- Crypto crash sees most tokens nursing double-digit percentage losses.

- Investors scramble for answers on what triggered the market turmoil.

- Shifts in financial policy and escalating geopolitical tensions are being blamed.

Cryptocurrency markets are known for their volatility and sudden sell-offs. A prominent example was China’s restrictions on crypto trading and mining in May 2021, which caused Bitcoin’s price to plummet by 50% to $30,000. Crypto crashes are a hallmark of the digital asset landscape, continuously testing investor resolve and market resilience.

Nonetheless, the crypto world was shaken by a sudden $360 billion drop in total market cap over the past 24 hours. Bitcoin fell 14% to an intraday low of $49,300 on Monday, hitting a 25-week low and reigniting bearish sentiment and concerns about the end of the bull market. Given the scale of the crypto crash, investors are urgently seeking answers.

What’s Behind the Crash?

The crypto crash intensified on Sunday evening, raising questions about what’s driving the market turmoil. Investor SlumDOGE Millionaire led the cries for an explanation by asking ‘why is crypto crashing?’

The total crypto market cap plummeted by $360 billion to $1.8 trillion over the last 24 hours, marking a 14% drop and causing token prices to crash.

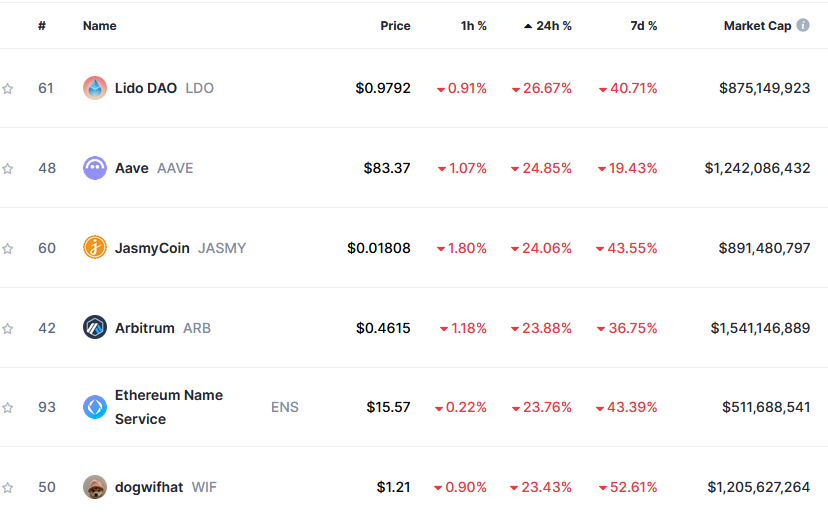

Altcoins generally fared worse than Bitcoin, with the top 100’s biggest losers being Lido DAO, Aave, and JasmyCoin down 27%, 25%, and 24%, respectively, over the past 24 hours at the time of writing.

Investors’ losses have triggered palpable fear in the market, with many bracing for further sell-offs. Amidst this anxiety, there is a concerted effort to understand what caused the turmoil.

End of the Yen Carry Trade

To understand what triggered the crypto crash, BitMEX co-founder Arthur Hayes speculated that a major firm might have been forced to liquidate its crypto holdings. However, Hayes noted that this information remains unverified.

Adding context to Hayes’ claim, Crypto Banter Podcast founder Ran Neuner shared on-chain data revealing that Jump Trading was selling crypto at an unusually fast rate. He speculated that this could be due to potential liquidations or meeting urgent financial obligations.

Investor ‘jonathan(love)wu’ proposed a link between the crypto sell-off and the Bank of Japan’s (BoJ) recent interest rate hike, the second in 17 years. jonathan(love)wu explained that the yen carry trade, where traders borrowed yen at zero interest to invest in higher-yielding assets abroad has been disrupted.

The BoJ’s policy shift has increased borrowing costs and strengthened the yen by raising rates, potentially forcing carry traders to unwind their positions. This could involve selling off foreign assets, including cryptocurrencies, to repurchase yen and repay their loans.

jonathan(love)wu speculated that this unwinding may have contributed to the sharp decline in crypto prices.

In addition to the unwinding of the yen carry trade, uncertainty in the crypto market is also being heightened by rising geopolitical tensions in the Middle East.

Middle East Tensions

The assassination of Hamas leader Ismail Haniyeh in Tehran on July 31 has significantly heightened tensions in the Middle East. Iranian authorities alleged that Israeli forces used a short-range missile for the attack and have vowed retaliation, also accusing the U.S. of supporting the strike. Israeli officials have not claimed responsibility for the incident.

This situation has cast a shadow over global financial markets, including cryptocurrencies. The threat of further escalation and potential broader conflict has increased pressure on risk-on assets, contributing to the recent downturn in the crypto market.

However, opinions within the crypto community remain divided. Some, like trader Satoshi Flipper, dismiss the situation as “overblown FUD,” predicting neither a recession nor an all-out war in the near future.

Others, such as trader ‘Scient,’ view the recent crypto crash as a potential precursor to larger market declines, suggesting that further conflict in the Middle East is likely. These differing views reflect the prevailing uncertainty in the market.

On the Flipside

- Glassnode data showed that Bitcoin whales are buying the dip.

- Gold is trading close to ATHs, suggesting markets do not view Bitcoin as a safe haven asset.

- Kamala Harris has surpassed Donald Trump in a CBS poll, fueling concerns that Trump’s pro-crypto policies may not materialize if he fails to win the U.S. election.

Why This Matters

While crypto markets have weathered storms before, this crash underscores the delicate balance between digital assets and the wider macro picture.

The weekend crypto sell-off triggers a dramatic collapse in token prices:

Crypto Market Suffers Bloodbath as Top Coins Tumble

Jan van Eck gives his Bitcoin price prediction:

VanEck CEO Puts Bitcoin at $350K in Worst-Case Scenario