that made the company remarkably innovative in its own right, and not just a SpaceX clone:

- Advanced capability for satellite deployment at very inclined orbit and staggered deployment. This makes Electron’s launch capacity rather unique for any special orbit challenging to reach with other rockets.

- Multiple launch sites, including in New Zealand, creating strong launch flexibility and record short time in the industry from booking a launch to getting it done (a new Electron can be built every 18 days).

- A 3D printed rocket engine (Rutherford engine), using a 90-ton, 30-meter 3D printer.

Source: 3D Printing Industry

Neutron

Electron is not the end product for Rocket Lab, but instead the lightest of its rockets so far. The next generation is called Neutron and is still in development.

With 13,000 kilos of payload to Low-earth Orbit (LEO), Neutron is lifting 43x more mass than Electron. It could even send up to 1,500 kg to Mars or Venus, making it a credible option for NASA missions sending rovers and experimental equipment to the nearest planets.

Source: Rocket Lab

While Electron was using LOX (liquid oxygen) /Kerosene, Neutron will use LOX / Methane, a similar fuel that SpaceX used for its Starship, and overall seemingly the direction of the latest generation of rockets is taking.

The company is planning to move fast, with 2 Neutron launches already booked for 2026 & 2027. These launches will be done for an undisclosed satellite constellation operator, likely a future competitor to SpaceX Starlink space-based Internet. Overall, Neutron is on track to be brought to market faster than any vehicle of its class, with the first hot fire test of its Archimedes engine done in August 2024. Archimedes is also a 3D-printed engine.

Source: Rocket Lab

The US government is very interested in the development of the Neutron rocket. Notably, it gave the company $8M for the development of its engine, is “next on-ramp” to Space Force’s NSSL Lane 1 program (a $5.6B over five years), and is eligible to compete for missions under OSP-4, a $986m IDIQ contract.

Neutrons will be sent through the launch complex 3, currently under construction. This will add to the Long Beach production assets such as machinery and equipment, which had been acquired in May 2023 out of Virgin Orbit’s bankruptcy proceedings.

Source: Rocket Lab

HASTE

The acronym stands for Hypersonic Accelerator Suborbital Test Electron. This special version of the Electron rocket is dedicated to testing hypersonic systems. This modified rocket has a modified larger 700kg payload to suborbital altitudes.

Hypersonic is a new frontier in military technology and a sector where Russia and China are proven to be further ahead than the USA, potentially creating strategic vulnerabilities.

By offering cheap and reusable launch capacity, it can help the US military speed up its hypersonic development programs. It also offers a customizable altitude, volume, and shape for the payload, making it more flexible for experimental designs.

Source: Rocket Lab

Responsive Space

The mission of this program is to “accelerate the path to orbit with rapid call-up launch on demand and agile satellite solutions”.

Here, Rocket Lab is leveraging its extremely quick turnaround when a client wants to schedule a launch. In the case of an existing satellite failing or getting destroyed, Rocket can combine:

- Fast prototyping of a replacement through its vertically integrated satellite department (see below).

- Deliver quick launch through its Electron rocket.

Rocket Lab Beyond Rockets

While rockets are the activity of Rocket Lab that catch the most attention, the company is actually currently mostly a satellite-building company by revenue.

It has a 10,000 sq. ft. satellite cleanroom and 40,000 sq. ft production & test facilities for manufacturing satellites at scale.

This makes Rocket Lab a “one-stop shop” for companies looking for both a satellite and launch provider at once, or as its management calls it, an “end-to-end space company.”

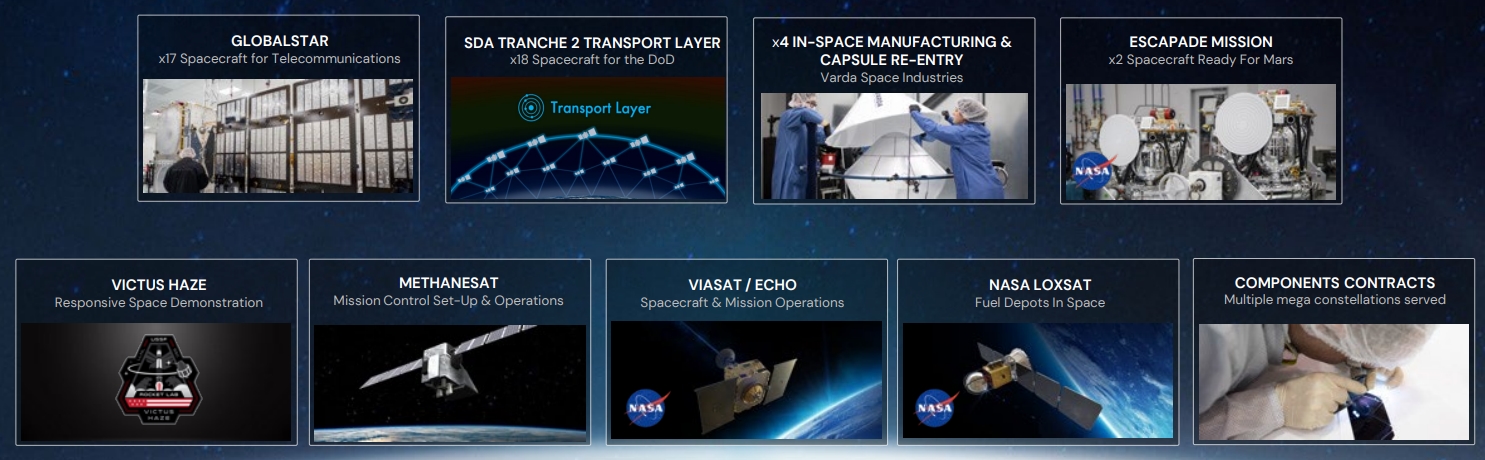

The company has currently $720M of spacecraft programs in production, from multiple contracts with NASA & the US government with a $515M military satellite contract and a civilian $143m contract for Globalstar.

Source: Rocket Lab

Components

As mentioned, Rocket Lab is not only a builder and designer of full satellites but a provider of key components to the rest of the industry as well.

A lot of these capacities have been acquired through a series of acquisitions, initiating a trend of consolidation in the industry that previously had been very fragmented, with a lot of bespoke equipment instead of a vertically integrated supply chain. To a large extent, this strategy replicates what SpaceX has done with Rocket for satellite production, bringing in-house and integrating together what were previously much more expensive systems produced by niche manufacturers.

This includes star trackers, propulsion, reaction wheels, flight and ground software, radios, avionics, composite structures and tanks, and separation systems.

However, one element where Rocket Lab may excel even further is solar cells and panels.

Source: Rocket Lab

Solar

Rocket Lab derives solar manufacturing from its 2022 acquisitions of SolAero Technologies, with 1000+ satellites powered by these panels, 500+ satellites scheduled to launch in the next few years with Rocket Lab solar hardware, and 4MW solar cells manufactured in total.

These solar cells display the highest efficiency, up to 34%, combined with a very lightweight and good durability. This is combined with automated assembly, reducing costs and boosting production.

Source: Rocket Lab

Mars & Venus Missions

While it is clear by now that any upcoming manned Martian mission will mostly be carried out by SpaceX’s superheavy rocket Starship, Rocket Lab is not left behind either when it comes to the red planet.

Notably, it has built 2 spacecrafts for NASA in just 3.5 years for the ESCAPADE mission, which was due for launch on Blue Origin New Glen Rocket in October 2024, but got postponed due to the rocket not being ready.

This comes on top of Rocket Lab’s previous contribution to almost all major Martian robotic missions in the past years, including the Perseverance rover and the Ingenuity Helicopter.

Source: Rocket Lab

All these missions pale in comparison to the upcoming Mars Sample Return, which hopes to bring back Martian mineral samples to Earth. The samples collected by Curiosity in 2021 have been left stranded there ever since.

This has been one of NASA’s highest priority programs but has suffered from considerable cost overrun (now above $11B estimate) and delay (not before 2040), leading NASA to instead put out a tender for private companies to do the job.

Rocket Lab has been awarded a NASA contract to explore new concepts for this mission, and is proposing instead a $2B, 2-launches mission, using the Neutron rocket, with a deadline of 2031.

Rocket Lab is also interested in Venus and is building a small probe, called the Venus Life Finder (VLF). The target launch date for the VLF aboard the Electron rocket was January 2025.

Considering that there is serious sign Venus could harbor microbial life in its atmosphere (see “Signs Of Life on Mars and Venus May Rewrite Our View Of The Universe“), proving it at a relatively low cost could be a major marketing stunt as well as a historical achievement for Rocket Lab.

Software

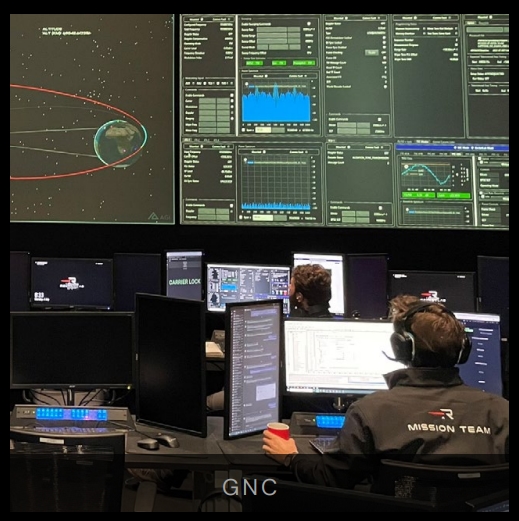

Through the 2021 acquisition of Advanced Solutions, Inc (ASI), Rocket Lab has become an industry leader in flight software, mission simulation, and Guidance, Navigation and Control (GNC).

Source: Rocket Lab

This gives the company an extra angle on which to monetize satellite business, with the integration of the software side with the hardware and the launch sides.

Others

Besides reusable 3D-printed rockets, satellite manufacturing, and Martian and Venus missions, Rocket Lab is also exploring new venues that might one day become the basis of a future space-based economy.

This includes an in-space manufacturing experience with Varda Space Industries, to Ritonavir crystals, a drug commonly used as an antiviral medication for HIV and hepatitis C.

It is also planning for early 2025 the “Astroscale Orbital Debris Inspection Demonstration Mission”, in collaboration with Astroscale-Japan (ADRAS-J). The 150-kilogram ADRAS-J satellite will approach an aged, derelict rocket stage in orbit to observe it closely, understand how it behaves, and determine potential methods for its assisted deorbiting in the future.

Considering that space debris is a growing concern and will need to be addressed before building any significant space infrastructure, this is a promising new market. It will also be equally crucial to develop these capabilities if we ever attain the ability to generate power in orbit and beam it back to Earth.

Rocket Lab Financials

The company has built a solid backlog during 2024, passing the $1B threshold for the first time, with half of that expected to be recognized in 12 months.

Source: Rocket Lab

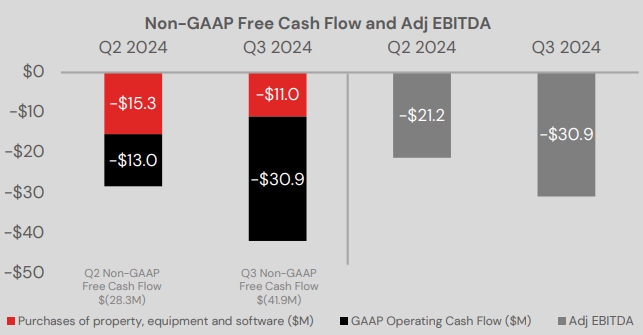

However, the company is not profitable yet, nor is it cash flow positive. This is in large part due to the massive investment in the development of Neutron and the associated launch facilities.

If anything, the company’s cash flow slipped further into negative territory (—$41.9M) in Q3 2024, with $508M in cash and cash equivalent at the same period.

Source: Rocket Lab

Investing In Rocket Lab

SpaceX Competition

Rocket Lab is often compared to SpaceX for obvious reasons. It, too, is a private company developing reusable rockets and outperforming the NASA & large aerospace companies programs by a wide margin when it comes to capital efficiency, speed of development, and overall efficiency.

This is, however, a little bit misleading, as Rocket Lab is currently mostly a satellite manufacturer with a large potential as a rocket company. Would the rocket fail to compete against SpaceX, a distinct possibility, it would still be a very efficient and important satellite company.

Another possibility is that instead of competing directly against SpaceX, it focuses on under-served segments of the market. For example, small launches with flexible schedules and excentric orbits are currently ignored by SpaceX, which is busy rushing toward the bigger, larger segment of ultra-heavy launchers with Starship.

In that context, it is possible that Neutron arrives just in time when SpaceX focuses on mass producing Starship for Moon and Mars colonization, progressively letting go of the market currently covered by Falcon 9 rockets.

Space Solar Opportunity

In two previous articles (“Space-Based Energy Solutions For Endless Clean Energy” & “A Sun that Never Sets – Reflect Orbital’s Big Plans for Upending Solar Energy“), we discussed how space-based solar could become a powerful renewable energy source solving some of the issues of ground-based solar.

Rocket Lab’s leadership in satellite solar panels could be a great advantage for such projects. Contrary to virtually all possible competitors, it will be able to transport at cost with its own rockets the power satellites.

This could prove the definitive advantage in developing the sector against other companies forced to provide juicy margins to SpaceX or Blue Origins.

This could also prove to be the self-sustaining application for Rocket Lab’s launches the way Starlink has been for SpaceX: more frequent launches means cheaper individual launches, helping win more contracts, and idle rocket time can be used to launch your own satellites, creating economies of scale on both launches and satellites productions.

Even if the power satellite business barely breaks even, it could help the company cut costs on satellites so much that it becomes the dominant satellite manufacturer in the industry, while paying off the ramping up of launches.

This manufacturing advantage could then be leveraged to become a key contributor to the production of orbital and cis-lunar habitats.

Conclusion

Something that both EV manufacturers and rocket companies have learned the hard way, is that it is tough to be a direct competitor of Elon Musk.

This does not mean it is impossible, as illustrated by the global success of BYD in EVs.

The same can be true for Rocket Lab, with an impressive track record in keeping pace with SpaceX, something that much more funded companies like Boeing or Jeff Bezos’s Blue Origin can hardly claim.

In addition to the rocket business line, Rocket Lab is also a remarkable satellite company, pursuing an aggressive path of vertical integration and consolidation in an industry that has historically failed to be properly competitive.

Altogether, this makes the company an interesting choice for investors willing to take the risks of unproven technologies, a quickly changing industry, aggressive growth targets, and daring to challenge the richest man in the world on his own turf.