- Solana records a significant lead in stablecoin transactions.

- Most Solana transactions use USDC.

- However, the origin of transactions is unlikely organic.

Solana, known for its low fees and high-speed blockchain, has been on a roll this year. High network activity, fuelled by the boom in memecoins, has propelled SOL to its yearly highs, near $200.

Most recently, Solana also emerged as a significant player in stablecoin transactions, leading in stablecoin volume. However, a closer look at the numbers reveals that high-frequency arbitrage trades may play a dominant role in these transactions.

Solana Stablecoin Transactions Surge, Surpassing Ethereum

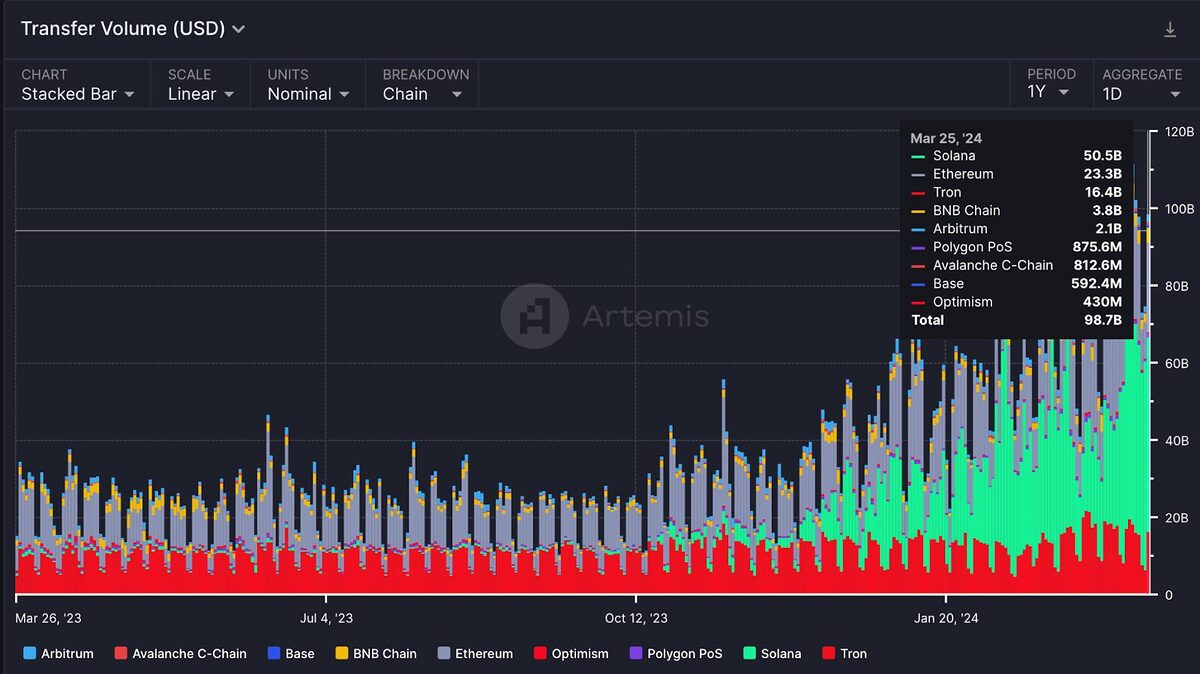

Recent data from Artemis highlighted a critical insight into the use of stablecoins across major blockchain platforms, including Solana, Arbitrum, Polygon, and Ethereum. Solana is currently in the lead, commanding more than 40% of stablecoin transfer volume.

On Monday, March 25, Solana saw a daily stablecoin volume of $50.5 billion, ahead of Ethereum’s $23.3 billion. Tron followed with $16.4 billion, while BNB was in fourth place with only $3.8 billion in transfers.

Solana’s current stablecoin dominance came from a surge in transfers in 2024. Notably, In 2023, its stablecoin volume largely hovered around 1-2% of the market. However, a closer look at the figures shows that high-frequency trades are likely behind the surge.

Solana Stablecoin Boom: Are Bots Behind it?

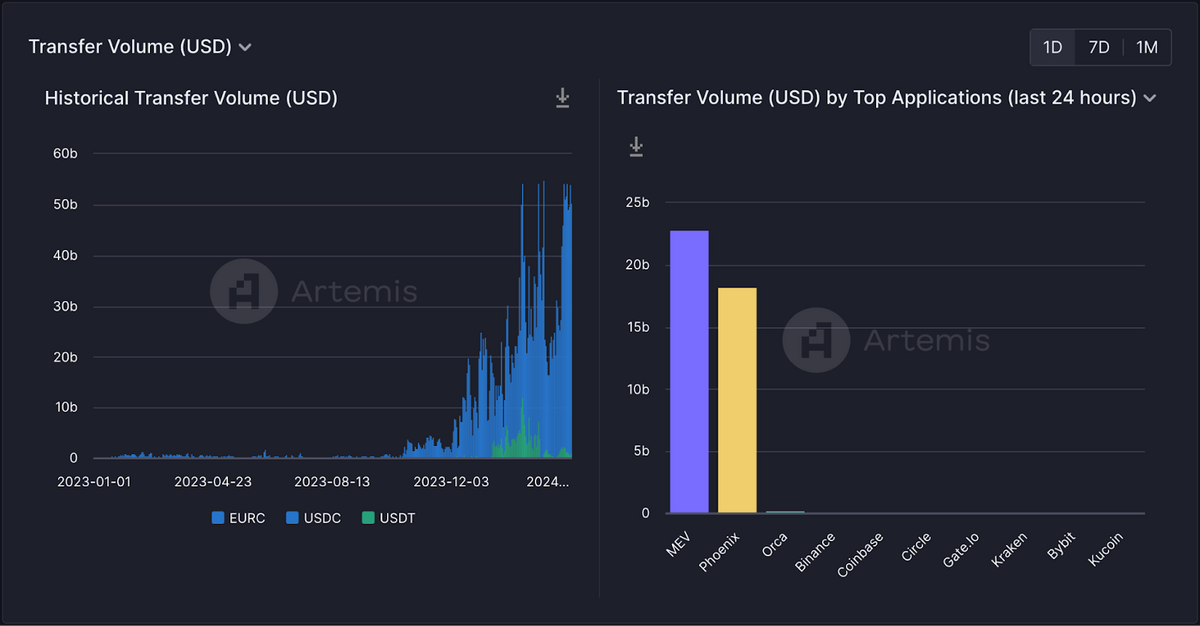

Data from Artemis suggests that a surge in high-frequency trades, rather than one in new users, is likely behind the Solana stablecoin dominance. For one, stablecoin transfers on popular exchanges, including Binance, Coinbase, and Kraken, account for a tiny fraction of Solana transfers.

Moreover, most Solana wallets use USDC rather than the more popular USDT. When it comes to transaction volume, USDC’s lead is dramatic. Solana recorded 822.8 billion transactions in USDC in February, compared to just 31.6 billion in USDT.

Instead, most stablecoin transactions on Solana come from MEV (Maximal Extractable Value) arbitrage operations and an on-chain orderbook Phoenix. These platforms cater to high-frequency arbitrage traders, who use bots to perform thousands of transactions daily.

Solana is particularly suited to facilitate these transactions due to its fast speeds and low fees. However, without these operations, Solana stablecoin transfers would not even close to Ethereum and Tron’s volume.

On the Flipside

- High-frequency traders can boost the liquidity on a chain, which is further complimented by Solana’s low fees and fast speeds.

- Most recently, reports have highlighted Solana’s high capital efficiency. This figure is reflected in its high transaction volume and relatively low total value locked (TVL).

Why This Matters

Solana’s emergence as a leader in stablecoin volume showcases the growing trend toward high-frequency trading. However, traders should understand the reasons behind the surge to make informed decisions.

Read more about how Solana’s ecosystem compares to Ethereum:

How Solana Stacks Up With Ethereum in One DeFi Key Metric

Read more about Binance’s involvement in Russia: