During the last bull market, i.e. from the 2020 bottom to the 2021’s bull peak, Cardano outperformed both Bitcoin and Ethereum. A recent Jarvis Labs’ newsletter pointed out that ADA “more than tripled” ETH’s performance in the last cycle. Parallelly, it outperformed BTC by “a factor of ten.” Specifically, the assets rallied by 17,469%, 5,560%, and 1,724% respectively.

However, since the onset of the bear market, Cardano’s performance has only worsened. With the asset down by almost 91% from its bull peak, investors have been losing hope. So, is it indeed game over for ADA?

Flipside: Cardano and its ‘impressive’ show

On the on-chain front, there are quite a few positive takeaways that show that Cardano’s heart is still beating. Take the case of the TVL itself. In USD terms, the value of all the funds locked in the ecosystem is over 50% of what it was at the peak [$326 million in March ’22 vs. $154 million now]. Such is the case, even though the price of the asset is just one-fifth of what it was back then [$1.19 vs. $0.28].

However, if the TVL is gauged in ADA terms, the DeFi “boom” becomes quite evident. The curve has steeply risen since the beginning of this year. In fact, the current value of funds locked is significantly higher than the peak created in 2021.

Also Read: Cardano Whales Transact 40 Billion ADA: Price to Recover?

Even in terms of staking, Cardano has been able to put up an impressive show. On most chains, there’s a minimum limit to stake. On Ethereum, for instance, validators need at least 32 ETH [worth $60.2k at today’s price]. In fact, developers have recently intended to raise the number to 2048 ETH [worth around $3.8 million] going forward. However, to stake ADA, there is no such threshold. Anyone who wants to stake tokens can by just bearing a fee of 2 ADA. As a result, around 60% of all ADA is already staked. Contextualizing the same with respect to Cardano’s peers, Jarvis Labs’ newsletter noted,

“Polygon has a staking ratio of 38%, and Ethereum fans are getting all excited as it’s just passed 20%.”

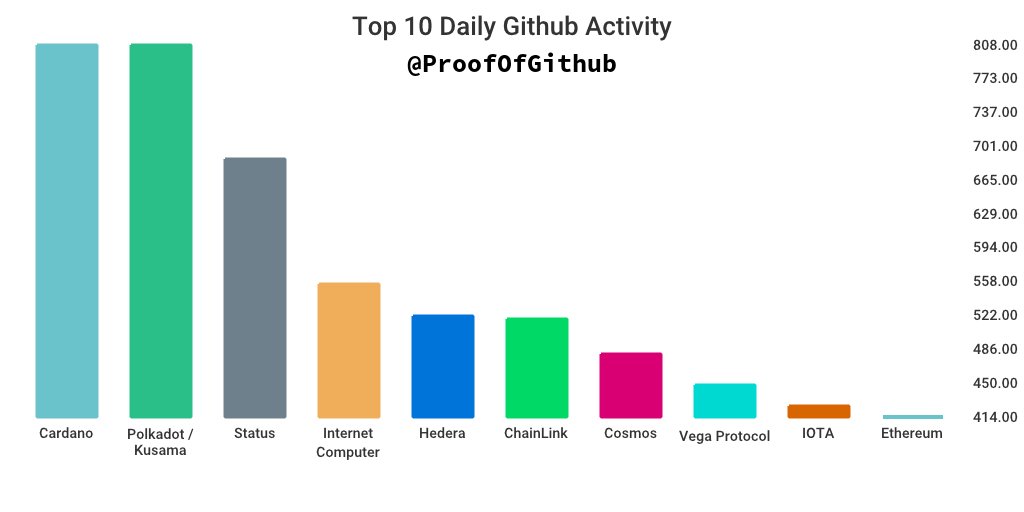

Leaving aside DeFi and staking, Cardano has also been faring quite well on the development front. Despite the lackluster price performance, developers continue to have the protocol’s back. In fact, as of mid-June, Cardano’s Github activity was higher than the likes of Chainlink, Ethereum, Polkadot, etc.

Thus, it can be contended that Cardano is “very much alive and kicking” at this stage. Perhaps the next bull run could change its fortunes on the price front, as the project is not abandoned yet.