The trading volume for virtual worlds in web3 recorded 229% growth in February and returned to its pre-Luna crash levels, according to DappRadar’s recent report.

During the month, the trade count doubled to reach 51,000, as the DappRadar data revealed. The growth was also supported by investors, as the gaming and metaverse space raised a joint $148 million in funding.

Virtual lands

The report noted that the trading volume of virtual lands has been growing over the past few months, and it continued its growth in February as well.

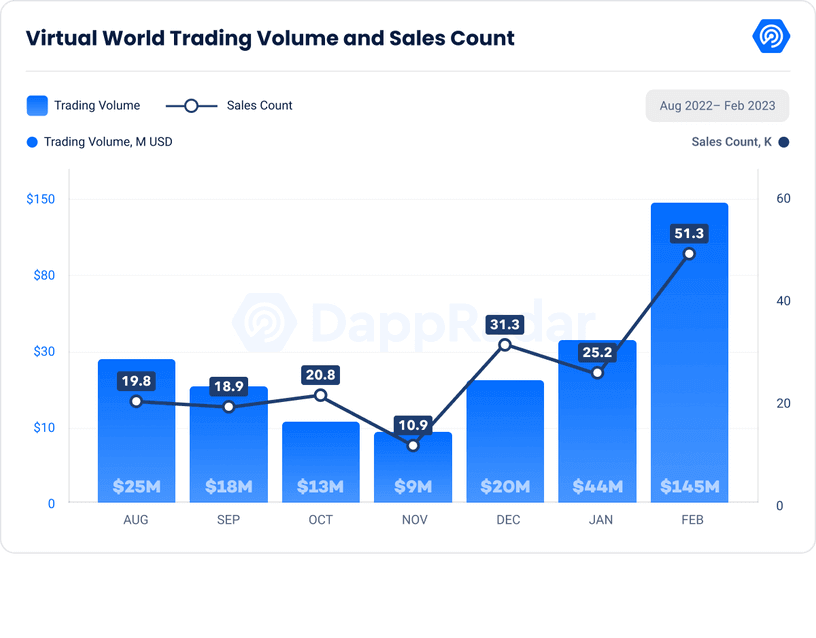

According to the data, the trading volume of virtual land increased to $145 million in February from $44 million in January, marking a 229% growth. The last time the trading volume recorded a decrease was in November 2022. In December 2022 and January 2023, the trading volume grew by 122% and 54%, respectively.

On the other hand, the sales count wasn’t as consistent with its growth as the trading volume. For example, even though the sales count recorded a 103% increase and reached 51,300 in February, it decreased by 19% in January.

Investments

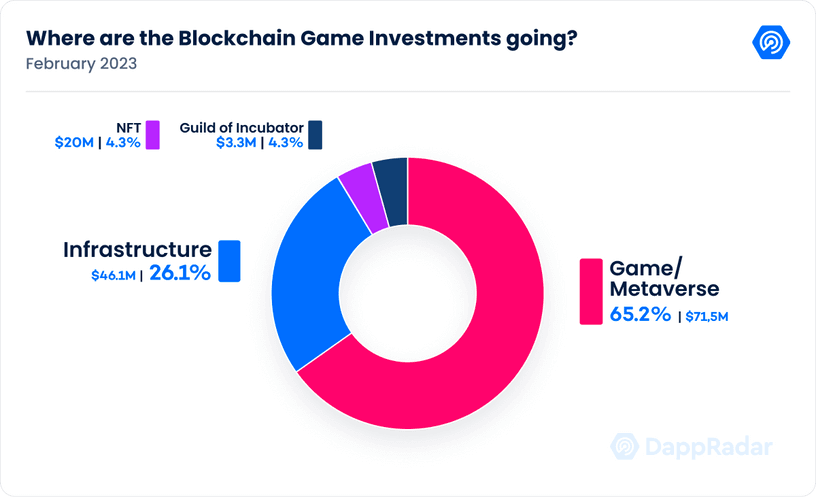

According to the data, the gaming and metaverse space had raised $156 million in funding in January and remained firm on the investments front in February by raising $148 million.

Over 65% of the total amount went directly to games and the metaverse, which equates to over $71 million. Infrastructure received the second largest portion at 26.1%, roughly $46 million.

NFTs return to pre-winter levels.

The NFT market also showed parallelism to the metaverse and gaming’s growth and returned to pre-luna crash levels in February.

The NFT trading volume recorded a 117% growth in February and increased to over $2 billion. However, despite the surge in the trading volume, the NFT sales count recorded a 31.46% decrease and fell to 6.3 million in February.

The contradiction between the sales counts and trading volumes indicates that the whales have played an active role in the trade volume surge, both for the NFT market and the metaverse.