- Solana gains 7.2% while the broader crypto market falls.

- Despite a general market retreat, investor confidence in SOL has strengthened.

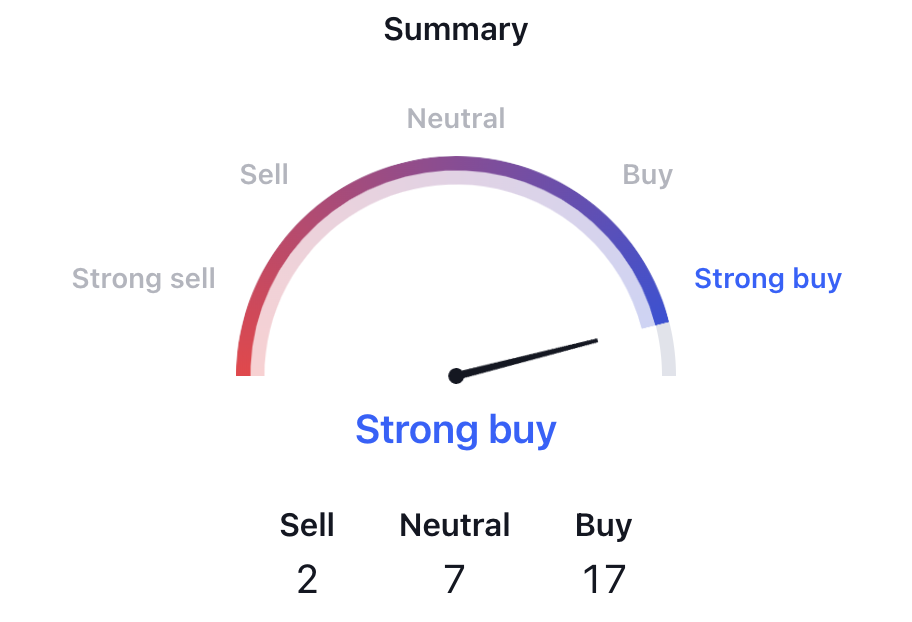

- Technicals show strong buy signals for SOL.

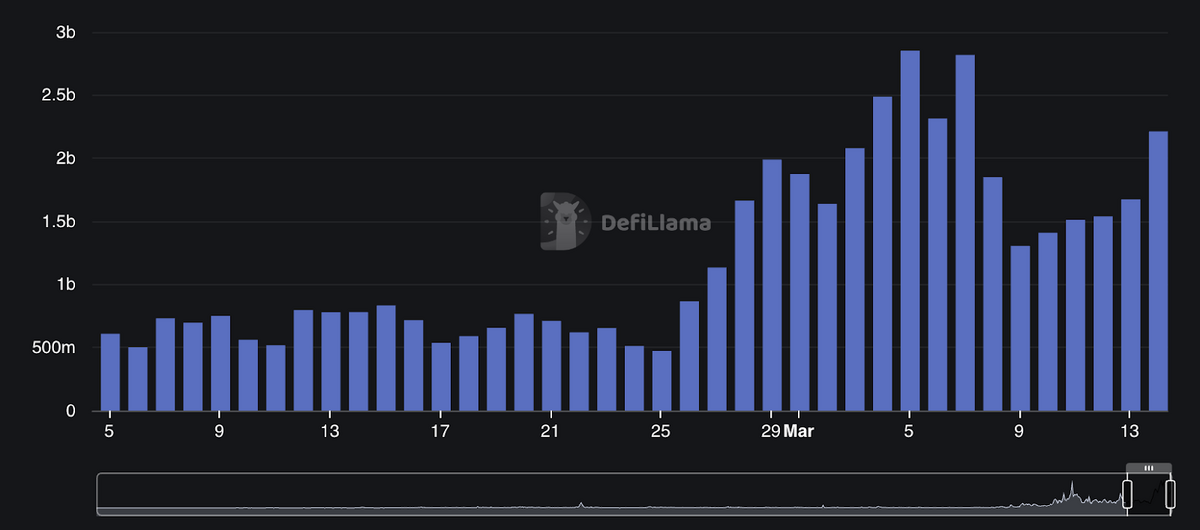

Solana, known for its high-performance blockchain that facilitates decentralized applications and cryptocurrencies, has recently gained traction. Thanks to surging DEX traffic, reaching a daily volume of $2 billion, investors are becoming increasingly confident in SOL.

Recently, Solana has shown its resilience despite the crypto market’s downturn, registering more than 7% gain while the overall crypto market was down.

Solana’s Shows Strong Technicals Despite Market Downturn

On Friday, March 15, Solana posted a significant daily gain of 7.2% despite a general market downturn. While leading cryptocurrencies like Bitcoin and Ethereum posted declines, with the overall crypto market dropping 4.13%, SOL’s gains attracted investor attention.

This surge has been accompanied by mixed technical signals for SOL, which overall point towards a cautiously optimistic sentiment. Most of Solana’s technical indicators were bullish on Friday, March 15.

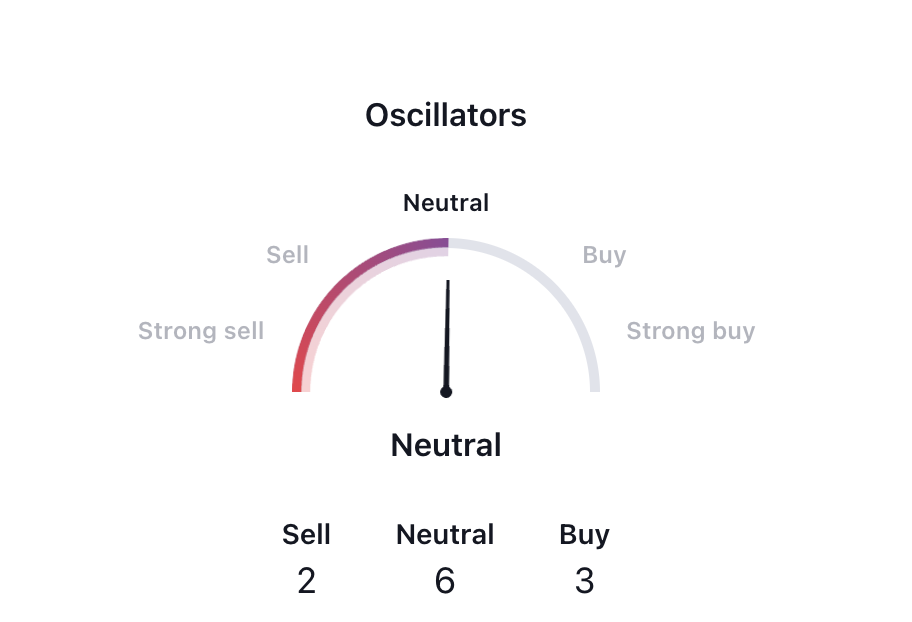

Specifically, oscillations show a more balanced picture. The Relative Strength Index (RSI) sits at 86.60, teetering on the edge of overbought territory. The Stochastic %K, similarly, at 95.81, underscores the cautious sentiment, while the Commodity Channel Index (CCI) at 176.40 advises a sell. On the other hand, the momentum indicator, showing a value of 57.28, along with a MACD level of 15.86, leans towards buying, evidencing the strong buying pressure Solana is currently experiencing.

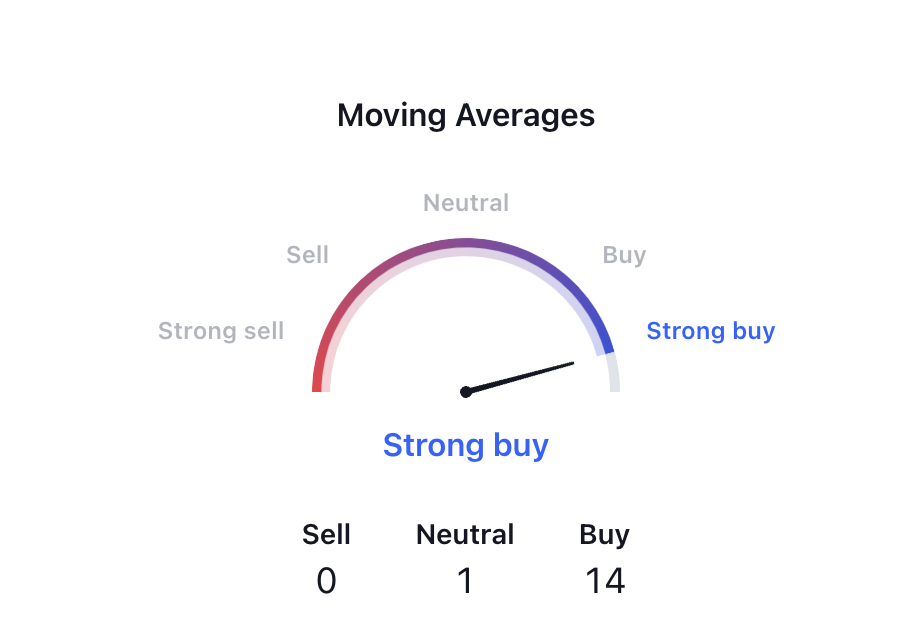

Moving Averages, however, solidify the overall bullish outlook. From short-term to long-term perspectives, indicators such as the 10-day EMA at 156.40 and the 200-day SMA at 69.29 unanimously point towards buy, showcasing a widespread belief in Solana’s growth potential. This is further evidenced by the Hull Moving Average (9) at 177.83, suggesting swift, recent gains.

In summary, Solana’s technical indicators are predominantly bullish, marked by a strong upward trajectory and reinforced by significant buying pressure. Yet, the presence of overbought signals amongst oscillators reminds investors to proceed with caution.

Solana’s Growth Fuelled By High DEX Volume

SOL’s rise has accompanied a surge in DEX volume on Solana. On Thursday, March 14, the daily volume was at $2,3 billion. This growth is attributed to the popularity of Solana-based DEXs like Jupiter (JUP), Orca, Raydium, and Phoenix, each driving significant trading volumes. This increase in activity has been propelled by the launch and popularity of memecoins on the Solana network, contributing to its growing DEX volumes and overall ecosystem expansion.

Moreover, the recent performance of Solana-based memecoins, such as Bonk (BONK) and dogwifhat (WIF), has played a significant role in increasing Solana DEX volumes. These memecoins have seen major gains, contributing to the flip in trading volumes between Solana and Ethereum DEXes at certain points.

On the Flipside

- Solana DEX volumes overtook Ethereum briefly between March 3 and March 4, 2024.

- Technical indicators reflect current market sentiment and are unreliable predictors of future performance.

Why This Matters

Investors should understand technical indicators for cryptocurrencies to give them a comprehensive view of the state of the market. The cryptocurrency market is highly sentiment-driven, meaning that awareness of the market’s perception of Solana is key for both short- and long-term trades.

Read more about Solana’s recent performance and potential:

Can Solana Overtake BNB After Record Daily New Addresses?

Read more about Worldcoin’s latest security audit after a major hack hit the network: